ugeauxgirl

Thinks s/he gets paid by the post

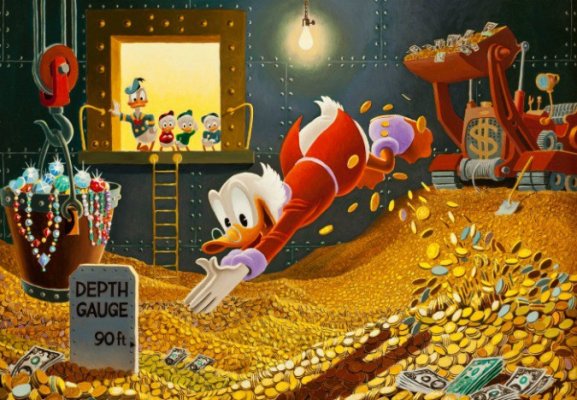

We just passed the $2mm net worth on Friday with the help of our Bonuses. Jumped straight to $2.1mm including our home equity and two rentals. We are 70% to goal before retiring. Continuing to pay down home at the rate of 60k per year and should have paid off in 7 years. Then can seriously think of retirement. Plan is to sell everything, buy a boat to live and travel on for a minimum of 2years. We can’t wait!

That must have been a heck of a bonus! Congrats