RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

My DW (52) and I (50) just recently retired and seeking real world spending experiences from those of you whom have been retired for at least 10 years and you are 70+ years old now.

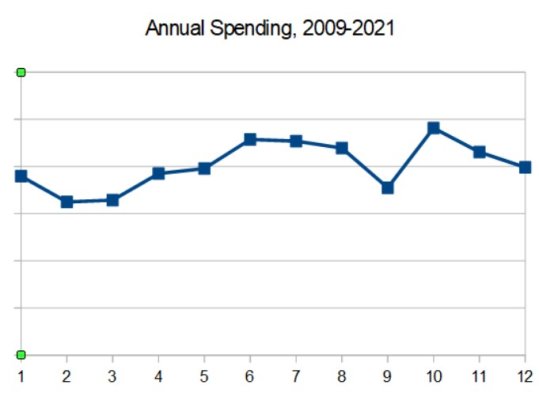

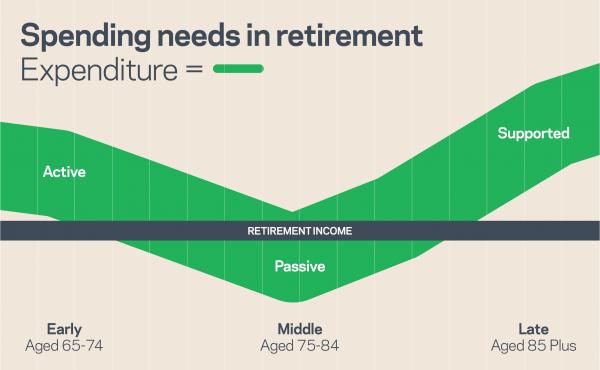

Our assumption is that we are going to spend (adjusted for inflation going forward) approximately $150k ($75k is our base and the other $75k is mostly play or lumpy expenses) for the next ~25 years. Our assumption then assumes our spending/expenses will taper and as we approach 80 years old and then flatline somewhere around our baseline of $75k a year.

We currently have no debt, no mortgage, and approx. $4 mil NW excluding our primary home.

Is it safe to assume that your spending drops as you approach 75 years and continues to drop as you hit 80+?

Our assumption is that we are going to spend (adjusted for inflation going forward) approximately $150k ($75k is our base and the other $75k is mostly play or lumpy expenses) for the next ~25 years. Our assumption then assumes our spending/expenses will taper and as we approach 80 years old and then flatline somewhere around our baseline of $75k a year.

We currently have no debt, no mortgage, and approx. $4 mil NW excluding our primary home.

Is it safe to assume that your spending drops as you approach 75 years and continues to drop as you hit 80+?