Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

https://www.cnbc.com/2021/06/16/social-security-cola-for-2022-could-be-higher-based-on-consumer-prices.html

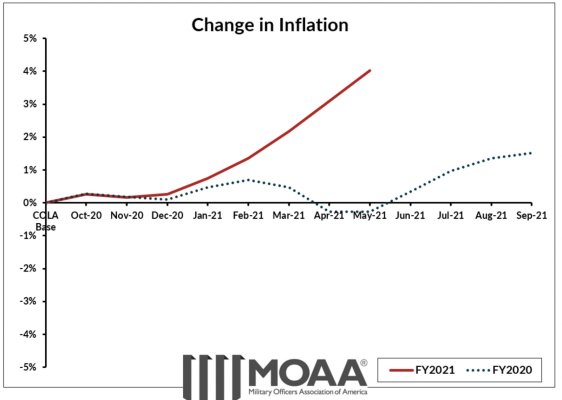

This will be a significant increase in usage of trust funds should it turn out to be true.

This will be a significant increase in usage of trust funds should it turn out to be true.