donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

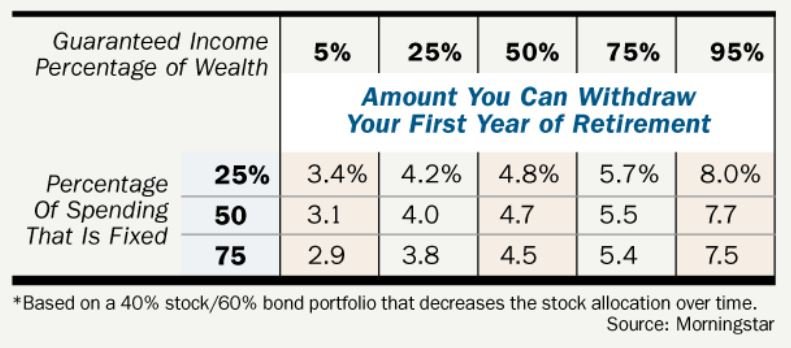

This is an interesting article in Barron's cautioning retirees about the 4% rule. It starts out pretty alarmist, saying this is the worse time to retire since before the dot com bubble. But despite the bleak intro the article then covers the standard ground of Wade Pfau, Guyton, et al in a manner familiar to most of us here. I found the Morningstar chart below that purports to set out conservative initial SWR percentages pretty reassuring given the bleak intro.