Caveat that this ama is a few years old now, but I found it to be a valuable thread with lots of interesting questions and answers. I learned a lot that I did not know.

https://www.reddit.com/r/financiali..._bill_bengen_and_i_first_proposed_the_4_safe/

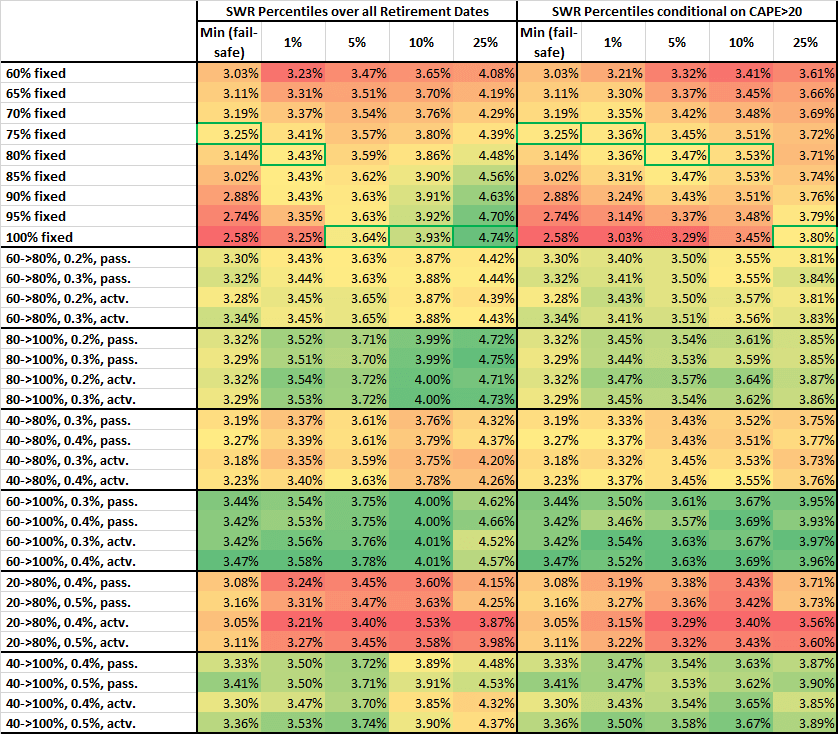

The first reply is that Bengen states that he later found out that it should actually have been a SWR of 4.5% vs. the 4% he initially reported. For someone with longer retirement plans over the traditional 25-30 years he offers alternative SWR rates.

I was shocked that he felt one could live in perpetuity on a 4% w/d rate.

He does also point out what his research indicated is the sweet spot of an AA to maximize the SWR. This which was 45-55% equities and the remainder in bonds/cash ("According to my research, I would have a well-diversified portfolio with probably 50% equities, 40% fixed-income, and 10% cash")

Thx for this. Read through that thread; interesting he says 55% stock is optimal equity exposure. I have never and could never hold such a low equity holding.