W2R

Moderator Emeritus

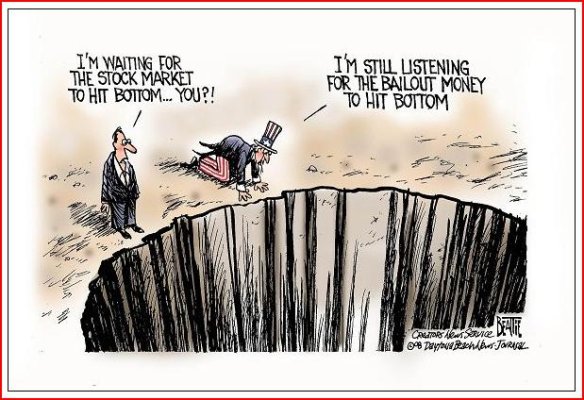

When said governments and central banks come up with something the market has some faith in, IMO, we'll see a violent rally -- but not before.

Love to hear your optimism!

I really hope you are right about that violent rally.

I really hope you are right about that violent rally. I have no idea of what to expect, but naturally my fears are that the market will not see 10,000 again for years.

At least I won't be disappointed.