You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stimulus $600

- Thread starter whatnot

- Start date

JustKickItForward

Recycles dryer sheets

- Joined

- Aug 5, 2018

- Messages

- 75

debit card is here!!!

Oh, my 19yo does not get a $600? She turned 18yo Feb 2020, graduated high school and entered junior college (full time) in 2020, filed her own 1040EZ in 2020 for a part time job. We claimed her as a dependent in our married filing joint tax return and she claimed herself as a dependent on her tax return. Should she get her own $600?

Oh, my 19yo does not get a $600? She turned 18yo Feb 2020, graduated high school and entered junior college (full time) in 2020, filed her own 1040EZ in 2020 for a part time job. We claimed her as a dependent in our married filing joint tax return and she claimed herself as a dependent on her tax return. Should she get her own $600?

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Same thing here. Received direct deposit last time. This time, website said a paper check will be mailed on January 6. Nothing has arrived yet.

Perhaps sent by carrier turtle (Apologies to Arlo Givens - JUSTIFIED.)

debit card is here!!!

Oh, my 19yo does not get a $600? She turned 18yo Feb 2020, graduated high school and entered junior college (full time) in 2020, filed her own 1040EZ in 2020 for a part time job. We claimed her as a dependent in our married filing joint tax return and she claimed herself as a dependent on her tax return. Should she get her own $600?

If you claimed her as a dependent on your 2019 tax return, then no, she doesn't get a $600 payment of her own.

There's no such thing as a 1040EZ any more, so hopefully she filed a regular 1040 for tax-year 2019 and checked the box that said someone else could claim her as a dependent.

- Joined

- Oct 13, 2010

- Messages

- 10,735

Unfortunately, Plastic, not Paper

Looks like I got the plastic.

I figured I'd just go to an in-network ATM at a 7-11 (no fee) and pull out cash, then drop it in the drive-thru ATM at my megabank.

But it's going to require two days of effort, because the limit is $1,000 per day [ https://www.eipcard.com/cardholder-agreement ]

I hope the ATM at the 7-11 is outside.

Looks like I got the plastic.

I figured I'd just go to an in-network ATM at a 7-11 (no fee) and pull out cash, then drop it in the drive-thru ATM at my megabank.

But it's going to require two days of effort, because the limit is $1,000 per day [ https://www.eipcard.com/cardholder-agreement ]

I hope the ATM at the 7-11 is outside.

Attachments

Last edited:

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wonder of wonders, our card appeared yesterday. Got the full $1200. I went ahead and activated it. Will try to put into the bank today. YMMV

stepford

Thinks s/he gets paid by the post

DW got the direct deposit 2 weeks ago. I just got the EIP Card today - and promptly went through the rigmarole on EIPCard.com to transfer the balance to my checking account.

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

Thanks, I did this today. Lotta screwing around, but beats going to the bank.

Five days later, The money is STILL not in my credit union account. I think these turkeys are hanging on to it to leverage it.

JustKickItForward

Recycles dryer sheets

- Joined

- Aug 5, 2018

- Messages

- 75

If you claimed her as a dependent on your 2019 tax return, then no, she doesn't get a $600 payment of her own.

There's no such thing as a 1040EZ any more, so hopefully she filed a regular 1040 for tax-year 2019 and checked the box that said someone else could claim her as a dependent.

That is such a bummer because she literally is dependent on us as she attends school full time, and young adults like her EAT A LOT !!!

So, if she filed as INDEPENDENT in 2020 on her tax return, she would have gotten her own $600?

Sorry, she did her own tax online with Turbo Tax because her return only consisted of that part time job, no dividends, no capital gains, etc, I just assumed it was 1040 EZ, what I did decades ago when I was in her shoes as a junior college student.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That is such a bummer because she literally is dependent on us as she attends school full time, and young adults like her EAT A LOT !!!

So, if she filed as INDEPENDENT in 2020 on her tax return, she would have gotten her own $600?

Sorry, she did her own tax online with Turbo Tax because her return only consisted of that part time job, no dividends, no capital gains, etc, I just assumed it was 1040 EZ, what I did decades ago when I was in her shoes as a junior college student.

Yes, if she files as not your dependent in 2020 then she would qualify for both the original $1200 EIP1 and the additional $600 EIP2 if she did not receive them in advance and assuming she otherwise met the basic qualifications for the EIPs (SSN and AGI<$75K are the main ones).

Even if she has already filed, she may be able to file an amended return with Form 1040-X. There are many things one can amend but some things cannot be amended. I am not sure whether or not or how she can change that particular checkbox on her return.

But note this: whether or not she is your dependent is up to the facts and circumstances. It is not something you or she gets to choose. In the case of young adults the rules are complex and the facts and circumstances can be complicated. Look in the IRS instructions, starting with the rules for qualifying children and then continuing on to the rules for qualifying relatives to see if she is your qualifying child, qualifying relative, or neither.

If she didn't provide more than half her own support in 2020, it looks like she'd be your qualifying relative for 2020, but check the IRS flowcharts to be sure. If she is your qualifying relative according to the IRS flowcharts, you cannot enable her to qualify for the EIPs - even if you don't claim her, the fact that she was able to be claimed disqualifies her.

College students like your daughter did sort of get left out in terms of these EIPs. I have a college-aged daughter in the same situation. There is some discussion in the new administration of making this group of people eligible for the additional stimulus payments; we'll have to see what the new laws say.

Last edited:

That is such a bummer because she literally is dependent on us as she attends school full time, and young adults like her EAT A LOT !!!

So, if she filed as INDEPENDENT in 2020 on her tax return, she would have gotten her own $600?

Sorry, she did her own tax online with Turbo Tax because her return only consisted of that part time job, no dividends, no capital gains, etc, I just assumed it was 1040 EZ, what I did decades ago when I was in her shoes as a junior college student.

Just to be clear, has she actually filed her 2020 tax return? That is the one that's due on April 15, 2021. Practically nobody has filed those yet because the IRS won't accept e-filed returns until Feb 12 this year. The returns that you and she filed during 2020 were actually for 2019. When discussing tax returns it's usually easier if you refer to the tax year rather than the actual date you filed.

If neither of you has yet filed your 2020 returns, then it's true that if you do not claim her as a dependent on your MFJ return, and she files her own return without checking the "someone can claim me as a dependent" box, then she would get both stimulus payments as part of her 2020 refund. But in order to do that legally, she has to qualify as independent by providing more than half her own support during 2020. If she has a 529 account that she's using to pay for college, or if she received money from someone other than you (i.e. a grandparent), or if her job pays very well, then it might be plausible to claim she's providing more than half her own support, but most likely she isn't and she is therefore not entitled to either of the 2020 stimulus payments.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Speaking of slow mail. We had a Medicare check mailed from Fidelity on the 6th so it would get to Medicare by the 11th. Normally Medicare cashes that check within a day or two of the scheduled delivery date, but we didn't see the check cashed until today the 20th, so something is much slower than usual.Informed Delivery shows a check will arrive today from the US Treasury. The IRS site said it was scheduled to be mailed on the 6th, so it only took 13 days to get here.

Last edited:

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

@cathy63 makes a good point about which tax years. You were probably meaning her 2019 return that she filed a year ago based on the timing that @cathy63 refers to.

My answer above @cathy's was assuming you were referring to her 2020 return and that she had just filed it now (people can file 2020 paper returns now).

And @cathy63's point about referring to the tax year rather than the year it was filed does make it easer, because that way we know which rules apply.

My answer above @cathy's was assuming you were referring to her 2020 return and that she had just filed it now (people can file 2020 paper returns now).

And @cathy63's point about referring to the tax year rather than the year it was filed does make it easer, because that way we know which rules apply.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My DF finally got his check for $600.

It was scheduled to be mailed and showed up today.

I'll put it in the bank for him Thursday.

It was scheduled to be mailed and showed up today.

I'll put it in the bank for him Thursday.

JustKickItForward

Recycles dryer sheets

- Joined

- Aug 5, 2018

- Messages

- 75

DD still lives at home, we basically support her except she did pay for her own books and tuition at the local junior college. We are saving her 529 until she transfer to the university in maybe another two years.Just to be clear, has she actually filed her 2020 tax return? That is the one that's due on April 15, 2021. Practically nobody has filed those yet because the IRS won't accept e-filed returns until Feb 12 this year. The returns that you and she filed during 2020 were actually for 2019. When discussing tax returns it's usually easier if you refer to the tax year rather than the actual date you filed.

If neither of you has yet filed your 2020 returns, then it's true that if you do not claim her as a dependent on your MFJ return, and she files her own return without checking the "someone can claim me as a dependent" box, then she would get both stimulus payments as part of her 2020 refund. But in order to do that legally, she has to qualify as independent by providing more than half her own support during 2020. If she has a 529 account that she's using to pay for college, or if she received money from someone other than you (i.e. a grandparent), or if her job pays very well, then it might be plausible to claim she's providing more than half her own support, but most likely she isn't and she is therefore not entitled to either of the 2020 stimulus payments.

You are correct - when I was referring to her filing her taxes last year, I meant in March 2020, she filed her 2019 taxes because of her part time job. This year (2021) coming up in April, she will once again file her taxes for 2020 because of her part time job.

Last edited:

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

^ When figuring who supported your DD19, you're supposed to look at who actually paid for things like food, housing, etc. I know that support also includes money spent on education, but excludes scholarships. So what she paid out of pocket for books and tuition would count as her providing her own support. What you paid for food and housing etc. would count as you providing her support.

You might find this worksheet helpful:

https://apps.irs.gov/app/vita/content/globalmedia/teacher/worksheet_for_determining_support_4012.pdf

Note that when determining support, it's who actually paid that matters, not how much a person made. So if she earns money from her part time job and puts it in savings, that doesn't count towards her support because it wasn't actually spent on support.

You might find this worksheet helpful:

https://apps.irs.gov/app/vita/content/globalmedia/teacher/worksheet_for_determining_support_4012.pdf

Note that when determining support, it's who actually paid that matters, not how much a person made. So if she earns money from her part time job and puts it in savings, that doesn't count towards her support because it wasn't actually spent on support.

Last edited:

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I felt just slightly guilty today putting my card's balance in my bank acct. It took the teller the better part of 10 minutes - including the fact that I mis-entered my pin. She asked me if I was SURE enough for a second try because she could over ride it. I went for the override. I sure didn't want to get locked out and have to deal with "whomever" to get it fixed.

I told the nice teller that the gummint should give her $10 for each of us old dinosaurs who brought our debit card in. She smiled. YMMV

I told the nice teller that the gummint should give her $10 for each of us old dinosaurs who brought our debit card in. She smiled. YMMV

EastWest Gal

Thinks s/he gets paid by the post

No stimulus payment for us-income too high in 2019. DS got his. Donated it to the local food bank. I don’t understand why a couple making $140K per year needs an extra $600. If I got one I’d give it to the food bank or give it back to the U.S. Treasury.

Checked with our son this morning and his was direct deposited this week. Like us he lives in England and e-files each year. He will put the money towards a new boiler and other house improvements he plans this year.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

My ladyfriend and I are wondering why she hasn't gotten her check yet. Her tax return is simple; no income other than her 1 job, income easily below the $75k limit to receive the full amount. The first payment was direct-deposited to her bank back in May. No change in address or banking info. Income nearly the same in 2020 as in 2019 (and 2018).

She filed her 2019 tax return back in March and her payment via paper check was cashed quickly. No questions about her return (which I actually prepared for her). So, when we go to that website within the IRS website to check on her latest payment's status, we see this:

"Payment #2 Status - Not Available

We are unable to provide the status of your payment right now because:

•We don't have enough information yet (we're working on this), or

•You're not eligible for a payment."

Could the IRS have not processed her 2019 tax return? Otherwise, what info could they still need?

If by some chance she doesn't get her payment, we plan to apply the $600 to her 2020 taxes because she will owe nearly that amount, triggering a small refund. She won't file until late March anyway.

She filed her 2019 tax return back in March and her payment via paper check was cashed quickly. No questions about her return (which I actually prepared for her). So, when we go to that website within the IRS website to check on her latest payment's status, we see this:

"Payment #2 Status - Not Available

We are unable to provide the status of your payment right now because:

•We don't have enough information yet (we're working on this), or

•You're not eligible for a payment."

Could the IRS have not processed her 2019 tax return? Otherwise, what info could they still need?

If by some chance she doesn't get her payment, we plan to apply the $600 to her 2020 taxes because she will owe nearly that amount, triggering a small refund. She won't file until late March anyway.

- Joined

- Oct 13, 2010

- Messages

- 10,735

When I opened this letter, what was inside was a replacement credit card from my credit union. Nothing to do with the stimulus payment. I guess we have an "informed delivery" failure, because the image below was tagged with "US Treasury..."

So, still waiting.

So, still waiting.

Looks like I got the plastic.

John Galt III

Thinks s/he gets paid by the post

- Joined

- Oct 19, 2008

- Messages

- 2,799

Still no $600 here, in Pa.

When I opened this letter, what was inside was a replacement credit card from my credit union. Nothing to do with the stimulus payment. I guess we have an "informed delivery" failure, because the image below was tagged with "US Treasury..."

So, still waiting.

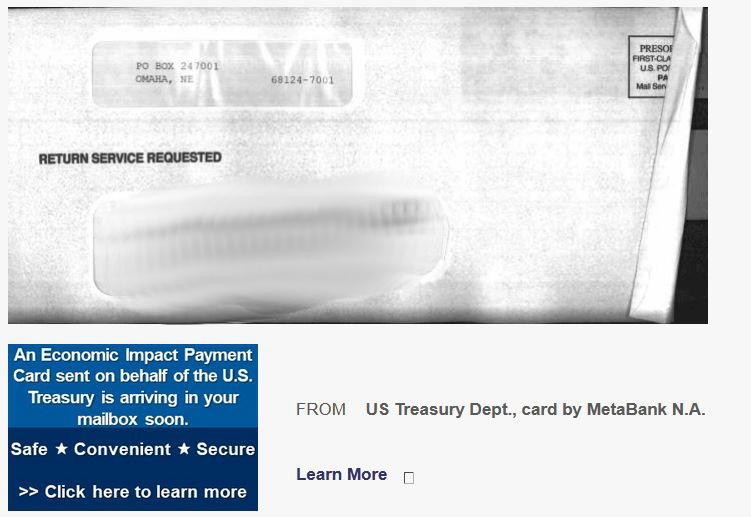

How interesting! Seems like they knew there was a card inside and just assumed it was from the Treasury. The EIP envelopes look more like this:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My ladyfriend and I are wondering why she hasn't gotten her check yet. Her tax return is simple; no income other than her 1 job, income easily below the $75k limit to receive the full amount. The first payment was direct-deposited to her bank back in May. No change in address or banking info. Income nearly the same in 2020 as in 2019 (and 2018).

She filed her 2019 tax return back in March and her payment via paper check was cashed quickly. No questions about her return (which I actually prepared for her). So, when we go to that website within the IRS website to check on her latest payment's status, we see this:

"Payment #2 Status - Not Available

We are unable to provide the status of your payment right now because:

•We don't have enough information yet (we're working on this), or

•You're not eligible for a payment."

Could the IRS have not processed her 2019 tax return? Otherwise, what info could they still need?

If by some chance she doesn't get her payment, we plan to apply the $600 to her 2020 taxes because she will owe nearly that amount, triggering a small refund. She won't file until late March anyway.

From what I read, if you get that not available status message, the IRS says that you will have to reconcile it on your 2020 taxes.

John Galt III

Thinks s/he gets paid by the post

- Joined

- Oct 19, 2008

- Messages

- 2,799

Still nada.

Similar threads

- Replies

- 30

- Views

- 3K

Latest posts

-

-

-

-

-

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: sengsational

-

-

Mailed on the 6th.

Mailed on the 6th.