Have any you been retired for a number of years, and at first wondered if you'd be able to make it?

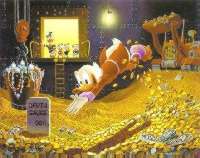

To now, realizing you'll never come close to spending all your money.

I would think that for many on this forum, it's become a reality.

To now, realizing you'll never come close to spending all your money.

I would think that for many on this forum, it's become a reality.