A bit of background on my investment experience. I was married to a bum who decided he didn't want to work. So I slaved away 7 days a week at a 12 hours/day job. The money I made started to accumulate and I invested some into Janus Fund. I also invested in Fidelity Magellan where my money grew. I continued to buy funds and held them with various fund companies.

Exhausted from working I asked my DH to manage the investments. He began investing through our local bank. Unfortunately, I didn't check my investments or really know the costs associated with them.

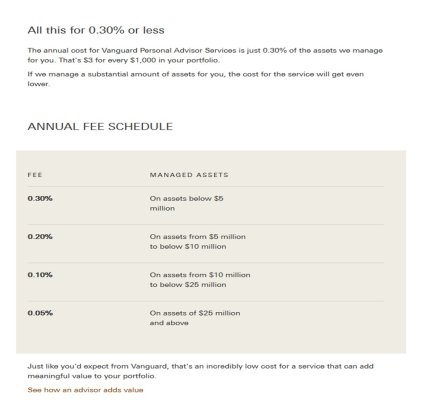

After he died, I had to take over the money matters and two years later I finally started looking at the management fees I was paying at several banks. One guy who had moved out of state was still making money off my investments was listed on the statement as getting paid 3% per quarter! I called every investment company where my money was at and told them I would manage my own money going forward.

Well, investing in equities got me good returns through the 90s and since my 401k was at Fidelity, I decided to start transferring my assets to Fidelity in 2012. I managed all my investments because I made huge mistakes and had learned from them while investing at the bank. Now almost all of my money is at Fidelity (though the investments are with various mutual fund companies).

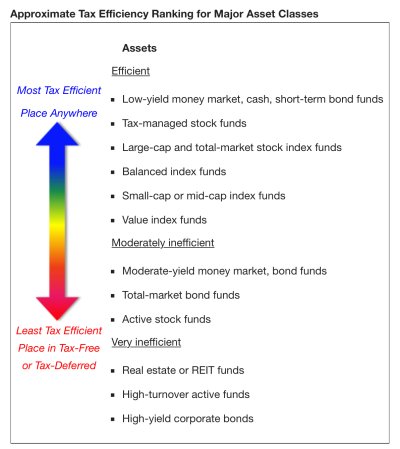

This past December, I got a new Fidelity rep as the previous one had been promoted to VP managing business accounts. The new rep has tax background and she recommended that I have my portfolio managed for better tax benefits. The Trust acct had really high dividend earnings which are not tax free. I made a lot of money which will go to uncle Sam as I don't have any write offs. She recommended I get the Portfolio Advisory Services. I signed the paperwork and have seen my account get balanced since my last visit on January 14th.

Does anyone else have a similiar set up with Fidelity. I have always invested my own money and have been a "Buy and Hold" investor. I don't worry about market fluctuations and check my portfolio when I think about it.

This past December I was too late in taking out my charity money from the Trust fund which had really high dividends. I was waiting to hear from my rep and she never saw the email. In hindsight, I should've taken care of it with a phone call. I use the charity contributions as a tax write off instead of paying the IRS.

I could sure use input about Portfolio Advisory Services and whether it is a good thing to have. It's the first time I am letting someone else do my investing for me. So far, they've managed to take most of the money out of the (heavily taxed) Trust Fund and put it into my ROTH IRAs and Annuity accounts. I had never thought to do that because of tax consequences due to selling my holdings.

Thanks for reading and I look forward to spending more time here to learn as much as I can from you all. In between jobs; so I will be spending time online getting educated on tax efficient investing.

-Barb

Exhausted from working I asked my DH to manage the investments. He began investing through our local bank. Unfortunately, I didn't check my investments or really know the costs associated with them.

After he died, I had to take over the money matters and two years later I finally started looking at the management fees I was paying at several banks. One guy who had moved out of state was still making money off my investments was listed on the statement as getting paid 3% per quarter! I called every investment company where my money was at and told them I would manage my own money going forward.

Well, investing in equities got me good returns through the 90s and since my 401k was at Fidelity, I decided to start transferring my assets to Fidelity in 2012. I managed all my investments because I made huge mistakes and had learned from them while investing at the bank. Now almost all of my money is at Fidelity (though the investments are with various mutual fund companies).

This past December, I got a new Fidelity rep as the previous one had been promoted to VP managing business accounts. The new rep has tax background and she recommended that I have my portfolio managed for better tax benefits. The Trust acct had really high dividend earnings which are not tax free. I made a lot of money which will go to uncle Sam as I don't have any write offs. She recommended I get the Portfolio Advisory Services. I signed the paperwork and have seen my account get balanced since my last visit on January 14th.

Does anyone else have a similiar set up with Fidelity. I have always invested my own money and have been a "Buy and Hold" investor. I don't worry about market fluctuations and check my portfolio when I think about it.

This past December I was too late in taking out my charity money from the Trust fund which had really high dividends. I was waiting to hear from my rep and she never saw the email. In hindsight, I should've taken care of it with a phone call. I use the charity contributions as a tax write off instead of paying the IRS.

I could sure use input about Portfolio Advisory Services and whether it is a good thing to have. It's the first time I am letting someone else do my investing for me. So far, they've managed to take most of the money out of the (heavily taxed) Trust Fund and put it into my ROTH IRAs and Annuity accounts. I had never thought to do that because of tax consequences due to selling my holdings.

Thanks for reading and I look forward to spending more time here to learn as much as I can from you all. In between jobs; so I will be spending time online getting educated on tax efficient investing.

-Barb