You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Social Security 1.3% increase 2021

- Thread starter bizlady

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Preview:

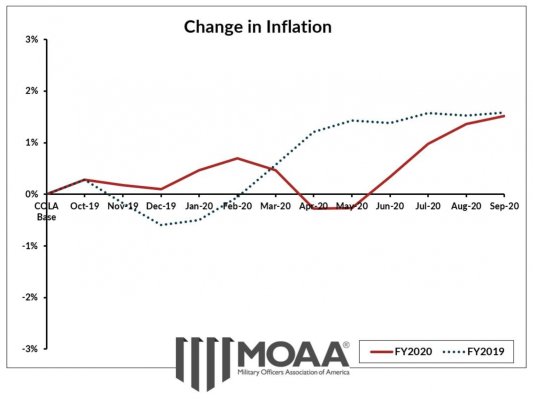

Seniors on Social Security will see their benefits increase by 1.3% come 2021. News of an official cost-of-living adjustment, or COLA, was announced this morning by the Social Security Administration.

That 1.3% COLA aligns with previous estimates made by the non-partisan Senior Citizens League and is based on third-quarter data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of common goods and services.

tenant13

Full time employment: Posting here.

Between this, Fed's officially stated goal of increasing inflation beyond 2% and real life negative interest rates I feel that in order to retire comfortably on 4% withdrawals one needs to take increasingly higher investments risks...

Between this, Fed's officially stated goal of increasing inflation beyond 2% and real life negative interest rates I feel that in order to retire comfortably on 4% withdrawals one needs to take increasingly higher investments risks...

Hence the record profits many casinos are experiencing.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Between this, Fed's officially stated goal of increasing inflation beyond 2% and real life negative interest rates I feel that in order to retire comfortably on 4% withdrawals one needs to take increasingly higher investments risks...

I'm not so sure. It might surprise you to know that in order for 4% inflation-adjusted withdrawals to be successful over 30 years that the nominal average rate of return only needs to be 3.1% with 2% inflation... that is only a 1.1% real return.

That 3.1% is less than half of the historical nominal return of a 20/80 AA portfolio of 6.6%. now obviously, the sequence of those returns matters, but with a low stock AA the SORR would be lower.

| Withdrawal | Balance | |

| Inflation | 2.00% | |

| Nominal return | 3.10% | |

| 0 | 100.00 | |

| 1 | 4.00 | 99.10 |

| 2 | 4.08 | 98.10 |

| 3 | 4.16 | 96.98 |

| 4 | 4.24 | 95.75 |

| 5 | 4.33 | 94.39 |

| 6 | 4.42 | 92.90 |

| 7 | 4.50 | 91.28 |

| 8 | 4.59 | 89.52 |

| 9 | 4.69 | 87.61 |

| 10 | 4.78 | 85.55 |

| 11 | 4.88 | 83.33 |

| 12 | 4.97 | 80.95 |

| 13 | 5.07 | 78.39 |

| 14 | 5.17 | 75.64 |

| 15 | 5.28 | 72.71 |

| 16 | 5.38 | 69.59 |

| 17 | 5.49 | 66.26 |

| 18 | 5.60 | 62.71 |

| 19 | 5.71 | 58.95 |

| 20 | 5.83 | 54.95 |

| 21 | 5.94 | 50.71 |

| 22 | 6.06 | 46.22 |

| 23 | 6.18 | 41.47 |

| 24 | 6.31 | 36.45 |

| 25 | 6.43 | 31.15 |

| 26 | 6.56 | 25.55 |

| 27 | 6.69 | 19.65 |

| 28 | 6.83 | 13.44 |

| 29 | 6.96 | 6.89 |

| 30 | 7.10 | 0.00 |

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I suppose that might mean “hold harmless” applies again next year?

tenant13

Full time employment: Posting here.

I'm not so sure. It might surprise you to know that in order for 4% inflation-adjusted withdrawals to be successful over 30 years that the nominal average rate of return only needs to be 3.1% with 2% inflation... that is only a 1.1% real return.

That 3.1% is less than half of the historical nominal return of a 20/80 AA portfolio of 6.6%. now obviously, the sequence of those returns matters, but with a low stock AA the SORR would be lower.

[/TABLE]

Numbers tell half of the story. The real inflation would be different for everyone depending on our type of spending. I feel that my number is reasonable but I don't have college age kids and real estate, vehicle or medical expenses. That may change if travel is back and all of a sudden flights cost twice as much but I'll worry about that when it comes to crossing that bridge.

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,140

Although not yet officially announced, and probably won't be until November, the 2021 Medicare premium is projected to increase around $4 - $5. The 2021 increase is limited to 25% of what it would normally be due to limits in the spending bill. But as always, the hold harmless will apply to any increase.

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I call BS on the 1.3%. Yes, I know it's adjusted for different categories but I think a good bellwether is food costs. From the USDA...

The CPI for all food was up 0.1 percent between July 2020 and August 2020, and food prices were 4.1 percent higher than the August 2019 level.

The degree of food price inflation varies depending on whether the food was purchased for consumption away from home or at home:

The food-away-from-home (restaurant purchases) CPI increased 0.3 percent in August and was 3.5 percent higher than August 2019; and

The food-at-home (grocery store or supermarket food items) CPI decreased 0.1 percent from July to August 2020 and was 4.6 percent higher than last August

The CPI for all food was up 0.1 percent between July 2020 and August 2020, and food prices were 4.1 percent higher than the August 2019 level.

The degree of food price inflation varies depending on whether the food was purchased for consumption away from home or at home:

The food-away-from-home (restaurant purchases) CPI increased 0.3 percent in August and was 3.5 percent higher than August 2019; and

The food-at-home (grocery store or supermarket food items) CPI decreased 0.1 percent from July to August 2020 and was 4.6 percent higher than last August

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I call BS on the 1.3%. Yes, I know it's adjusted for different categories but I think a good bellwether is food costs. ...

I'm not so sure that food is a good bellweather... groceries is only ~10% of our spending. I think you need to look at spending as a whole and that is hard to get a good apples-to-apples comparison that isolates the price increases vs volume changes.

I had looked at a few things for us the other day and posted in another thread:

For those that I can compare apples-to-apples.... electric rate per KW is 8.8% higher. Insurance (home, auto, umbrella, et al) is the same as last year. Property tax rate is actually a hair lower than 2019, but property tax is higher due to town-wide reappraisal hitting lakefront property more than total.

Last edited:

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm not so sure that food is a good bellweather... groceries is only ~10% of our spending. I think you need to look at spending as a whole and that is hard to get a good apples-to-apples comparison that isolates the price increases vs volume changes.

I had looked at a few things fro us the other day and posted in another thread:

Other increases *I* have seen: Auto and home owners...increased enough that it's time to shop around. Electricity up 2.3% this year and the powers that be are looking at a 23% increase over the next 5 years (so about 4.6%). Property tax up about 2%.

Added:

Americans spend more on food than on almost any other line-item in the household budget. According to the Bureau of Labor Statistics, nationally we spend more than $7,700 per year on groceries and going out. For rural and suburban consumers it's their third-highest expense after housing and transportation. Urban residents spend more on food than anything aside from housing.

bada bing

Full time employment: Posting here.

Meanwhile the wage index increased 3.7% .

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Nice!

I guess this is good for people who haven’t turned 62 yet?

I guess this is good for people who haven’t turned 62 yet?

https://socialsecurityintelligence.com/the-average-wage-index-awi/For retirement benefits, the COLAs are applied to your benefit in the year you turn 63 and thereafter. You do receive the COLA for the year you turn 62; it just isn’t applied until the year you turn 63. Another way to frame this is by thinking of the AWI as taking care of the inflation before age 62, and the CPI-W taking care of the inflation at and after age 62.

Last edited:

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Nice!

I guess this is good for people who haven’t turned 62 yet?

https://socialsecurityintelligence.com/the-average-wage-index-awi/

Usually the AWI is higher than the SS COL increase.

Questions for all.

When does this % get posted?

When is the Medicare B increase posted?

What happened to that estimate issue for those born in 1960?

This thread/topic is timely.

I just elected to start SS, expecting my first payment to be deposited in November.

Will the 1.3% COLA increase be applied in Jan, 2021 payment (deposited in Feb, 2021)?

I'll gladly take the 1.3%. Better that 0.0%.

I just elected to start SS, expecting my first payment to be deposited in November.

Will the 1.3% COLA increase be applied in Jan, 2021 payment (deposited in Feb, 2021)?

I'll gladly take the 1.3%. Better that 0.0%.

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,140

This thread/topic is timely.

I just elected to start SS, expecting my first payment to be deposited in November.

Will the 1.3% COLA increase be applied in Jan, 2021 payment (deposited in Feb, 2021)?

I'll gladly take the 1.3%. Better that 0.0%.

In the past, the COLA was applied to the deposit received in January.

bada bing

Full time employment: Posting here.

Nice!

I guess this is good for people who haven’t turned 62 yet?

It depends a little on your individual situation, like everything in SS. The AWI is used as the annual inflator on an individual's earning record prior to age 60, and it is used to adjust the bend points up, and it is used to adjust the contribution cap. If you are under 60 and earn less than the FICA cap, the AWI increase is all around beneficial. If you earn above the annual cap, you'll pay more. At age 60, the AWI no longer applies to your existing earnings record and the lower COLA rate is used for benefits adjustments from then on. It is another "gotcha" for upper income earners still working and contributing to FICA - just another small reason to retire

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks for the explanation. I had forgotten the details. I haven't worked for a very long time.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I could whine about the inflation increase. I've mentioned many times that I don't buy the official inflation numbers. My HOA dues went up 8% this year and that's NOT unusual on the Island. THAT's a fair chunk of money. Most of the food items I purchase in the grocery are up WAY more than 1.3% (or the official number, what ever it is.) I could go on... and on. But I won't.

I think what this discussion points out is that we (those who have and those who want to FIRE) are still pretty much on our own. We here, for the most part, don't "live or die" on a 1.3% increase in SS. We may or may not whine about it (and the MC costs to be announced and ACA subsidies and income limits, etc.). My contention is that if this "news" gives anyone of us pause about retiring or being able to stay retired, we need to rethink our "plan." Natural, YMMV.

I think what this discussion points out is that we (those who have and those who want to FIRE) are still pretty much on our own. We here, for the most part, don't "live or die" on a 1.3% increase in SS. We may or may not whine about it (and the MC costs to be announced and ACA subsidies and income limits, etc.). My contention is that if this "news" gives anyone of us pause about retiring or being able to stay retired, we need to rethink our "plan." Natural, YMMV.

CRLLS

Thinks s/he gets paid by the post

Let's wait to see how much the Medicare premiums increase to see how much we actually receive. I'm sure some might say that Medicare premium costs, along with the deductibles are included in that 1.3% Cola. I suspect that I may see close to zero additional SS next year.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Let's wait to see how much the Medicare premiums increase to see how much we actually receive. I'm sure some might say that Medicare premium costs, along with the deductibles are included in that 1.3% Cola. I suspect that I may see close to zero additional SS next year.

I certainly don't want to pay more for MC (I'm crazy but not stupid!

) Having said that, MC is such a great benefit that I'm never too upset when the new "numbers" come in each year. I can deal with a few % increase in premiums when I see how little I have to cough up when I have a claim. (Hopefully, the gummint isn't reading this!

) Having said that, MC is such a great benefit that I'm never too upset when the new "numbers" come in each year. I can deal with a few % increase in premiums when I see how little I have to cough up when I have a claim. (Hopefully, the gummint isn't reading this!Similar threads

- Replies

- 6

- Views

- 1K

- Replies

- 33

- Views

- 4K

- Replies

- 15

- Views

- 746