RetiredAndLovingIt

Thinks s/he gets paid by the post

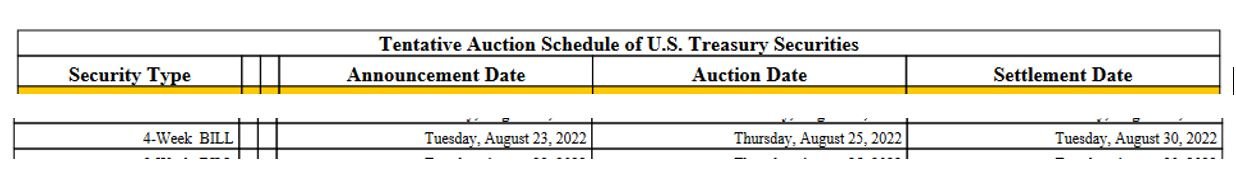

I went to Treasury Direct last Monday 8/22 and placed my first ever order for a 4 week T-Bill as a test.

It seemed fairly simple, and I got an acknowledgement from them the same day

Dear Retired

A purchase has been scheduled in your TreasuryDirect account on 8/22/2022. For more details, go to the History tab and click Security History. If you have a question about this activity, please call (844) 284-2676.

Thank you for using TreasuryDirect.

I assumed the auction was happening last week but still no payment has been withdrawn from my bank account. I finally checked my Treasury Direct today and it looks like it has an issue date of 8/30. I thought they did auctions weekly, how did I manage to miss last weeks auction or is this normal?

It seemed fairly simple, and I got an acknowledgement from them the same day

Dear Retired

A purchase has been scheduled in your TreasuryDirect account on 8/22/2022. For more details, go to the History tab and click Security History. If you have a question about this activity, please call (844) 284-2676.

Thank you for using TreasuryDirect.

I assumed the auction was happening last week but still no payment has been withdrawn from my bank account. I finally checked my Treasury Direct today and it looks like it has an issue date of 8/30. I thought they did auctions weekly, how did I manage to miss last weeks auction or is this normal?