First, some facts.

I’ll turn 70 early next year—unless something kinda’ bad happens to me between now and then.

I am self-employed (no one ever wanted to hire me—so, unfortunately I never had the chance to be a disgruntled employee).

I started working part time a few months ago. Next year will be the first full year I will be working part time (I can quit any time I like-- but, I think it's only right I give myself two weeks notice).

I have gross earnings and net earnings.

I started collecting Social Security at age 66. ($26,000 a year, before deductions for Medicare and Drug insurance).

That’s the end of the fact portion. So, here are the questions:

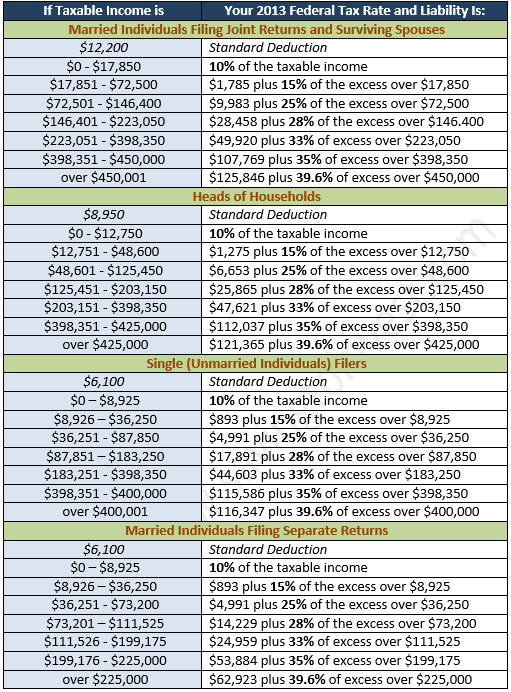

What do I have to watch out for next year? I’m mainly wondering about taxes. Is there a cut-off (or several different cut-offs) where it would make sense to stop earning money? I don’t want to just edge over some line and make an extra $600 and end up paying 42% in taxes instead of 20% in taxes. (In case you are wondering--I just made up those percentages).

Regarding taxed money: is Social Security monies and dividends and interest included? I assume that they are but maybe there’s a bit more to this than I am aware of. (Really, duck , something outside of your awareness regarding taxes? Hard to believe).

Just for the record, the air conditioning seems to be working well now. We haven't yet turned on the heat; when I do I will give an update.

And, yesterday Stockard Channing was right behind me in the grocery store line. In case you're wondering, she drives a Porsche Carrera. I was going to ask her about these tax questions, but we were in the express line and she seemed to be in a hurry--at least she was when I mentioned that I was almost seventy years old and I never had the chance to be a disgruntled employee. I'm not sure she would have been much help anyway. (Maybe that's me just be negative).

Anyhow, to refresh your memory (memories?): what do I need to look for re: taxes?

I’ll turn 70 early next year—unless something kinda’ bad happens to me between now and then.

I am self-employed (no one ever wanted to hire me—so, unfortunately I never had the chance to be a disgruntled employee).

I started working part time a few months ago. Next year will be the first full year I will be working part time (I can quit any time I like-- but, I think it's only right I give myself two weeks notice).

I have gross earnings and net earnings.

I started collecting Social Security at age 66. ($26,000 a year, before deductions for Medicare and Drug insurance).

That’s the end of the fact portion. So, here are the questions:

What do I have to watch out for next year? I’m mainly wondering about taxes. Is there a cut-off (or several different cut-offs) where it would make sense to stop earning money? I don’t want to just edge over some line and make an extra $600 and end up paying 42% in taxes instead of 20% in taxes. (In case you are wondering--I just made up those percentages).

Regarding taxed money: is Social Security monies and dividends and interest included? I assume that they are but maybe there’s a bit more to this than I am aware of. (Really, duck , something outside of your awareness regarding taxes? Hard to believe).

Just for the record, the air conditioning seems to be working well now. We haven't yet turned on the heat; when I do I will give an update.

And, yesterday Stockard Channing was right behind me in the grocery store line. In case you're wondering, she drives a Porsche Carrera. I was going to ask her about these tax questions, but we were in the express line and she seemed to be in a hurry--at least she was when I mentioned that I was almost seventy years old and I never had the chance to be a disgruntled employee. I'm not sure she would have been much help anyway. (Maybe that's me just be negative).

Anyhow, to refresh your memory (memories?): what do I need to look for re: taxes?

Last edited: