You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Talked to 2 Retired Neighbors .. They didn't pay off mortgage, but both have pensions

- Thread starter cyber888

- Start date

LoneStarJeffe

Confused about dryer sheets

Every situation is different. One large factor is if you plan to live in your house long-term after you retire. Our home is single story and we added a walk-in shower when we remodeled it so it is more "senior" friendly. My mortgage balance is less than 50k and my payment is less than $600 so the remaining amount still owed is not critical and easily paid off if I need to do so. But my interest rate is low and I can cover the monthly cost. For me, retirement is about finding the right balance and managing risks. it is not about trying to achieve perfection. I just want to feel I have a retirement plan I am comfortable with and don't have to worry.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks. No mortgage might give more in return over time, but it might not if markets head south. The direction to go is what the rates are at the time of taking the mortgage.

Sure. But historically, there isn't a single 20 or 30 year period in the markets that didn't beat today's mortgage rates. On average a very significant difference.

If someone doesn't want to take that bet because it's not guaranteed, fine, their decision. But they should understand the numbers first.

From an earlier post:

Ok, here's some info I had from a post I made a while back:

Maybe someone can come up with more recent/better sources, but these show 20 and 30 year rolling average total returns for the stock market:

https://awealthofcommonsense.com/2016/05/deconstructing-30-year-stock-market-returns/

https://www.crestmontresearch.com/docs/Stock-20-Yr-Returns.pdf

From what I can see, only three 20 year periods dropped below 5%, and only one barely below 4% (out of 78).

Thirty year returns were all above 7.75%

And the average returns of course, are way higher. Historically, investments have beat a 3.5% mortgage over all 20 year cycles, and even the very worst had double the return over 30 year cycles. It's no guarantee, the future could be worse than the worst of the past, but if you don't take the bets that a clearly in your favor, you are unlikely to get ahead.

-ERD50

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Which TIPS are returning 5 to 7% and what are the terms? Thanks.

The ones bought a decade or more ago. Interest rates of 0 - 2%, plus inflation factors.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Thanks. No mortgage might give more in return over time, but it might not if markets head south. The direction to go is what the rates are at the time of taking the mortgage.

I think the idea for the mortgage folks is to lock in mortgages or refinance when rates are at historic lows, and play the odds that investment rates will go up over time, but the mortgage is locked in (or possibly can be refinanced again at no cost if rates drop even lower).

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The ones bought a decade or more ago. Interest rates of 0 - 2%, plus inflation factors.

Sorry this is off subject but do we believe TIPS (maybe I-bonds as well) will now get a boost in "real" interest rates since inflation has reared its ugly rear?

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Sorry this is off subject but do we believe TIPS (maybe I-bonds as well) will now get a boost in "real" interest rates since inflation has reared its ugly rear?

The interest rate portion on TIPs sold at auction has turned negative because the demand has gone up, so has the price. But even with the negative yield with the inflation factor being tied to the CPI, they may still be a good deal compared to current CDs or regular treasuries rates - United States Rates & Bonds - Bloomberg

I-bonds are a relatively good deal right now compared to other fixed investments as they aren't sold at auction and don't have a negative yield like TIPS, but they are limited to how much each Social Security number entity can buy in a year. We have thought about gifting our adults kids via I-bonds each year as a way to give them some of their inheritance now and increase the family purchase limit.

Last edited:

Markola

Thinks s/he gets paid by the post

The ones bought a decade or more ago. Interest rates of 0 - 2%, plus inflation factors.

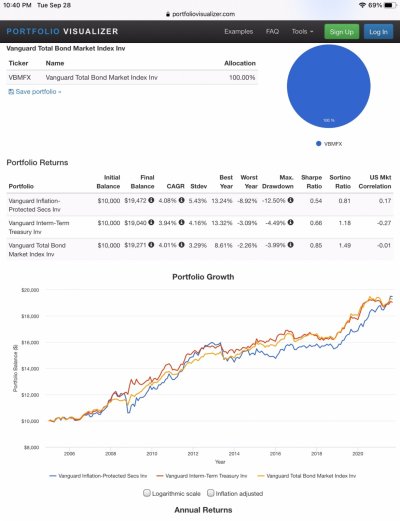

I like the idea of TIPS, but I haven’t been impressed with the reality of them. If one loaded up on them prior to 2005, they’d have enjoyed about a 3/4% average annual return advantage over a total bond index fund or an intermediate Treasuries index fund, albeit with more volatility. However, if one bought them in any year since 2005, there hasn’t been an advantage, only more volatility in what is supposed to be one’s fixed income bucket. Maybe time will tell. A lot of people have been predicting big inflation for a long time now, but that keeps not happening.

Attachments

Last edited:

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The interest rate portion on YIPs sold at auction has turned negative because the demand has gone up, so has the price. But even with the negative yield with the inflation factor being tied to the CPI, they may still be a good deal compared to current CDs or regular treasuries rates - United States Rates & Bonds - Bloomberg

I-bonds are a relatively good deal right now compared to other fixed investments as they aren't sold at auction and don't have a negative yield like TIPS, but they are limited to how much each Social Security number entity can buy in a year. We have thought about gifting our adults kids via I-bonds each year as a way to give them some of their inheritance now and increase the family purchase limit.

To me, it's kinda frustrating. To get safety (US Gummint) you MIGHT just keep up with inflation (but pay taxes on the gains.) But, of course, it's better than a CD at this point so YMMV.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,086

Street, my pension pays all my bills. If I didn’t have it I would be saving that amount. My mortgage with taxes and insurance is only 440/month.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Paid off home = money prison with a life sentence [emoji3]

That should clear up any debate.

Cheers

Heh, heh, same could be said of marriage - but I'd never say it.

Heh, heh, same could be said of marriage - but I'd never say it.

New debate then [emoji3]

If this was the same for marriage then your partner would have to be locked away out of reach where you could never benefit from their company.

So maybe the marriage is more like the mortgage [emoji857]

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

New debate then [emoji3]

If this was the same for marriage then your partner would have to be locked away out of reach where you could never benefit from their company.

So maybe the marriage is more like the mortgage [emoji857]

No, actually I DID pay off the mortgage!

So, I think the illustration breaks down - or something. Hope DW doesn't see any of this.

So, I think the illustration breaks down - or something. Hope DW doesn't see any of this.No, actually I DID pay off the mortgage!So, I think the illustration breaks down - or something. Hope DW doesn't see any of this.

Haha. Good by money. I will never see you again.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Haha. Good by money. I will never see you again.

Suddenly, we're writing Country and Western songs!

Suddenly, we're writing Country and Western songs!

I had you for 30 years

But now your gone

Off to prison

I am alone in my home

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,543

Street, my pension pays all my bills. If I didn’t have it I would be saving that amount. My mortgage with taxes and insurance is only 440/month.

That is really good and payment isn't high at all.

You read and hear all the time and strongly recommend when you retire, you should be debt free. There again ones protocol doesn't fit everyone. There are many paths, no right or wrong way to ER and beyond. It all comes down to how each manage their money.

Thanks

Last edited:

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Whether to carry a mortgage is subjective. No 2 scenarios are the same. In our case we paid of ours in 1997 after a big bonus' from our J*bs, we were DINKs. It was $200k, the home was ~$370k. (SoCAL).

Fast forward to today, 3 homes later, all purchased for cash, current home is ~$1m, not having a mortgage frees up a significant amount of monthly expense. Suits us just fine.

As far as Neighbors are concerned, the ones we chat with and communicate regularly are all professional, only one carries a mortgage, more out of laziness I think, as they are pretty well off. They are quite happy to share, as are we. All are retires although a few still dabble.

Fast forward to today, 3 homes later, all purchased for cash, current home is ~$1m, not having a mortgage frees up a significant amount of monthly expense. Suits us just fine.

As far as Neighbors are concerned, the ones we chat with and communicate regularly are all professional, only one carries a mortgage, more out of laziness I think, as they are pretty well off. They are quite happy to share, as are we. All are retires although a few still dabble.

Great discussion that hits close to home. I'm going to retire in May of 2022, and my wife has 2 more years to go after that. We will be receiving pensions. We just inherited an IRA. My first plan was to distribute the IRA over the next 10 years, and invest. She wants to payoff the mortgage. I'm going to let the inherited IRA build (hopefully) a couple of years and then pay off the mortgage using the inherited IRA when she retires. Happy wife = Happy life ??

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

^^^ Watch out for taxes... depending on how much of a mortgage you have, "pay off the mortgage usingthe inherited IRA" could result in a huge tax bill. If it does you can just use withdrawals from the inherited IRA to make the mortgage payments and the overall impact is the same but without the big tax bill. YMMV.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Great discussion that hits close to home. I'm going to retire in May of 2022, and my wife has 2 more years to go after that. We will be receiving pensions. We just inherited an IRA. My first plan was to distribute the IRA over the next 10 years, and invest. She wants to payoff the mortgage. I'm going to let the inherited IRA build (hopefully) a couple of years and then pay off the mortgage using the inherited IRA when she retires. Happy wife = Happy life ??

Watch the potential tax issues, as pb4uski just posted.

Also, Happy wife = Happy life? Sure, but maybe try educating her to what the benefits may be to keeping the mortage (assuming your mortgage is a low rate, or consider a refi). then, depending on the numbers, that may mean you are happy, wife is happy (and impressed with how smart you are!), and your pocketbook is happy.

win-win-win. Hard to beat that.

-ERD50

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Saying that not having a mortgage frees up cash ignores the opportunity cost of the money in the house. Not having a mortgage means more cash if you would have put the money under a mattress or spent it on your beanie baby collection - actions with a likely zero or negative investment return.

If you invested the difference, then a mortgage may or may not free up cash depending on various factors, including your mortgage rate, investment returns, tax considerations, and inflation increases on SS and pensions.

If you invested the difference, then a mortgage may or may not free up cash depending on various factors, including your mortgage rate, investment returns, tax considerations, and inflation increases on SS and pensions.

Last edited:

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It occurred to me that keeping the mortgage and investing the "extra" available funds is a type of leverage - or, dare I say it, "buying on margin." All else equal, a good case can be (and has been) made to keep the mortgage. Just wondered if anyone else might see this in terms of borrowing money to invest with? YMMV

Markola

Thinks s/he gets paid by the post

Seems no one can really explain why some financial advisors insist mortgages should be compared to, or paid off by, fixed income investments rather than one’s equities. It makes no logical sense, so I’m happy to move on.

Similar threads

- Replies

- 15

- Views

- 764

- Replies

- 15

- Views

- 603

- Replies

- 59

- Views

- 4K

- Replies

- 19

- Views

- 592

- Replies

- 8

- Views

- 625