I'm not arguing your point about WEP, but reading this made me chuckle. The 2nd guy better be glad the extra 10 lowest earning years aren't counted. That would mean a lower average monthly earnings, and therefore a lower SS payment.Exactly! Since SS is not a bank account or investment account holding your money, it is a PAYG retirement system largely biased toward lower income earners.

Consider another case where one person worked 10 years under SS and then 35 years outside of SS. Under some people's idea of fair, that person would get 35 years of pension plus 10 years' benefits for SS. A 2nd person worked 45 years under SS. Both the 2nd guy and his employer paid into SS for 45 years, only the top 35 years get counted toward his retirement benefit. Assuming ever increasing incomes for both people, why should the 1st guy expect to get anything from his 1st 10 years of employment where the 2nd guy doesn't? IMO the 1st is lucky he gets anything out of SS since the other guy doesn't get anything for his first 10 years.

No changing the rules though. Not by us. The rules do change constantly though. Who knows what might be in 10 years? Certainly not me.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SS benefit taxes

- Thread starter rocks911

- Start date

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm not arguing your point about WEP, but reading this made me chuckle. The 2nd guy better be glad the extra 10 lowest earning years aren't counted. That would mean a lower average monthly earnings, and therefore a lower SS payment.

I don't think it works this way.

I think SS adds up all your SS earnings to get a total, using the highest numbers in 30 years of earnings.

So removing 10 years of earnings will lower the persons total number.

The total number is then used to calculate the amount of SS deserved.

Nope, the payment is based on the AIME (Average Indexed Monthly Earnings). Counting more lower earning years (after wage indexing for inflation) would bring that average down, resulting in a lower SS payment. Remember, we're talking about people with more than 35 years of SS taxed earnings.I don't think it works this way.

I think SS adds up all your SS earnings to get a total, using the highest numbers in 30 years of earnings.

So removing 10 years of earnings will lower the persons total number.

The total number is then used to calculate the amount of SS deserved.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Nope, the payment is based on the AIME (Average Indexed Monthly Earnings). Counting more lower earning years (after wage indexing for inflation) would bring that average down, resulting in a lower SS payment. Remember, we're talking about people with more than 35 years of SS taxed earnings.

I was wrong about the # of years and didn't bother to explain the avg part. As Adding extra low years to 35 doesn't change the result, since they don't count them.

https://www.ssa.gov/OACT/ProgData/retirebenefit1.html

"We use the highest 35 years of indexed earnings in a benefit computation. The dropped indexed amounts are shown in red. Below the indexed earnings are the sums for the highest 35 years of indexed earnings and the corresponding average monthly amounts of such earnings. (The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years.) Such an average is called an "average indexed monthly earnings" (AIME). The next step is to calculate benefits based on AIME amounts."

Right, that's what I was referring to - if they counted and averaged over 45 years instead of 35 for the hypothetical guy mentioned before, he would actually get a lower SS payment due to including the lower earning years in the average. I was just pointing out that limiting the maximum number of years to 35 was actually a benefit even if you work more years than that (like I did). Anyway, enough said.I was wrong about the # of years and didn't bother to explain the avg part. As Adding extra low years to 35 doesn't change the result, since they don't count them.

https://www.ssa.gov/OACT/ProgData/retirebenefit1.html

"We use the highest 35 years of indexed earnings in a benefit computation. The dropped indexed amounts are shown in red. Below the indexed earnings are the sums for the highest 35 years of indexed earnings and the corresponding average monthly amounts of such earnings. (The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years.) Such an average is called an "average indexed monthly earnings" (AIME). The next step is to calculate benefits based on AIME amounts."

I am an admin for a SS education facebook group.

1. Did you pay into SS also while a firefighter or would you be subject to the WEP/GPO reduction of your SS benefit?

2. Does your wife have a lower SS benefit? On this point alone, it would be best to delay SS as long as possible. Most likely your wife will outlive you and if you delay, it will mean that she will have more money after you die (surviving spouse benefit equal to yours). That money may be needed since she would not have a spouse to help her and would need to hire others, or move into assisted living.

And yes, because of your taxable income, 85% of your SS benefit will be subject to income taxes - at whatever your tax bracket is.

Question....what if someone files as Single and their only income is SS and dividend income? the way I understand it then almost all will be tax free

i used this calculator:

https://www.irscalculators.com/tax-calculator

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It depends on how much their dividend income is, but generally true to some extent.

So for example using the link if a single had $27,500 of qualified dividends and $35,000 of SS their tax would be $0.

Change that to $35,000 of dividends and $35,000 of SS and their tax would be less than 1% of their $70,000 of income.

But change it to $100,000 of qualified dividends and $35,000 of SS and the tax is 9.2% of the $135,000 of income.

I love America! [emoji16]

So for example using the link if a single had $27,500 of qualified dividends and $35,000 of SS their tax would be $0.

Change that to $35,000 of dividends and $35,000 of SS and their tax would be less than 1% of their $70,000 of income.

But change it to $100,000 of qualified dividends and $35,000 of SS and the tax is 9.2% of the $135,000 of income.

I love America! [emoji16]

Last edited:

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Question....what if someone files as Single and their only income is SS and dividend income? the way I understand it then almost all will be tax free

i used this calculator:

https://www.irscalculators.com/tax-calculator

Yeah, my mom and dad and then just my mom never owed any taxes when they were only on SS. YMMV

As others have noted, it depends on how much SS and dividend income.Question....what if someone files as Single and their only income is SS and dividend income? the way I understand it then almost all will be tax free

i used this calculator:

https://www.irscalculators.com/tax-calculator

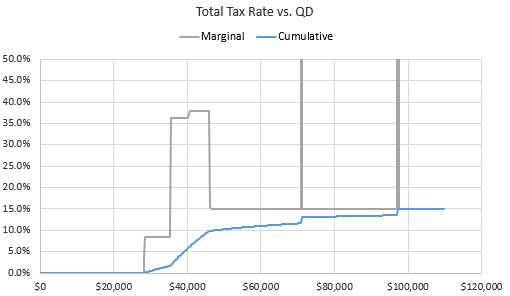

Using $35K SS, the case study spreadsheet shows the marginal rates for increasing qualified dividends below. Spikes are IRMAA tiers.

As others have noted, it depends on how much SS and dividend income.

Using $35K SS, the case study spreadsheet shows the marginal rates for increasing qualified dividends below. Spikes are IRMAA tiers.

thx to you and others for responding........dividend income, in my case, is very small.....we all know anything can happen, but my "plan" for now to get SS at 70 in the year 2036 looks very minimal in terms of tax responsibility

ncbill

Thinks s/he gets paid by the post

I think my youngest has the pension game down.

Currently reserve military working in state law enforcement but planning on moving to federal law enforcement ASAP (only need 20 years for full pension) then move back to state law enforcement before retirement.

So he could earn a federal pension plus a military pension plus possibly a state pension.

Plus whatever tax-free disability 'pension' for any service-related injuries.

Currently reserve military working in state law enforcement but planning on moving to federal law enforcement ASAP (only need 20 years for full pension) then move back to state law enforcement before retirement.

So he could earn a federal pension plus a military pension plus possibly a state pension.

Plus whatever tax-free disability 'pension' for any service-related injuries.

bada bing

Full time employment: Posting here.

Perhaps. I just got sick and tired of hearing people complain about SS being a raw deal, that they could have done better saving on their own (if they really had the fiscal discipline to save on their own, but most people don't), etc and wanted to see if it was at all true.

A lot of (most?) people who complain about SS being a raw deal are uninformed about their particular "raw deal". But there's the rub - we all have a different "deal" with SS. I've read (don't have links handy) that about 80% of participants get at least a "fair" deal in the value of their payment streams verses the amount paid in. That leaves about 20% who get a "raw deal" to some extent of another. I'm sensitive to this because I am a corner case with respect to the rawness of my "deal". I paid 35 years at the cap with an additional 7 years (so far) of significant earnings. 12 years of those cap years were self employed, which cancels a somewhat dubious claim (IMO) that employer contributions don't count.

I would 100% agree the general public knowledge of SS is woefully lacking and that results in all kinds of mostly unsupportable opinions. The idea that we're all in it together to the same extent is one of those unsupportable opinions though. We are not and by quite large differences.

It is unfashionable, especially currently, to put much stock in complaints of long career high earners and to discount them as complaining about "first world problems" (or worse). You see that playing out now in the popular opinions of who should be paying more to fix SS. That's what makes me "sick and tired". I earned my good earnings record far away from home with my hands, on the floor of oil production rigs in the arctic and the third world desert. So I feel I probably at least earned it in comparison to the majority of tough career tales. I don't have malice or much resentment over my particular SS "raw deal", but I can spreadsheet it to demonstrate that yes, there are some "raw deals" among SS participants. And likely in the future, the deal will get much raw-er for long career high earners. Somebody has to pay and it isn't likely to be the majority, who already get at least a fair deal.

I'm at the other end of the spectrum, although I did have a lot of self employment where I paid both sides.

Before I post any numbers, I want to say, SS is more than just a Pension at retirement. It is a disability policy, that paid off very well for me. My dad had a severe heart attack when he was 43 and I was 18. SS disability helped me get where I am because I didn't have to support my parents. It also paid some for my sister until she got out of college.

So, it is a pension, a disability policy and a pension for the surviving spouse and kids at death.

Over 49 years of work I paid $116,535 in SS taxes and my employer paid $14,898 for a total of $131,433. I'm waiting until 70 to start collecting and I expect $40k a year in SS, (assumes a COLA of 4% the next two years).

That means in 3 yrs 5 months I will get back all I paid in. Plus I was covered for disability and my family had some security if I had died.

Before I post any numbers, I want to say, SS is more than just a Pension at retirement. It is a disability policy, that paid off very well for me. My dad had a severe heart attack when he was 43 and I was 18. SS disability helped me get where I am because I didn't have to support my parents. It also paid some for my sister until she got out of college.

So, it is a pension, a disability policy and a pension for the surviving spouse and kids at death.

Over 49 years of work I paid $116,535 in SS taxes and my employer paid $14,898 for a total of $131,433. I'm waiting until 70 to start collecting and I expect $40k a year in SS, (assumes a COLA of 4% the next two years).

That means in 3 yrs 5 months I will get back all I paid in. Plus I was covered for disability and my family had some security if I had died.

Those dollars you paid in 49 years ago could buy a lot more at the time than the dollars you will get from SS today to make purchases now. How many years will it take if you adjust for inflation?I'm at the other end of the spectrum, although I did have a lot of self employment where I paid both sides.

Before I post any numbers, I want to say, SS is more than just a Pension at retirement. It is a disability policy, that paid off very well for me. My dad had a severe heart attack when he was 43 and I was 18. SS disability helped me get where I am because I didn't have to support my parents. It also paid some for my sister until she got out of college.

So, it is a pension, a disability policy and a pension for the surviving spouse and kids at death.

Over 49 years of work I paid $116,535 in SS taxes and my employer paid $14,898 for a total of $131,433. I'm waiting until 70 to start collecting and I expect $40k a year in SS, (assumes a COLA of 4% the next two years).

That means in 3 yrs 5 months I will get back all I paid in. Plus I was covered for disability and my family had some security if I had died.

Those dollars you paid in 49 years ago could buy a lot more at the time than the dollars you will get from SS today to make purchases now. How many years will it take if you adjust for inflation?

I'm sure all on this group are aware of what inflation does to buying power of a dollar, that includes me.

I'm not sure if investing my SS money for myself would have had a better outcome, especially after buying disability insurance and a life insurance policy to cover my family. Maybe, but, I'm happy with what we have.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Those dollars you paid in 49 years ago could buy a lot more at the time than the dollars you will get from SS today to make purchases now. How many years will it take if you adjust for inflation?

What you say is true, but it is embedded in the retirement benefit, which is why I think it more useful to look at the IRR given what I paid over the years and what I expect to receive to age 82. What I paid over the years would need to be reduced for the "value" of survivor and disability coverage... I read somewhere that about 72% relates to retirement benefits, so in IRR I use 72% of what I paid in and my benefits from when I claim until age 82.

Similar threads

- Replies

- 15

- Views

- 736

- Replies

- 3

- Views

- 328

- Replies

- 6

- Views

- 1K