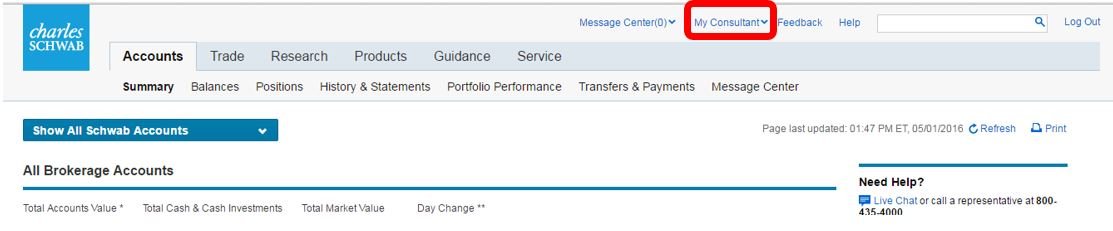

I don't know about "by default," but when I log in to my Schwab accounts, there's a link at the very top, slightly to the right of center, that is labeled "My Consultant." I didn't choose the consultant. Schwab chose her, and she reached out to me. I don't pay any fees for the consultant, but I understand that she makes a bit for being assigned to my accounts. She has run some retirement calculations for me, and from time to time she invites me to a talk given by one of her colleagues.

Are you saying that you don't have a "My Consultant" link when you log in to your Schwab accounts?