|

|

04-04-2012, 11:20 AM

04-04-2012, 11:20 AM

|

#21

|

|

Full time employment: Posting here.

Join Date: May 2004

Location: Worldwide

Posts: 913

|

Letj,

The short answer is no.

No one knows what your tax rate is therefore it would be difficult to compute.

However if you use your IRA for this purpose then you will have no tax issue.

Regards,

Billy

__________________

In 1991 Billy and Akaisha Kaderli retired at the age of 38. They have lived over 2 decades of this financially independent lifestyle, traveling the globe.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

04-04-2012, 12:10 PM

04-04-2012, 12:10 PM

|

#22

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,708

|

"Sell in May", does not take into consideration taxes or transaction costs. It is a slogan derived from looking at the months with highest volatility, calculating the averages, and calling it investment advice. Tax tables are public and rate assumptions are easy enough. But the people that promote these ideas actually need to do the calculations, and very few do.

Looking at the example cited earlier - 7% vs 5.4% - that difference almost completely disappears once short term capital gains taxes are applied yearly to the 7% and long term capital gains taxes are applied once to the 5.4%. Applying transaction costs probably takes away any remaining advantage.

Tax deferred account? Sure, why not. Of course, when there are losses, they can't be used to offset taxable gains, but every strategy has its shortcomings.

Value Line Investment Analyzer has developed a methodology that is even better, consistently identifying the stocks that outperform their markets. They have shown the data and historical comparisons that make this irrefutable. Still, they are unable to actually make that strategy work in a mutual fund. So, does "sell in May" work? Sure it does, and will continue to do so, until it doesn't. And then it will be something else.

|

|

|

04-04-2012, 01:30 PM

04-04-2012, 01:30 PM

|

#23

|

|

Full time employment: Posting here.

Join Date: May 2004

Location: Worldwide

Posts: 913

|

Michael,

Transactions costs are so small now that I doubt they affect returns much. But the point that you might be missing, is that once you “sell in May” with your gains protected, you have cash available to make money on the downside.

Last year…. I know one year is not a sample, but for illustration purposes, …the market peaked in April, then dropped 20% inter-day. If you got out in April, went short, making 10-15% on the downside, then went long again in the fall you far out performed the averages for the year.

Could this pattern repeat again this April? I have my doubts this being an election year but that’s a whole other discussion.

Regards,

Billy

__________________

In 1991 Billy and Akaisha Kaderli retired at the age of 38. They have lived over 2 decades of this financially independent lifestyle, traveling the globe.

|

|

|

04-04-2012, 01:55 PM

04-04-2012, 01:55 PM

|

#24

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

It looks like people are selling in April now instead of May. Darn, they beat me out the door! It's not fair.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

04-04-2012, 01:57 PM

04-04-2012, 01:57 PM

|

#25

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,708

|

Quote: Quote:

Originally Posted by Billy

Michael,

Transactions costs are so small now that I doubt they affect returns much. But the point that you might be missing, is that once you “sell in May” with your gains protected, you have cash available to make money on the downside.

Last year…. I know one year is not a sample, but for illustration purposes, …the market peaked in April, then dropped 20% inter-day. If you got out in April, went short, making 10-15% on the downside, then went long again in the fall you far out performed the averages for the year.

Could this pattern repeat again this April? I have my doubts this being an election year but that’s a whole other discussion.

Regards,

Billy

|

Billy, the proposal isn't sell in May and protect your gains, it's "Sell in May and reinvest in October". It is a strategy that identifies the two months of greatest average volatility, one up and the other down and assumes those two months will continue to behave in that same fashion. That is like gambling, placing the bets based on past winning and losing numbers. There is no relation between past results and future outcomes on something this random. If someone wants to set aside part of their portfolio to do this and they can afford to lose, why not? Its as good as any other scheme based on past performance, and there are quite a few. But lets not kids ourselves into thinking this is investing that will lead to increased odds of portfolio survival.

|

|

|

04-04-2012, 03:18 PM

04-04-2012, 03:18 PM

|

#26

|

|

Full time employment: Posting here.

Join Date: May 2004

Location: Worldwide

Posts: 913

|

Billy, the proposal isn't sell in May and protect your gains, it's "Sell in May and reinvest in October". It is a strategy that identifies the two months of greatest average volatility, one up and the other down and assumes those two months will continue to behave in that same fashion.

Michael, That is you interpretation, perhaps you should read the interview then you would know what I am talking about.

The returns speak for themselves.

Regards,

Billy

__________________

In 1991 Billy and Akaisha Kaderli retired at the age of 38. They have lived over 2 decades of this financially independent lifestyle, traveling the globe.

|

|

|

04-04-2012, 03:43 PM

04-04-2012, 03:43 PM

|

#27

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,708

|

Quote: Quote:

Originally Posted by Billy

Michael, That is you interpretation, perhaps you should read the interview then you would know what I am talking about.

The returns speak for themselves.

Regards,

Billy |

Ok. Now I see. The original post and most of the responses to the thread, including mine, are about "sell in May and buy in October (or November). You are discussing a different strategy that is detailed elsewhere. If you care to post a summary of the strategy here I am happy to look at it, and others probably will as well.

Cheers, and hope you're feeling better.

|

|

|

04-04-2012, 04:41 PM

04-04-2012, 04:41 PM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,363

|

Quote: Quote:

Originally Posted by Retire Soon

During the past 10 years if someone had sold their entire stock portfolio on May Day and reinvested their entire stock portfolio on Halloween their annualized return in the Wilshire 5000 would have been 7% versus a buy and hold strategy of 5.4%......

|

I wonder if this is all in - that is, including dividends, interest on cash, transaction costs, taxes, etc. or just based on the change in indices themselves?

|

|

|

04-04-2012, 04:56 PM

04-04-2012, 04:56 PM

|

#29

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by Billy

Michael,

Transactions costs are so small now that I doubt they affect returns much. ...

|

I think Michael was referring to doing the study that shows how much better a sell-in-May plan has been. When doing backtesting of patterns the past existing scenarios should be included.

So if we go back to the 1950's we should be including (1) the tax scenario then, (2) the brokerage fees back then, (3) the investment instruments available then. For the 1950's through maybe the 1970's it probably would not be fair to assume one invested in the SP500 index, for instance, as there were no easy ways for retail investors to do that (I think). There were no-load mutual funds that could be switched out of with a telephone call but even no-loads were used by only a minority of retail investors. They might have had a bit higher ER on average to allow for the investor switching and the type of investor attracted to such a fund. Did the study consider these sorts of things?

BTW, I'm not at all opposed to market timing but few seem to have the statistics to back up their approach.

|

|

|

04-04-2012, 09:52 PM

04-04-2012, 09:52 PM

|

#30

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2004

Location: Minneapolis

Posts: 4,455

|

Quote: Quote:

Originally Posted by Billy

Michael, That is you interpretation, perhaps you should read the interview then you would know what I am talking about.

The returns speak for themselves.

Regards,

Billy |

This test: Simple Tests of Sy Harding’s Seasonal Timing Strategy

asserts this following conclusion:

" In summary, evidence from simple tests on available data for SPY does not support belief that Sy Harding’s Seasonal Timing Strategy is a compelling improvement over a buy-and-hold strategy or that the MACD signal refinement improves seasonal entry and exit."

__________________

May we live in peace and harmony and be free from all human sufferings.

|

|

|

04-04-2012, 10:00 PM

04-04-2012, 10:00 PM

|

#31

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2008

Location: No fixed abode

Posts: 8,765

|

I prefer the "buy AAPL in 1987 and live in investor heaven" technique. Wish I'd followed it.

__________________

"Good judgment comes from experience. Experience comes from bad judgement." - Anonymous (not Will Rogers or Sam Clemens)

DW and I - FIREd at 50 (7/06), living off assets

|

|

|

04-04-2012, 10:42 PM

04-04-2012, 10:42 PM

|

#32

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2004

Location: Minneapolis

Posts: 4,455

|

Quote: Quote:

Originally Posted by harley

I prefer the "buy AAPL in 1987 and live in investor heaven" technique. Wish I'd followed it.

|

This is a great story about people investing in Apple:

Apple's Once Unfortunate Investor, Now Multi-Millionaire | ValueWalk

__________________

May we live in peace and harmony and be free from all human sufferings.

|

|

|

04-05-2012, 07:16 AM

04-05-2012, 07:16 AM

|

#33

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2008

Posts: 13,143

|

Quote: Quote:

Originally Posted by harley

I prefer the "buy AAPL in 1987 and live in investor heaven" technique. Wish I'd followed it.

|

Don't remind me. About my non-buy of APPL back when it was about $13/share.

At least now it's my biggest holding. Not directly, but indirectly via VTSMX.

__________________

Have you ever seen a headstone with these words

"If only I had spent more time at work" ... from "Busy Man" sung by Billy Ray Cyrus

|

|

|

04-05-2012, 07:37 AM

04-05-2012, 07:37 AM

|

#34

|

|

gone traveling

Join Date: Sep 2003

Location: DFW

Posts: 7,586

|

I believe this strategy has to do with being in the market during its historically best months (Nov - April) and out from May - October which historically are the worse months. This certainly was not a good strategy back in 2009.

|

|

|

04-05-2012, 08:28 AM

04-05-2012, 08:28 AM

|

#35

|

|

Full time employment: Posting here.

Join Date: May 2004

Location: Worldwide

Posts: 913

|

Spanky,

It’s good to see someone here took the time to do a little research on this before they responded.

Thanks.

The first thing I noticed in that back test was that they used SPY. Sy does not. I am not sure how much of a difference it would make, but just saying.

IMO, Sy’s strategy had a couple of off years due to the FED injecting sweetener into the markets at various times of the year. Perhaps this happened when Sy was in cash thus reducing his gains. I do not know. But the past is just that and we cannot change it. I am interested in future returns and my bottom line and after over three decades of investing and 22 years of being homeless and jobless, i.e. retirement, I am still here.

That said he produced the above returns while being out of the market 50% of the time and thus reducing risk, and this is not the only portfolio he runs.

Again, IMO we are still working off the effects of huge debt run ups by both the consumer and governments and have a few more years of these going nowhere markets. I hope I am wrong but in the meanwhile I want to profit from the opportunities both on the long and short side.

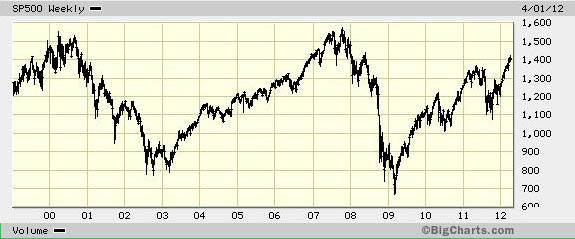

13 years….flat lining.

Or

Now I am going back to chanting with my Mayan friends on the shores of Lake Atitlan, Guatemala and discussing what if the world really doesn’t end December 21st 2012.

Regards,

Billy

__________________

In 1991 Billy and Akaisha Kaderli retired at the age of 38. They have lived over 2 decades of this financially independent lifestyle, traveling the globe.

|

|

|

04-05-2012, 10:02 AM

04-05-2012, 10:02 AM

|

#36

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

If there was a time that I wish I had "sold in May", it was last year. I was doing great gun, then while I went RV boondocking in the summer, the congressional budget debacle and the Greece situation caused me to lose 20%.

But, but, but looking at the above chart, I cannot help thinking that the seasonal market timing is small potatoes compared to the bigger multi-year market cycles. Of course, a buy-and-rebalance investor gets some of that too.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

04-05-2012, 01:04 PM

04-05-2012, 01:04 PM

|

#37

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,363

|

If this really works I wonder what would happen if one went long from Nov-May and then went short from June-Oct.

|

|

|

04-05-2012, 02:08 PM

04-05-2012, 02:08 PM

|

#38

|

|

Full time employment: Posting here.

Join Date: Feb 2012

Posts: 648

|

I've studied this a lot over the last few years and as other have eluded to already... it is one of those "who knows what it'll actually be like this year though"

There are plenty of other patterns you see besides the popular "sell in may" one... if you look at the overall market (DOW or S&P500, take your pick) you'll see that almost all of the return over the last 50 years has occurred in a 5 day period each month (the last 3 days of the month leading into the first 2 days of the next).... some have concluded that this is because people tend to invest the most during those periods of time (drip investing... or putting extra month left over from the monthly budget into stocks)

Accurate models exist that will show you that investing in the stock market for only 60 days out of the year while leaving your money in cash or money market accounts the other 300 days will give you a better return with less volatility... of course... trading costs money and there are buy/sell penalties as the spread, or trading friction, works against you (when you request to buy something, you typically pay more for it... and when you want to sell something you typically get less for it - simple supply/demand).

Computer models are fun... but they usually lead people to over-react to patterns they've seen in the past. This over-reaction is often more damaging than just staying invested long term and not messing with things...

Some people try to predict exactly when the sell in May will begin and try to get their money out before that drop... when others see the market falling they pile on and sell too causing a domino effect. Fact is... you never really know when/if it will even come...

trying to time the market is speculation at best... you are just adding unnecessary risk in doing so - risk that you might be selling at the bottom and sitting on the sideline during a recovery.

just my 2 cents...

|

|

|

04-05-2012, 02:12 PM

04-05-2012, 02:12 PM

|

#39

|

|

Moderator Emeritus

Join Date: Dec 2002

Location: Oahu

Posts: 26,860

|

Quote: Quote:

Originally Posted by Mulligan

I wonder if the sell in May rule applied to Hathaway, too.

|

The problem is that the annual meeting is in early May and insurance companies start gearing up for hurricane season in June. I'd think that either one of those would have a bigger effect.

We bought at $11 and sold at $15 because it looked like they didn't have a prayer after ignoring their core computer business to chase after this iPod fad.

Seriously, I think it's fair to say that most troubled companies have low stock prices for a reason.

__________________

*

Co-author (with my daughter) of “Raising Your Money-Savvy Family For Next Generation Financial Independence.”

Author of the book written on E-R.org: "The Military Guide to Financial Independence and Retirement."

I don't spend much time here— please send a PM.

|

|

|

04-05-2012, 02:48 PM

04-05-2012, 02:48 PM

|

#40

|

|

Full time employment: Posting here.

Join Date: Feb 2012

Posts: 648

|

life is full of

back in 2003 for a senior design class in my undergrad studies a group of 3 other students and I created what essentially could have been facebook, we called it Friendster (individual website profiles for user accounts that stored photos and life stories while linking each-other through friend requests)... we even went above and beyond showing how apps could be developed for cellphone to integrate into the system. The design as more advanced than what facebook would be for its startup phase as facebook mobile didn't come around until 2007. The name was a play off of napster (which is still pretty popular at the time)

We received an A+ for the course and the teacher recommended we submit the project for a national conference in Human to Computer Interaction (what this kind of thing was called before the phrase Social Media was coined)...

we took our A's and left for the summer without thinking twice about his advice to turn the project into something real... I forgot about the project entirely until late 2004, when I signed up for facebook and thought "interesting... this guy basically did the same thing we did, good for him. This is neat."

Some other future projects I decided to actually put out there and they've done well for me... guess you learn from your mistakes as you go

(also... it doesn't just take a good idea to make what facebook is today... Mark Z clearly has a business side to him that I lack. Most of what facebook is today is because of how it was marketed and the risks that were taken early on with raising capital for the project... things that we never would have done had we decided to turn our idea into a company...)

Plus, I would have just sold it for $10 million in its first few years and retired at the age of 25  - who needs that kind of stress?

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|