|

|

Social Security Marriage Hump Penalty

09-24-2017, 05:18 PM

09-24-2017, 05:18 PM

|

#1

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Social Security Marriage Hump Penalty

Sorry for the PG rated title, but I didn’t know how else to arrange the 5 words this post is about. At least I did get your attention.

This post is not a question, I just wanted to pass on the primary issues that Shirley and I are taking into account as we plan for her retirement. Recognizing these issues early helped us to do things like Roth conversions and recharacterizations early so that we will have non-taxable sources of income as needed to avoid the Hump taxes we are about to discuss!

We are posting this because very few of the people that we talk to have any idea that they can be facing marginal federal tax rates as high as 55.5% with gross retirement income levels as low as $50,000. They also believe that all of the marriage penalties in our tax code were eliminated in 2002 and have no idea that they still exist for married couples today who are on Social Security.

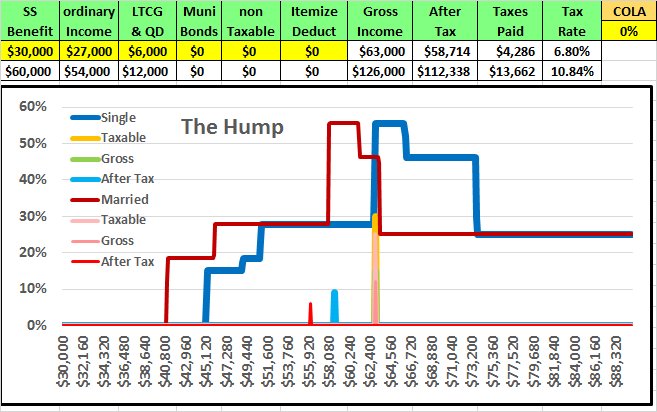

This is a picture of what we want to talk about.  We are all used to the current 10%, 15%, and 25% tax brackets while we are working. The “parallel taxation” of our Social Security benefits can cause our marginal tax brackets to go as high as 55.5% at relatively low income levels, something that, as this picture illustrates, we call The Hump. The fact that the per capita married tax rate line happens before the per capita single tax rate line illustrates the marriage penalty that still exists for retirees, we all pay the same taxes, but married couples pay them earlier!

P.S. A marginal tax rate bracket comes from the total amount that your federal taxes increase for each additional dollar of income. Your actual Tax Bracket is only one of the reasons you pay more taxes.

Reference: https://taxfoundation.org/us-federal...sted-brackets/

Prior to 2002 the ratio between tax brackets for Single vs. Married was 5 to 3. If the top of a single bracket was $6,000, the top of the same married bracket was only $10,000. The “ Economic Growth and Tax Relief Reconciliation Act of 2001” changed that ratio to 2 to 1 so the bracket tops are now $6,000 and $12,000, the tax brackets for two married individuals are now 2 times the size of the same tax bracket for one single individual, as it should be.

Prior to 1983 the Social Security benefits you received during retirement were tax free. After all, the money you gave to Social Security from your paycheck had already been taxed once. The “ 1983 Amendments to the Social Security Act” recognized that your contribution was also matched by your employer who was able to make the contribution before paying taxes on it, so congress decided that half of your benefits check still needed to be taxable.

Since this was done during the Marriage Penalty years, they came up with a formula for the 50% taxation of your benefits to start at $25,000 for a single person and $32,000 for a married couple, a ratio of only 1.28 to 1! When your income is above these levels, taking an additional $100 withdrawal from a taxable source like your IRA/401K would increase your income for tax purposes by the $100 you withdrew plus another $50 of your SSB. If you were in the 15% bracket your taxes would increase $22.50, 15% of $150, a marginal rate of 22.5%. This double taxation would stop when 50% of your benefits had been taxed.

This changed again in 1993. “ The Omnibus Budget Reconciliation Act of 1993” defined a second level of SSB taxability at 85% starting at income levels of $34,000 and $44,000, a 1.29 to 1 ratio, until 85% of your benefits have been taxed. Now if you were in the 15% bracket your taxes would increase $27.75, 15% of $185. This second level of double taxation would stop when 85% of your benefits had been taxed.

The taxation starting points of both of these bills are based on ˝ of your SSB plus all of your other taxable income, and these starting points were defined by congress so they would not to tax lower income individuals IN 1983 AND 1993 WHEN THE LAWS WERE WRITTEN! After all, congress was only “taxing the rich”.

All of the other brackets and numbers related to your taxes and Social Security are adjusted each year for inflations or COLA. The $25,000, $32,000, $34,000, and $44,000 starting points for SSB taxation were specifically designed by congress not to be COLA adjusted. They are at the same levels today as they were 34 years ago. These double taxation points are now imposed on middle income and even some lower income retired individuals.

The 1993 legislation also created something that we personally refer to as the Tax Hump. We already mentioned the 27.75% marginal tax bracket when your actual tax bracket was 15%. The 1983 50% taxability levels rarely push anyone past the 15% standard tax bracket “today”, but the 85% taxability levels imposed in 1993 do! If you are in the 25% bracket your tax due increase would be $46.25, 25% of $185, a marginal tax bracket of 46.25%.

But, this can get even higher if you have personal investments that are earning dividends. Dividends are also tax deferred. They are tax free until they are pushed into the 25% bracket by your other taxable income at which time they are then taxed at a lower 15% dividend tax rate. Read the following multiple times if you don’t follow it the first time!

- · You take $100 out of your IRA.

- · This causes $85 of your SSB to become taxable income.

- · Your taxes due will increase by $27.75 which is 15% of $185.

- · This additional $185 of taxable income also pushes an additional $185 of your dividends across the 25% boundary.

- · Your taxes due on this additional dividend income will also be $27.75, 15% of $185.

- · Your total taxes due will be $27.75 on the income plus SSB and another $27.75 on the dividends.

- · This is a total tax increase of $55.50 on a $100 withdrawal from your IRA/401K, a marginal federal tax rate of 55.5%!

- · The 25% Federal Brackets for 2017 are scheduled to start at $37,950 for individuals and $75,900 for married couples. At these income level your marginal tax rates could be 46.25% or 55.5%.

- · If your taxable income is over $418,400 your marginal tax rate will only be 39.6%!

You can see why a thorough knowledge of these tax rates can be helpful when planning for or living on your retirement income. The actual chart is nice to understand, but the essential thing for everyone to keep track of is how close their taxable income will be compared to the start of their 25% federal bracket.

We try to estimate our year end tax returns quarterly and always pre-do our annual returns on Black Friday, the day after Thanksgiving. Depending on what we see; sometimes we let our bills wait until after the first of the year or pay them with Roth savings instead of IRA withdrawals. Sometimes we take out a little more in December to max out the 27.75% marginal bracket instead of our normal January withdrawals. This just gives us a head start / cushion on our needs for the next year.

To illustrate The Hump, this table is based on the current 2017 tax brackets:

| Benefit | Start Tax | Save | Start Hump | Width | Return | | Single Individual | | | | | | | $20,000 | $31,954 | $2,534 | $55,567 | $3,139 | $1,784 | | $25,000 | $36,954 | $3,284 | $59,419 | $6,787 | $2,347 | | $30,000 | $41,303 | $3,937 | $63,270 | $10,436 | $2,812 | | $35,000 | $45,467 | $4,561 | $67,121 | $14,085 | $3,249 | | Domestic Couple | | | | | | | $40,000 | $63,908 | $5,069 | $111,134 | $6,278 | $3,569 | | $50,000 | $73,908 | $6,569 | $118,838 | $13,574 | $4,694 | | $60,000 | $82,606 | $7,873 | $126,540 | $20,872 | $5,623 | | $70,000 | $90,934 | $9,123 | $134,242 | $28,170 | $6,498 | | Married Couple | | | | | | | $40,000 | $56,597 | $4,062 | N/A | N/A | $3,162 | | $50,000 | $64,299 | $5,217 | N/A | N/A | $3,642 | | $60,000 | $72,002 | $6,373 | $113,027 | $5,679 | $4,123 | | $70,000 | $79,704 | $7,528 | $120,730 | $12,976 | $4,903 |

The Start of your Tax Hump and it’s the width are determined by your personal SS benefit level, everyone’s situation is different. Since larger benefit amounts result in more deferred income, your taxes start at higher gross income levels so you save more in taxes than an individual whose entire gross income was not deferred. Since you are saving more in taxes at the start, you have to “Return” more of those savings inside The Hump so that your total savings will be reduced back to the point where only 15% of your benefit was tax free.

Also take note of the marriage penalty. The Domestic Couple income levels are two times the Single Individual levels, but Married Couple income and saving levels are all lower.

It should be noted that at all benefit levels if everyone is paying their full Hump taxes, their total taxes are almost equal and the marriage penalty no longer exists.

The first graph shows the worse case situation where the income levels are Single $63,000 each and Married $126,000 joint. If those numbers were increased to $80,000 and $160,000, everyone would be “Over The Hump”, only 15% of everyone’s SSB were tax free, and the taxes paid would be almost identical. The SSB Marriage Penalty is only that a married couple pays more at lower income levels. This only effects middle income Americans, not the Rich!

Hate to ramble on like this, but we just hope that this post has been informative to those who are planning for their early retirement!

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

09-24-2017, 05:33 PM

09-24-2017, 05:33 PM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: Williston, FL

Posts: 3,925

|

You are correct. There are huge penalties when you are married. And not just for social security. By being single, my DGF of 27 years get 100% free healthcare, which includes pharmacy, dental and vision. No premiums, no co-pays.

She even gets a gift card when she goes for routine preventive care.

If we were married, it would cost several thousand a year.

Married, in a legal sense, is an outdated concept. No religion requires you to pay money to a government for a license to get married.

__________________

FIRE no later than 7/5/2016 at 56 (done), securing '16 401K match (done), getting '15 401K match (done), LTI Bonus (done), Perf bonus (done), maxing out 401K (done), picking up 1,000 hours to get another year of pension (done), July 1st benefits (vacation day, healthcare) (done), July 4th holiday. 0 days left. (done) OFFICIALLY RETIRED 7/5/2016!!

|

|

|

09-24-2017, 05:35 PM

09-24-2017, 05:35 PM

|

#3

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2015

Posts: 2,692

|

Maybe I'm not reading the graph correctly, but looks like the "single" and "married" lines are reversed in the chart. Single should have a lower taxable income relative to "married". But good info.

|

|

|

09-24-2017, 05:37 PM

09-24-2017, 05:37 PM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2017

Location: New York City

Posts: 2,838

|

You certainly got my attention,  , I might be wrong, I believe someone poster on this a while ago, but its a well laid out post, thank you, when I have more time Im going to study this at length.

__________________

Withdrawal Rate currently zero, Pension 137 % of our spending, Wasted 5 years of my prime working extra for a safe withdrawal rate. I can live like a King for a year, or a Prince for the rest of my life. I will stay on topic, I will stay on topic, I will stay on topic

|

|

|

09-24-2017, 05:46 PM

09-24-2017, 05:46 PM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

And then you have me. Being married to a high earner and not having enough credits myself, I will get half of her SS even though I did not pay much into it. About $13,000 a year at FRA.

I guess that is the marriage hump bonus?

|

|

|

09-24-2017, 06:55 PM

09-24-2017, 06:55 PM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: Williston, FL

Posts: 3,925

|

Quote: Quote:

Originally Posted by Fermion

And then you have me. Being married to a high earner and not having enough credits myself, I will get half of her SS even though I did not pay much into it. About $13,000 a year at FRA.

I guess that is the marriage hump bonus?

|

Great point. If she dies before you do, you hit the jackpot on SS. You get 100% of hers, and I believe you get the entire amount she is getting when she passes, including delay credits. I do not think it gets reduced even if you started collecting at 62.

That is the one reason why at some point I will likely get married. DGF SS is much less than mine, and she only has 31 years, not 35+. It will double+ her SS. And If I die, she gets a windfall from SS.

And you only have to be married for 9 months I think to get spousal SS benefits.

__________________

FIRE no later than 7/5/2016 at 56 (done), securing '16 401K match (done), getting '15 401K match (done), LTI Bonus (done), Perf bonus (done), maxing out 401K (done), picking up 1,000 hours to get another year of pension (done), July 1st benefits (vacation day, healthcare) (done), July 4th holiday. 0 days left. (done) OFFICIALLY RETIRED 7/5/2016!!

|

|

|

09-24-2017, 07:02 PM

09-24-2017, 07:02 PM

|

#7

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Quote: Quote:

Originally Posted by Senator

And you only have to be married for 9 months I think to get spousal SS benefits.

|

I thought it was 10 years? Might be 10 years if you are divorced but only 9 months if you are currently married when someone passes?

|

|

|

09-24-2017, 07:24 PM

09-24-2017, 07:24 PM

|

#8

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: Williston, FL

Posts: 3,925

|

Quote: Quote:

Originally Posted by Fermion

I thought it was 10 years? Might be 10 years if you are divorced but only 9 months if you are currently married when someone passes?

|

Yes, as I remember, if you are married it's either 9 or 10 months when one passes. The other has to be 60+ years of age to collect. I think 9 months to get 1/2 of the living, and 10 months of marriage to get death benefits.

If the one left remarries and then passes, I am not sure if the third party then get the SS benefits, potentially into perpetuity as additional marriages occur?

For a divorced couple, it's 10 years of marriage to get spousal benefits.

__________________

FIRE no later than 7/5/2016 at 56 (done), securing '16 401K match (done), getting '15 401K match (done), LTI Bonus (done), Perf bonus (done), maxing out 401K (done), picking up 1,000 hours to get another year of pension (done), July 1st benefits (vacation day, healthcare) (done), July 4th holiday. 0 days left. (done) OFFICIALLY RETIRED 7/5/2016!!

|

|

|

09-24-2017, 07:38 PM

09-24-2017, 07:38 PM

|

#9

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Quote: Quote:

Originally Posted by bobandsherry

Maybe I'm not reading the graph correctly, but looks like the "single" and "married" lines are reversed in the chart. Single should have a lower taxable income relative to "married". But good info.

|

To keep things on the same scale, they represent per-capita income. Note how married gross income is $126,000, double the single value, and the graph ends at $88,320.

|

|

|

09-24-2017, 07:57 PM

09-24-2017, 07:57 PM

|

#10

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

I have been retired for almost 3 years now and made a lot of mistakes. I started my pension and annuity too early. I was forced into taking my SSB because of long term disability. I did not take advantage of getting 60% of my pay tax free for 21 months. I could have taken large sums out of my Traditional IRA at that time almost tax free. Now I am stuck with taking MRDs and paying higher taxes.

What I already posted is part of my research on how to make Shirley’s retirement as profitable as possible. Being retired I can only spend from 5 AM to 10 PM 7 days a week working on things!

Shirley is a widow. She will be able to start her retirement on 80% of her late husband’s survivor benefits and then switch to 130% of her own at age 70. When you know all the tax and conversion possibilities, you can really profit from situations like that. Live off of your Traditional IRAs when your benefits and taxes are lower, then start your pensions and annuities at higher guaranteed rates when all of your MRDs have been eliminated.

Our motto is that if we die young while spending down things like our IRAs, we had enough money to last the rest of our lives. If we live longer we will have higher incomes to last the rest of our lives. A Win Win!

|

|

|

09-24-2017, 08:42 PM

09-24-2017, 08:42 PM

|

#11

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2015

Posts: 2,692

|

Quote: Quote:

Originally Posted by Sandy & Shirley

To keep things on the same scale, they represent per-capita income. Note how married gross income is $126,000, double the single value, and the graph ends at $88,320.

|

OK - got it. Thanks

|

|

|

09-24-2017, 10:02 PM

09-24-2017, 10:02 PM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,374

|

That's it. I'm telling DW that I want a divorce.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

09-24-2017, 10:30 PM

09-24-2017, 10:30 PM

|

#13

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Quote: Quote:

Originally Posted by pb4uski

That's it. I'm telling DW that I want a divorce.

|

Be extremely careful how you talk to her, she gets her best benefits as a widow!

|

|

|

09-24-2017, 10:33 PM

09-24-2017, 10:33 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2014

Location: Spending the Kids Inheritance and living in Chicago

Posts: 17,099

|

Quote: Quote:

Originally Posted by Sandy & Shirley

To keep things on the same scale, they represent per-capita income. Note how married gross income is $126,000, double the single value, and the graph ends at $88,320.

|

That makes it more confusing for me.

A married couple is filing 1 tax return and it's the totals that are counted.

I think the graph would be more clear no breaking out the income per person as it looks reversed colors this way.

|

|

|

09-24-2017, 10:38 PM

09-24-2017, 10:38 PM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2014

Location: Spending the Kids Inheritance and living in Chicago

Posts: 17,099

|

OP - by the way I really like your explanation, that part was easy to follow. Although the solution is awkward.

|

|

|

09-25-2017, 03:07 AM

09-25-2017, 03:07 AM

|

#16

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Quote: Quote:

Originally Posted by Sunset

That makes it more confusing for me.

A married couple is filing 1 tax return and it's the totals that are counted.

I think the graph would be more clear no breaking out the income per person as it looks reversed colors this way.

|

I understand your point, but using a single scale with actual dollars of income and taxes for a single person and a couple would completely reverse the example and I do mention that the lines are “per capita” in the paragraph after the graph.

I could have started with the table that I used later where I showed the income levels for a Domestic Couple as double the levels for a Single Individual, and then drawn the graph to compare the Married Couple to the Domestic Couple. The only difference would have been that the income axis values would have been doubled.

It is only my personal opinion, but I found it less confusing this way.

Again, this post is all about the second paragraph at the top. This is not a question, I just wanted to pass on some information because most of the people I talked to have no idea these things even exist.

And, yes, our solution is awkward. But, our solution is defined by our specific situation; at what ages did we start saving, how much have we saved, is it all in 401K or other investments, do we have pensions, how large are they, did we live above or below our income levels, etc, etc, etc.

Everyone will have a different set of answers to those and many other questions.

The biggest question is: What level of income, lifestyle, are you planning to retire on? If that number is very low, you will be nowhere near The Hump and none of this makes any difference. If that number is well into six figures for each of you, who cares, looking over your shoulder you got 15% of your benefits tax free.

This post was aimed at those who are making average to a little better than average incomes who will be facing these Hump tax rates if they need a little extra that year for a nice vacation.

Another very important point is that the use of the term “average” income is getting lower each year because the taxation points are set in concrete and don’t move as inflation moves income levels higher.

|

|

|

09-25-2017, 08:27 AM

09-25-2017, 08:27 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2014

Location: Spending the Kids Inheritance and living in Chicago

Posts: 17,099

|

So I think from your explanation, the optimization is to stay below the hump, but if you find you get humped a bit each year, that the best course might be to go really big on withdrawals 1 year, to blow past the hump.

Then in the next "x" years a person/couple could stay below the hump.

Of course all this applies only once you start SS.

|

|

|

09-25-2017, 08:42 AM

09-25-2017, 08:42 AM

|

#18

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 1,691

|

I didn't see where you added in the ACA taxes, loss of subsidies when reaching 400% of poverty and extra tax when in 39.6 tax bracket.

|

|

|

09-25-2017, 09:14 AM

09-25-2017, 09:14 AM

|

#19

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Quote: Quote:

Originally Posted by Sunset

So I think from your explanation, the optimization is to stay below the hump, but if you find you get humped a bit each year, that the best course might be to go really big on withdrawals 1 year, to blow past the hump.

Then in the next "x" years a person/couple could stay below the hump.

Of course all this applies only once you start SS.

|

That is basically correct, but you also have to look at MAGI, your Modified Adjusted Gross Income level. If you go too high your Medicare benefits will go up.

Everyone’s situation is different. Shirley and I are a Domestic Couple. We try to maximize our withdrawals each year to create extra cash for special needs. We also each have Roth accounts to fall back on.

If we were both up against the Hump and needed more than that, we could take turns each year, one of us stays below the Hump, the other pushes through it and get the rest of our needed cash at 25% on the other side. Each year you switch places.

Like I keep saying, everyone’s situation is different.

|

|

|

09-25-2017, 10:05 AM

09-25-2017, 10:05 AM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2014

Location: Spending the Kids Inheritance and living in Chicago

Posts: 17,099

|

Quote: Quote:

Originally Posted by Sandy & Shirley

That is basically correct, but you also have to look at MAGI, your Modified Adjusted Gross Income level. If you go too high your Medicare benefits will go up.

Everyone’s situation is different. Shirley and I are a Domestic Couple. We try to maximize our withdrawals each year to create extra cash for special needs. We also each have Roth accounts to fall back on.

If we were both up against the Hump and needed more than that, we could take turns each year, one of us stays below the Hump, the other pushes through it and get the rest of our needed cash at 25% on the other side. Each year you switch places.

Like I keep saying, everyone’s situation is different.

|

Using the tax terms, We file Married Filing Jointly, which is why my perspective was from the incomes tied together.

I don't think DW will allow me to push our MAGI high enough to affect Medicare

But if you Married Filing Separately or Single, then I see how you can take turns getting over the hump.

Maybe sometimes it's valuable for us to switch from MFJ to MFS, I'll have to pay more attention when we collect SS.

Some of the Tax Filing Terms:

Single,

Head of Household,

Married Filing Jointly,

Married Filing Separately,

Qualifying Widow(er) with Dependent Child.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|