ratface

Recycles dryer sheets

- Joined

- Jan 13, 2009

- Messages

- 255

My question is on the clarification of this federal tax code rule. My understanding is that capital gains tax is forgiven at death for inherited property. "Someone who inherits stock or other property and later sells it is subject to capital gains tax on the difference between what the stock was sold for and what the stock was worth when inherited. The capital gain from when the stock was purchased to when it was inherited is taxed at zero. "

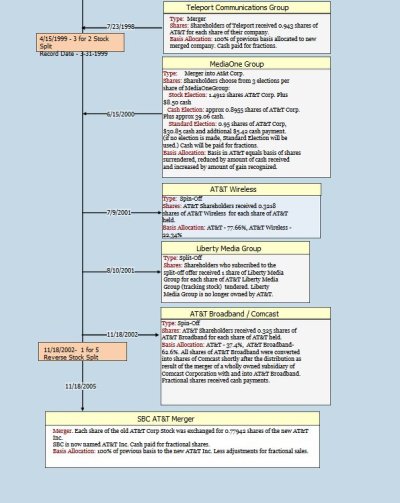

Dose anyone have experience with this type of transaction and can verify that this rule is in fact true? My situation would involve selling ATT stock inherited in 1998 at a cost basis of $53 and selling it today at $35. Would this then be a capital loss and incur no tax or would it still be treated as a capital gain under my marginal tax rate of 25% married filing jointly giving me a 15% tax rate on the sale of long term capital gains?

My plan if it makes sense is to payoff two separate Parent Plus student loans of appx. $21K each with monthly interest rates of around 8% which are costing me around $150 a month combined.

Dose anyone have experience with this type of transaction and can verify that this rule is in fact true? My situation would involve selling ATT stock inherited in 1998 at a cost basis of $53 and selling it today at $35. Would this then be a capital loss and incur no tax or would it still be treated as a capital gain under my marginal tax rate of 25% married filing jointly giving me a 15% tax rate on the sale of long term capital gains?

My plan if it makes sense is to payoff two separate Parent Plus student loans of appx. $21K each with monthly interest rates of around 8% which are costing me around $150 a month combined.