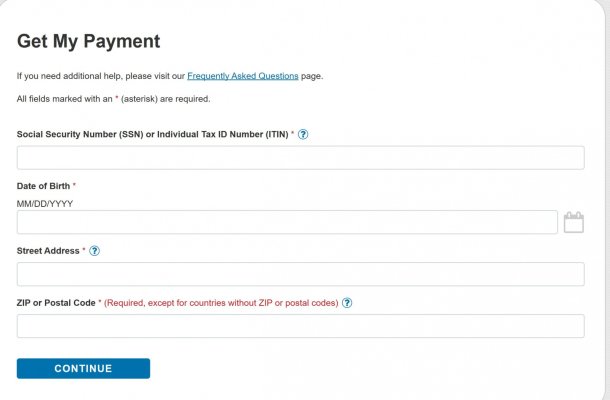

Keep getting "technical difficulties" notice when submitting my banking info. Now I am locked out for 24 hrs. No clue what is the problem. I did see that the zip code that I entered is different from what is on my tax return. It is the same zip code but on the return there is the extra - xxxx number and I didn't enter it that way. Maybe that's it. The only other thing I can think of is that I checked that I am getting a refund but entered 0 for the amount which is what is on line 21a that the instructions say to use. I overpaid and was due a refund but I applied it all to next yr's estimated taxes. I hope after 24 hrs in the penalty box I can figure it out. Otherwise, I guess I wait for the paper check. No big deal other than the frustration of this thing not working.

You're not the only one- I got this. After three times I'm locked out for 24 hours. Disappointing, but I'm not surprised.

I think that you are seeing the new message that replaces the previous "Payment Not Available" message. Apparently that was due to high traffic (although, they had a waiting room type of entry, so they should definitely have been able to control for that). Here's an article: https://www.cnbc.com/2020/04/15/irs-stimulus-check-tracking-tool-isnt-working-for-everyone.html

In most cases, this happened because the system was overloaded, Luis Garcia, an IRS spokesperson, told CNBC Make It.

“What happened is instead of having an error message or a message saying the system is very busy, it just says your information isn’t in here, that was the default,” says Garcia. But that should be fixed now.