Hello,

I just now joined this forum after finding it....

I am a very healthy 57 year old male, single, no kids, living in NJ. With the exception of a small mortgage balance of 38K, I have ZERO debt...no credit card, no car payments, no student loans, NOTHING. I have a 15 month emergency fund to cover all expenses in the event of a job loss.

I have been contributing 33% of my salary towards retirement and my combined asset total in both my 403(b) and my ROTH is $650,000.00.

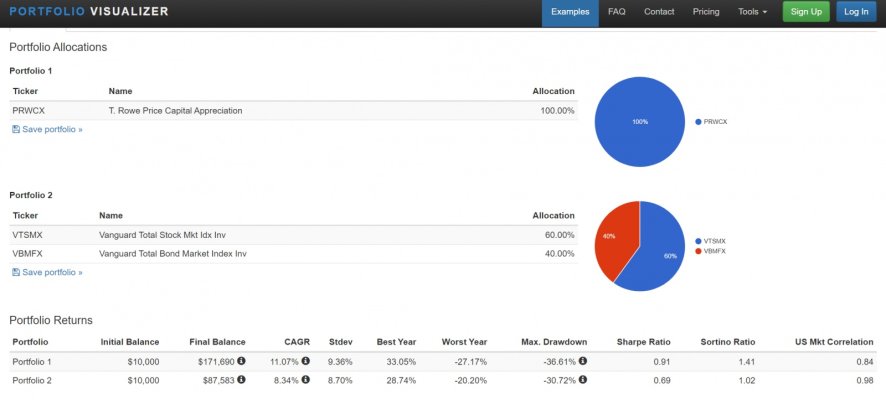

I feel I am broadly diversified in my 403(b) but not so much with my ROTH, which I have T Rowe Price's Capital Appreciation Fund. I know it has been a

amazing fund over the last 10 years but a financial advisor I recently met with feels this fund will lost a fair amount in the next market crash and feels my ROTH should be just a bit my diversified and a bit more conservative so when the downtown comes, I don't lose that much.

I plan on working at least 10 more years to 67.

So with that said, what might be a better choice as a SINGLE CORE fund to hold in my ROTH?? I would appreciate all recommendations!

Thanks

Michael in NJ

I just now joined this forum after finding it....

I am a very healthy 57 year old male, single, no kids, living in NJ. With the exception of a small mortgage balance of 38K, I have ZERO debt...no credit card, no car payments, no student loans, NOTHING. I have a 15 month emergency fund to cover all expenses in the event of a job loss.

I have been contributing 33% of my salary towards retirement and my combined asset total in both my 403(b) and my ROTH is $650,000.00.

I feel I am broadly diversified in my 403(b) but not so much with my ROTH, which I have T Rowe Price's Capital Appreciation Fund. I know it has been a

amazing fund over the last 10 years but a financial advisor I recently met with feels this fund will lost a fair amount in the next market crash and feels my ROTH should be just a bit my diversified and a bit more conservative so when the downtown comes, I don't lose that much.

I plan on working at least 10 more years to 67.

So with that said, what might be a better choice as a SINGLE CORE fund to hold in my ROTH?? I would appreciate all recommendations!

Thanks

Michael in NJ

Last edited: