SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Please expand. It did seem a bit long and wordy. Were there errors?

I (think I) can explain the 4% rule in 50 words or less (but don't hold me to it.) YMMV

Oh, OK. My criticisms:

1. Page 3 - "We're going to ignore Social Security because it's complex." Possibly fair. But then later they introduce complexity in a number of different ways (international investing, Monte Carlo-based proprietary analysis prediction of the future). They're not being consistent.

2. Page 3 - Giant strawman that is never stated is that FIRE people rely on and follow the 4% rule slavishly. Generally entirely untrue as a premise for the rest of their criticisms.

3. Page 3 - They exclusively choose a 50/50 portfolio and then later criticize longer periods. Either Bengen or Trinity looked at multiple portfolio AAs, and it's been well known and studied for decades that higher equity porfolios have better survivability over longer periods. So this is a combination of straw men and circular arguments, or simply ignorance.

4. Page 4 - "We don't want to rely on historical returns." Again, possibly fair, but I hardly think that introducing a proprietary Monte Carlo-based analysis with no visibility into how it works or the assumptions it makes is a better approach. This is a red herring fallacy (I think).

5. Page 4 - "The future may be different from the past." Because we're going to compare past history to our future proprietary guess. This is what's known as a circular argument.

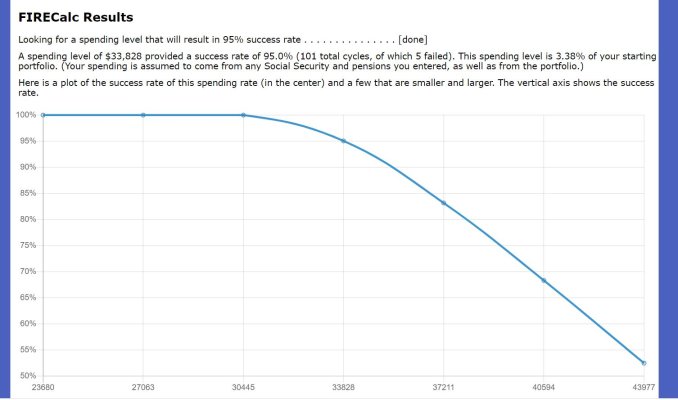

6. Page 5 - Using their VCMM pessimistic guess to analyze longer historical periods. This simply ignores historical analyses like FIREcalc which analyze the historical survivability for 40- and 50-year periods. It is suspicious to me that the latter provide results that indicate better survivability than the VCMM analysis.

7. Page 5 - 50 years. Yes, FIREes in their 30s may need to look at a 50 year planning period. And I think most FIREes that I've seen do so. But the number of FIREes in their 30s are an extraordinarily small part of the FIRE population - most FIREes are in their 40s and 50s, where a 30- or 40-year plan is probably more likely.

8. Page 5 - Fees. FIREcalc accounts for fees, and I think most FIREes do as well. Just because Bengen ignored them for simplicity, it's not really a relevant argument, so it's another straw man. And I think many FIREes have portfolios that have a weighted cost much less than 20bps, much less 100bps. So a double straw man here.

9. Page 7 - Logical flaw: "For example, if the market falls substantially in a given period, the 4% rule would advise boosting spending each year to account for inflation. This can substantially increase the risk of portfolio depletion in retirement." Well, the risk is already baked into the 4% historical analysis; repeating it this way makes it seem like an additional or extra risk when it is not.

10. Page 7 - Logical flaw: "On the other hand, if the market goes up substantially, annual spending will not increase after accounting for inflation under the 4% rule, even if investors would like to enjoy a higher standard of living given the good market performance." Again, only if you're a slavish follower of the 4% rule, which nobody is. Also, this ignores the payout period reset or retire again and again approach, which has been an idea known about for two decades and rediscovered by many new FIREes on a regular basis.

11. Page 9 and 10 - Again, their footnotes show that their analyses are all predicated on their VCMM pessimistic and proprietary guess. (The larger point about variable spending being a good thing is nearly a given to anyone with half a brain.)

12. Page 11 - Figure 10 footnote, 85% success - Does anyone else think that 85% is a smart standard for FIREes facing a 50 year planning period? I do not.

13. Overall, they seem to be assuming that FIREes are blindly following 27 year old research without any additional thought or analysis, and ignoring all the additional information, research, options, and strategies that have been identified, thought of, and/or written about since then. So again, one gigantic straw man.

Last edited: