You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

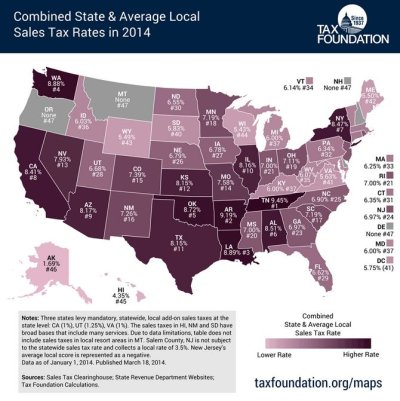

Sales taxes by state

- Thread starter REWahoo

- Start date

Very interesting chart. I'm in Florida and always thought we were one of the best states for taxes levied. However, I find us in the middle of the pack, which is not too bad. Guess I thought no state income tax would put us in a better position.

Nice picture! It's worth at least a thousand words.

Amazon just announced it will begin collecting sales tax in Fl in a week or so (May 1). The quest for lower taxes is Quixotic.

Amazon just announced it will begin collecting sales tax in Fl in a week or so (May 1). The quest for lower taxes is Quixotic.

Interesting, but it is an average for the state. Lists PA as 6.34% but that really breaks down as 6% for most of the state but 7% in Pittsburgh and 8% in Philadelphia.

Also does not tell you what is taxable as in PA food from grocery and most clothing is not subject to sales tax. In contrast, Alabama taxes all consumer goods sold, including food.

Chart has significant limitations.

Also does not tell you what is taxable as in PA food from grocery and most clothing is not subject to sales tax. In contrast, Alabama taxes all consumer goods sold, including food.

Chart has significant limitations.

Last edited:

Sales tax varies wildly by area. Some states don't tax food, drugs, etc, or tax at a different rate. Here in the Chicago area where we live - town to town can be 7.5% to +9% (the local taxing authority can change things significantly - this was Amazon's dilemma). The only way you can figure out your tax is by doing the math with the receipt - a lot of businesses don't state the actual tax percentages. Really want to be upset - look at your receipt for your hotel stay or car rental (tax percentage can be more than double shown on REWahoo's map, not to mention special assessment fees). I've had tax/fees on car rentals be close to 25% of the bill. Guess they look at it like we screw the out of towner and not the locals  I feel that this is an area of taxing the public that has gotten out of hand. The attached link to some Kiplinger info touches on a more total tax picture, although hidden taxes/fees like those I've mentioned are everywhere, and not accounted for in most tax articles. It's best to visit an area you are considering relocating to along with utilizing this type of tax info.

I feel that this is an area of taxing the public that has gotten out of hand. The attached link to some Kiplinger info touches on a more total tax picture, although hidden taxes/fees like those I've mentioned are everywhere, and not accounted for in most tax articles. It's best to visit an area you are considering relocating to along with utilizing this type of tax info.

State-by-State Guide to Taxes on Retirees-Kiplinger

State-by-State Guide to Taxes on Retirees-Kiplinger

Last edited:

While I suppose it is person- and state-specific, sales tax is often a small fraction of the total state/local taxes even when the sales tax rate is high. The last time I tracked this in detail was in 2009. As a California resident, I paid ...

$13702: State Income Tax

0$3109: Property Tax (1200 sqft house)

00$997: State Disability Tax

000$41: Sales Tax (didn't purchase much)

There were other state and local taxes/fees amounting to a few hundred dollars (e.g., vehicle registration).

So the high California sales tax rate had insignificant impact compared to the high taxes in other areas. Even when I purchased a new car in 2010, the sales tax was "only" $1400 or so. Still relatively small compared to the total state/local taxes.

$13702: State Income Tax

0$3109: Property Tax (1200 sqft house)

00$997: State Disability Tax

000$41: Sales Tax (didn't purchase much)

There were other state and local taxes/fees amounting to a few hundred dollars (e.g., vehicle registration).

So the high California sales tax rate had insignificant impact compared to the high taxes in other areas. Even when I purchased a new car in 2010, the sales tax was "only" $1400 or so. Still relatively small compared to the total state/local taxes.

W2R

Moderator Emeritus

At last, a sales tax map that includes LOCAL sales tax.

Most of these tax compendia list sales tax in Louisiana at 4%, which is what the state gets. But that is just ridiculous here. We also have an additional 4.75% or more that goes to the Parish (=County), so for example the total in my Parish is 8.75%.

Most of these tax compendia list sales tax in Louisiana at 4%, which is what the state gets. But that is just ridiculous here. We also have an additional 4.75% or more that goes to the Parish (=County), so for example the total in my Parish is 8.75%.

While I suppose it is person- and state-specific, sales tax is often a small fraction of the total state/local taxes even when the sales tax rate is high. The last time I tracked this in detail was in 2009. As a California resident, I paid ...

$13702: State Income Tax

0$3109: Property Tax (1200 sqft house)

00$997: State Disability Tax

000$41: Sales Tax (didn't purchase much)

There were other state and local taxes/fees amounting to a few hundred dollars (e.g., vehicle registration).

So the high California sales tax rate had insignificant impact compared to the high taxes in other areas. Even when I purchased a new car in 2010, the sales tax was "only" $1400 or so. Still relatively small compared to the total state/local taxes.

+1 For me the sales tax (8.75%) is a rounding error. Most of what I spend my money on (rent, food, insurance, etc...) is exempt from the sales tax.

Nice picture! It's worth at least a thousand words.

Amazon just announced it will begin collecting sales tax in Fl in a week or so (May 1). The quest for lower taxes is Quixotic.

I knew that was going to happen when they announced they were going to build a large complex in our area. This giant distribution center is being built about three miles from our house. I hear it's for small to medium size items while they are building another distribution center in Lakeland (I think). It will be for larger items, like maybe furniture. The one being built in our immediate area will employ 1000 people. If I can't save on taxes anymore, maybe I can save the shipping cost by just driving over and picking it up.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

One more good piece of information. Estimating the total tax take of any state depends on how one earns and spends money.

That will save having to file the use tax.Amazon just announced it will begin collecting sales tax in Fl in a week or so (May 1).

At last, a sales tax map that includes LOCAL sales tax.

Most of these tax compendia list sales tax in Louisiana at 4%, which is what the state gets. But that is just ridiculous here. We also have an additional 4.75% or more that goes to the Parish (=County), so for example the total in my Parish is 8.75%.

Only some of 'em. Indiana is listed at 7%, but locals can add another 2% for 9% total. Groceries are exempt, but restaurant tax is another 1% in metro Indy to help fund the pro sports teams.