There was an old thread on this (now locked due to age) but I'm wondering what current thinking is?

Let's assume one has a substantial nest egg and wants to partially or fully retire at age 30 (or 40). Also assume he or she is very conservative and wants to only live off 'income' from his assets (& reinvest enough to at least cover any inflation, so therefore the nest egg is actually staying stable or even growing slowly over time).

Final assumption assume the portfolio is mostly taxable accounts and is a 60/40 stock/bond split.

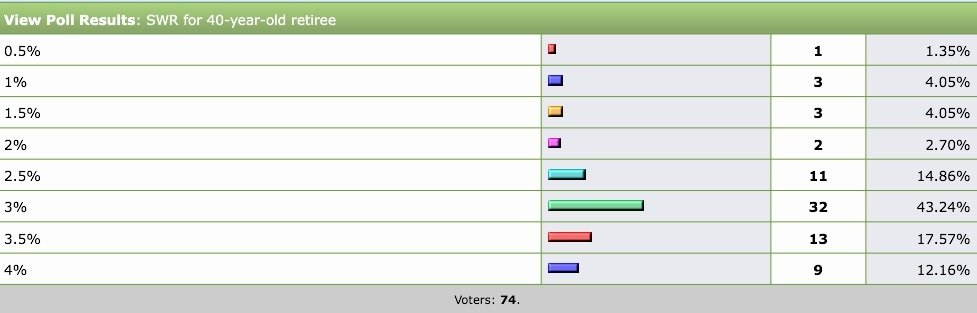

What would a SWR be?

The 4% rule is out the window obviously. I am thinking the right number might be 1% to 1.5%?

Let's assume one has a substantial nest egg and wants to partially or fully retire at age 30 (or 40). Also assume he or she is very conservative and wants to only live off 'income' from his assets (& reinvest enough to at least cover any inflation, so therefore the nest egg is actually staying stable or even growing slowly over time).

Final assumption assume the portfolio is mostly taxable accounts and is a 60/40 stock/bond split.

What would a SWR be?

The 4% rule is out the window obviously. I am thinking the right number might be 1% to 1.5%?