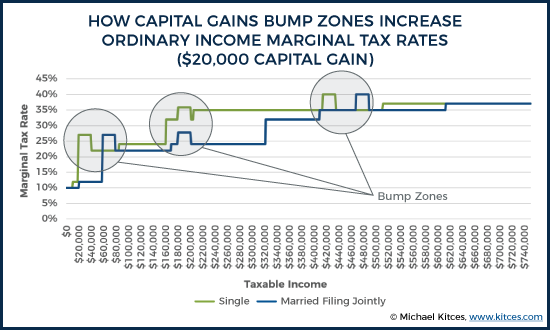

There is another possible issue with Roth conversions when you have other income sources (e.g. ordinary and capital gains/qualified dividends)...the issue with "bumps" where additional ordinary income (such as comes from a Roth conversion) impacting capital gains/qualified dividend rates:

https://www.kitces.com/blog/long-term-capital-gains-bump-zone-higher-marginal-tax-rate-phase-in-0-rate/

And there are huge potential issues when one is also drawing social security:

[QUOTEChandler and Monica are retired, and thanks to the fact that both had successful careers, are each eligible for nearly $2,400/month in Social Security benefits. And because Chandler is 4 years older, his Social Security benefits have been further increased to $3,168/month with delayed retirement credits.

In addition to their combined $5,568/month ($66,816/year) in Social Security benefits, the couple is also drawing $28,000/year from Chandler’s IRA (due to required minimum distributions), and liquidated another $32,000 in long-term capital gains this year.

...

Accordingly, if the couple were to withdraw another $10,000 from their IRA while they are current in both the Social Security phase-in zone and the capital gains bump zone, not only would their ordinary income increase by $10,000, but the taxable portion of their Social Security would also increase by $8,500, and $10,000 of their long-term capital gains would be pushed up into the 15% zone.

...

Which means their $10,000 of additional income generated $11,526 – $6,531 = $4,995 of additional taxes… or a whopping 49.95% marginal tax rate, due to the combination of Social Security benefits phase-in, plus the capital gains bump zone (and the interaction effect between the two!).

[/QUOTE]