Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

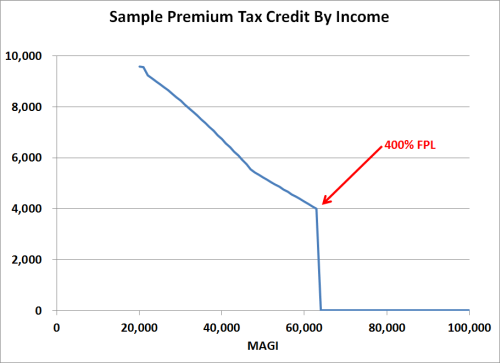

Hi all, just wanted to remind those who are on ACA plans about the tax cliff.

Since I do a lot of trading, especially in Robinhood where I am trying to simply turn $2500 into $250,000 in a reasonable 10 years, I tend to generate a lot of short term capital gains.

Since we are now in November, I took the time to load my 2018 tax software and put in the current taxable interest, dividend and capital gains across our various accounts.

I made two estimated tax payments this year totaling $8,000 because, well, this has been a decently good year.

Right now we will get a refund of about $1900 (really just a partial refund of the estimated tax payment).

If we make another $6000 in gains, we will get a refund of $1100.

If however we make $7000 more in gains this year, we will instead owe $6100!

Yes, that is right. If we make $1000 in profit we will owe $7200 in tax! The effective tax rate on that $1000 profit is 720%

Nobody wants to pay 720% in tax, so be careful out there!

edit: It would actually be of some benefit for a person to take $1000, invest it in a weekly option for anything, like Amazon $3000 calls and just take the capital loss when it expires worthless.

Since I do a lot of trading, especially in Robinhood where I am trying to simply turn $2500 into $250,000 in a reasonable 10 years, I tend to generate a lot of short term capital gains.

Since we are now in November, I took the time to load my 2018 tax software and put in the current taxable interest, dividend and capital gains across our various accounts.

I made two estimated tax payments this year totaling $8,000 because, well, this has been a decently good year.

Right now we will get a refund of about $1900 (really just a partial refund of the estimated tax payment).

If we make another $6000 in gains, we will get a refund of $1100.

If however we make $7000 more in gains this year, we will instead owe $6100!

Yes, that is right. If we make $1000 in profit we will owe $7200 in tax! The effective tax rate on that $1000 profit is 720%

Nobody wants to pay 720% in tax, so be careful out there!

edit: It would actually be of some benefit for a person to take $1000, invest it in a weekly option for anything, like Amazon $3000 calls and just take the capital loss when it expires worthless.

Last edited: