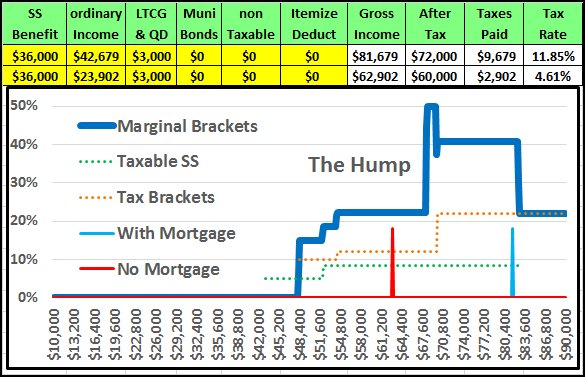

Sandy, maybe I missed something, but where is the marginal tax rate 50% for someone making 70k?

The 1983 amendment to the social security act changed the “tax free” nature of your Social Security benefits to “tax deferred”. The “basis” for this taxation is one half of your benefits plus your other taxable income. This is represented on the graph by the dotted green line. This taxation starts for an individual at $25,000 and $32,000 for a married couple.

Half of $36,000 is $18,000 plus $7,000 equals $25,000. So the dotted green line starts at $36,000 plus $7,000: $43,000 on the graph. It starts at 5%, representing the 50% taxability level of your benefits. The 1993 Budget Bill added a second 85% taxability level starting at $34,000 for a single person and $44,000 for a married couple.

Note how the solid blue line starts at 15%. If you earn / withdraw an additional $100 when your tax bracket, the dotted red line, is 10%, that $100 makes $50 of your deferred social security benefit taxable so you are paying 10% of $150, not just the $100 that your income increased and $15 is 15% of the $100 that you withdrew. The next marginal tax level is 18.5% when the taxability level is 85% and your tax bracket is 10%. The next marginal tax level is $22.20 which is 12% of $100 plus $85.

Let’s ignore the 49.95% level and jump to the 40.7% level. 22% of $185 is $40.70.

Now to the more complex 49.95% marginal bracket. The 22% bracket starts at $38,700. For some reason the new tax bill starts the taxability of your deferred LTCGs at $38,600. This is why there is a small dip in the marginal tax line over that $100 income level.

Assume that your taxable income is at $35,600. Plus your $3,000 of LTCGs is a total of $38,600, nothing over that so none of your gains are taxable. Now, you withdraw an additional $100 from your IRA which makes an additional $85 of your Social Security benefits taxable. So your taxable income increases by $185. $185 at the 12% tax bracket is $22.20. But, this also pushes $185 of your tax deferred LTCGs over the $38,600 limit where they are now taxed at the special 15% bracket. 15% of $185 is $27.75.

Bottom line: When the taxation of your additional income is added to the deferred taxation of your Social Security Benefits plus the deferred taxation of your LTCGs, $22.20 plus $27.75 results in paying an additional $49.95 because you withdrew $100 and that is a 49.95% marginal tax bracket.

So, to correct your statement, the IRS is not taking 50% of your money, they are only taking 49.95%.