|

State Tax Question: *Possibly Related To Series E Savings Bond Sale*

03-18-2018, 11:19 AM

03-18-2018, 11:19 AM

|

#1

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,561

|

State Tax Question: *Possibly Related To Series E Savings Bond Sale*

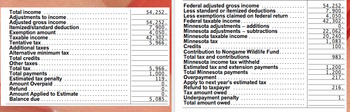

My Mother cashed in series E savings bonds late in 2017. The interest was substantial, slightly over 18 K. I've never had any experience with savings bonds, but as I understand it, the interest earned is taxable @ the federal level, but not by the state. She knew this as well, but never made adjustments to her est. federal taxes to compensate. She also had 11k in RMD from her IRA.

She did a pencil return about a month ago & it was no surprise when it showed that she owed just over 5k to the feds, & was to get back around $30.00 from the state.

Last week I gathered up all her tax info, bought it home, & did a return using TurboTax deluxe.

The amount she owes the feds is the same, but the refund from the state that I came up with is $217.00 but…….. there’s also an underpayment penalty of $1.00 making the refund $216.00 ?

Is it possible to be due a refund, yet also have an under payment penalty ?

Obviously, the 1$ penalty is of no concern to us, we just want to be sure to file the right return. For what it's worth, turbo tax checked for errors, & said everything is 100% correct.

In case it could be helpful, here’s a screenshot of her fed & state tax summaries.

__________________

"No beast so fierce but knows some touch of pity, but I know none, therefore am no beast"

Shown @ The End Of The Movie 'Runaway Train'

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

03-18-2018, 11:39 AM

03-18-2018, 11:39 AM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2011

Posts: 3,602

|

Depends on your state laws, but in general yes.

At the Federal level, if you make estimated payments (typically quarterly), but forget a few payments early in the year, you could overcompensate in the last payment. You could get a refund, but still owe and underpayment penaltly for not paying on time (quarterly).

-gauss

|

|

|

03-18-2018, 01:43 PM

03-18-2018, 01:43 PM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,363

|

OP, yes it is possible if income is earned throughout the year but estimated payments are made in the last quarter. OTHO, if her estimated payments were made ratably throughout 2017 then it makes no sense at all.

Have you prepared a Schedule M15 in the state return? It looks like the M15 is simialr to the Federal Form 2210.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

03-18-2018, 07:38 PM

03-18-2018, 07:38 PM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,561

|

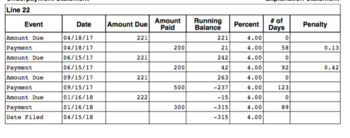

I opened her return & here's what she paid in state est. taxes by quarter.

200-april 18th

200-june 15th

500-sept 15th

300-jan 15th 2018

So as one or both of you stated, this doesn't make any sense ?

I'll just have to keep digging

__________________

"No beast so fierce but knows some touch of pity, but I know none, therefore am no beast"

Shown @ The End Of The Movie 'Runaway Train'

|

|

|

03-18-2018, 08:59 PM

03-18-2018, 08:59 PM

|

#5

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2007

Posts: 3,229

|

Quote: Quote:

Originally Posted by ownyourfuture

I opened her return & here's what she paid in state est. taxes by quarter.

200-april 18th

200-june 15th

500-sept 15th

300-jan 15th 2018

So as one or both of you stated, this doesn't make any sense ?

I'll just have to keep digging  |

Usually the first estimated payment is due on 15 April, maybe they charged a penalty for that payment being late.

|

|

|

03-18-2018, 11:09 PM

03-18-2018, 11:09 PM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,561

|

Quote: Quote:

Originally Posted by zinger1457

Usually the first estimated payment is due on 15 April, maybe they charged a penalty for that payment being late.

|

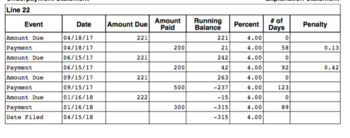

I noticed the same thing, so I went back into the return & saw that the penalty wasn't for any estimated payments being late, but that the 1st & 2nd payments for 2017 were less than what they should have been.

Here's a screenshot.

When I did her taxes, & it came time to enter estimated taxes, turboTax automatically put in the dates I showed here, both fed & state.

__________________

"No beast so fierce but knows some touch of pity, but I know none, therefore am no beast"

Shown @ The End Of The Movie 'Runaway Train'

|

|

|

03-19-2018, 05:35 AM

03-19-2018, 05:35 AM

|

#7

|

|

Recycles dryer sheets

Join Date: Jan 2010

Posts: 190

|

Several years back i got 'hit with an underpayment penalty" after filing my taxes. In Q3 and Q4 i had increased the estimated payment due to some higher income during that time frame. I challenged the state and sent them a lengthy excel spreadsheet showing the timing of income and the timing of the estimated payments. I included a 3 page explanation along with the excel spreadsheet. They eliminated the penalty. Now either they agreed i was correct or they figured any person who would spend that much time on the subject was just wacko!!!

|

|

|

03-19-2018, 06:22 AM

03-19-2018, 06:22 AM

|

#8

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2006

Posts: 4,172

|

Quote: Quote:

Originally Posted by ownyourfuture

I noticed the same thing, so I went back into the return & saw that the penalty wasn't for any estimated payments being late, but that the 1st & 2nd payments for 2017 were less than what they should have been.

Here's a screenshot.

When I did her taxes, & it came time to enter estimated taxes, turboTax automatically put in the dates I showed here, both fed & state. |

Sounds about right...suppose you were short $50 on the 1st 2 payments. You would pay 4% for 9 mo on $50= 1.50; and 4% on 50 for 7 mo=1.17. This is a bit more than you actually were charged. Perhaps you had a safe harbor.

Unless you demonstrate that taxes were tied to income, the tax folks assume income was even throughout the yr and expect taxes accordingly.

|

|

|

03-19-2018, 07:48 AM

03-19-2018, 07:48 AM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,363

|

However... if her income isn't consistent throughout the year but is loaded to the second half, you may be able to avoid the penalty by using the installment method... you essentially calculate your income and income tax based on YTD income and then compare that to payments made. Form 2210 for federal and MN15 for state.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

03-19-2018, 12:42 PM

03-19-2018, 12:42 PM

|

#10

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,561

|

Quote: Quote:

Originally Posted by jwkde

Several years back i got 'hit with an underpayment penalty" after filing my taxes. In Q3 and Q4 i had increased the estimated payment due to some higher income during that time frame. I challenged the state and sent them a lengthy excel spreadsheet showing the timing of income and the timing of the estimated payments. I included a 3 page explanation along with the excel spreadsheet. They eliminated the penalty. Now either they agreed i was correct or they figured any person who would spend that much time on the subject was just wacko!!!

|

Well done!

__________________

"No beast so fierce but knows some touch of pity, but I know none, therefore am no beast"

Shown @ The End Of The Movie 'Runaway Train'

|

|

|

03-19-2018, 12:44 PM

03-19-2018, 12:44 PM

|

#11

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,561

|

Quote: Quote:

Originally Posted by kaneohe

Sounds about right...suppose you were short $50 on the 1st 2 payments. You would pay 4% for 9 mo on $50= 1.50; and 4% on 50 for 7 mo=1.17. This is a bit more than you actually were charged. Perhaps you had a safe harbor.

Unless you demonstrate that taxes were tied to income, the tax folks assume income was even throughout the yr and expect taxes accordingly.

|

Agreed.

__________________

"No beast so fierce but knows some touch of pity, but I know none, therefore am no beast"

Shown @ The End Of The Movie 'Runaway Train'

|

|

|

03-19-2018, 12:48 PM

03-19-2018, 12:48 PM

|

#12

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,561

|

Quote: Quote:

Originally Posted by pb4uski

However... if her income isn't consistent throughout the year but is loaded to the second half, you may be able to avoid the penalty by using the installment method... you essentially calculate your income and income tax based on YTD income and then compare that to payments made. Form 2210 for federal and MN15 for state.

|

I checked out form 2210. Interesting. Not sure if we'll pursue that for the federal return (where the penalty was substantial $119.00) but I appreciate you making me aware of that option.

__________________

"No beast so fierce but knows some touch of pity, but I know none, therefore am no beast"

Shown @ The End Of The Movie 'Runaway Train'

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|