|

|

Tax cliff warning/reminder

11-02-2019, 10:33 AM

11-02-2019, 10:33 AM

|

#1

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Tax cliff warning/reminder

Hi all, just wanted to remind those who are on ACA plans about the tax cliff.

Since I do a lot of trading, especially in Robinhood where I am trying to simply turn $2500 into $250,000 in a reasonable 10 years, I tend to generate a lot of short term capital gains.

Since we are now in November, I took the time to load my 2018 tax software and put in the current taxable interest, dividend and capital gains across our various accounts.

I made two estimated tax payments this year totaling $8,000 because, well, this has been a decently good year.

Right now we will get a refund of about $1900 (really just a partial refund of the estimated tax payment).

If we make another $6000 in gains, we will get a refund of $1100.

If however we make $7000 more in gains this year, we will instead owe $6100!

Yes, that is right. If we make $1000 in profit we will owe $7200 in tax! The effective tax rate on that $1000 profit is 720%

Nobody wants to pay 720% in tax, so be careful out there!

edit: It would actually be of some benefit for a person to take $1000, invest it in a weekly option for anything, like Amazon $3000 calls and just take the capital loss when it expires worthless.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

11-02-2019, 10:55 AM

11-02-2019, 10:55 AM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: South central PA

Posts: 3,486

|

For those who use Schwab:

Schwab updated their website to include an estimated income for year end from the taxable brokerage account. based on past years, it looks like it's fairly accurate. Helpful for ACA planning, but the exact amount is important if you are close to the cliff.

Don't forget another place you can reduce your MAGI: HSA account.

Any hobby income? Put it in an IRA.

|

|

|

11-02-2019, 11:10 AM

11-02-2019, 11:10 AM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Hobby income might not qualify as earned income, so be careful with that.

In general earned income would be income that you pay SS tax on, which you do not for hobby income.

It would kind of suck to be planning on deducting your $3000 in hobby income from selling crafts by opening an IRA with it and then find out instead that you now owe $7,000 in tax on that $3000 of crafts you sold because you went over the cliff.

|

|

|

11-02-2019, 11:07 PM

11-02-2019, 11:07 PM

|

#4

|

|

Recycles dryer sheets

Join Date: Jul 2015

Posts: 395

|

Quote: Quote:

Originally Posted by Fermion

If we make another $6000 in gains, we will get a refund of $1100.

If however we make $7000 more in gains this year, we will instead owe $6100!

.

|

Please explain why? just because your tax software says so?

|

|

|

11-03-2019, 04:04 AM

11-03-2019, 04:04 AM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Quote: Quote:

Originally Posted by clobber

Please explain why? just because your tax software says so?

|

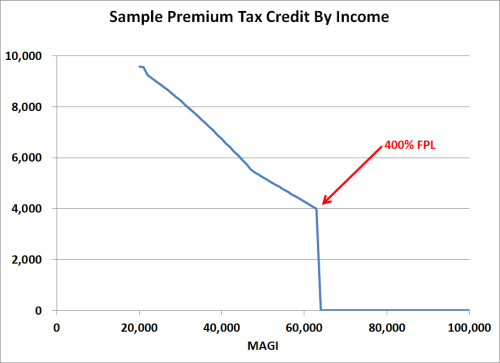

It has to do with the ACA subsidy and the cutoff for either receiving a tax credit when you file or having to pay back tax credits you received during the year that were applied to your insurance premium payment.

I knew it was steep but it still shocks me how steep the cliff is.

Essentially there is a income figure where making $1 more means you have to pay back about $7000 (in our case). It could be more or less for others depending on the size of their subsidy.

Something like the jury duty $10 pay my wife got could push you over the edge. Imagine jury duty costing you $7000!

|

|

|

11-03-2019, 06:41 AM

11-03-2019, 06:41 AM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2007

Posts: 3,229

|

Quote: Quote:

Originally Posted by Fermion

Something like the jury duty $10 pay my wife got could push you over the edge. Imagine jury duty costing you $7000!

|

If you are getting a subsidy you definitely need to leave a buffer so that unexpected income like higher than expected dividends/capital gains won't bite you. It wasn't so bad when you could recharacterize a ROTH conversion if needed, that allowed you the ability to go back and adjust your income after the end of the year if needed, that options no longer available. I came within $50 of the cliff a couple years ago but had the recharacterization option if needed, definitely don't play it so tight anymore, it would cost me close to $10K.

|

|

|

Don't forget NII if Roth converting....

11-03-2019, 07:53 AM

11-03-2019, 07:53 AM

|

#7

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2011

Posts: 3,604

|

Don't forget NII if Roth converting....

While on this topic, I will add my own PSA on this that may be relevant for Roth converters or anyone else who can have high discretionary income.

Another threshold to be aware of is when Net Investment Income (NII) tax kicks in. Although not a steep cliff like the ACA subsidy threshold, it can add up if you blow through the exemption amount. The amount can be an 3.8% additional tax above the threshold

I made some large Roth conversions last year and blew through the threshold unexpectedly, but not by too much fortunately.

FWIW the threshold is 200k/250k for single/married filing respectively.

-gauss

|

|

|

11-03-2019, 07:58 AM

11-03-2019, 07:58 AM

|

#8

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2017

Location: Champaign

Posts: 4,726

|

Since DH has a consulting business at home, there is income which allows us to contribute to tIRA. Along with HSA contribution that helps avoid ACA cliff.

__________________

"Do not go where the path may lead, go instead where there is no path and leave a trail."

Ralph Waldo Emerson

|

|

|

11-03-2019, 08:21 AM

11-03-2019, 08:21 AM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Posts: 5,350

|

There should never be a $7000 cliff. If you think you will be close to the cliff then don't claim a low income to get a big subsidy. Claim an income slightly below the cliff so you get some subsidy. Then if you go over you don't owe much. If you go under on expected income then you get a refund. If you claim $25K income at the start of the year then realize later you will make close to the cliff then change it. Change in income is a "life event" so you can adjust your subsidy payment anytime during the year if you want to avoid a large payment at tax time. A $7000 payment is completely avoidable.

|

|

|

11-03-2019, 08:29 AM

11-03-2019, 08:29 AM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2007

Posts: 13,227

|

Quote: Quote:

Originally Posted by aaronc879

There should never be a $7000 cliff. If you think you will be close to the cliff then don't claim a low income to get a big subsidy. Claim an income slightly below the cliff so you get some subsidy. Then if you go over you don't owe much. If you go under on expected income then you get a refund. If you claim $25K income at the start of the year then realize later you will make close to the cliff then change it. Change in income is a "life event" so you can adjust your subsidy payment anytime during the year if you want to avoid a large payment at tax time. A $7000 payment is completely avoidable.

|

You don't understand the cliff some of us face. At the start of the year I estimate my income to be about $100 under 400% FPL. If I go $1 over 400% FPL I get no subsidy. If I stay $1 under 400% FPL, I get about an $8000 subsidy. There is no in-between, or what you seem to call "some" subsidy. It is not at all avoidable.

|

|

|

11-03-2019, 08:33 AM

11-03-2019, 08:33 AM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Posts: 5,350

|

Quote: Quote:

Originally Posted by RunningBum

You don't understand the cliff some of us face. At the start of the year I estimate my income to be about $100 under 400% FPL. If I go $1 over 400% FPL I get no subsidy. If I stay $1 under 400% FPL, I get about an $8000 subsidy. There is no in-between, or what you seem to call "some" subsidy. It is not at all avoidable.

|

I wasn't aware people with that high of an income($1 under 400%FPL) got such a large subsidy. That doesn't seem right but I guess that's another discussion.

|

|

|

11-03-2019, 09:30 AM

11-03-2019, 09:30 AM

|

#12

|

|

Recycles dryer sheets

Join Date: May 2015

Location: NorCal

Posts: 333

|

Quote: Quote:

Originally Posted by aaronc879

I wasn't aware people with that high of an income($1 under 400%FPL) got such a large subsidy. That doesn't seem right but I guess that's another discussion.

|

That's what the state of California said and so California extended the ACA subsidy to 600% FPL for 3 years starting in 2020. No more cliff at least in California for the next 3 years.

https://health-access.org/wp-content...et_6.24.19.pdf

|

|

|

11-03-2019, 09:31 AM

11-03-2019, 09:31 AM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2013

Location: Coronado

Posts: 3,706

|

Quote: Quote:

Originally Posted by aaronc879

I wasn't aware people with that high of an income($1 under 400%FPL) got such a large subsidy. That doesn't seem right but I guess that's another discussion.

|

It's called a cliff because it goes from a high number to zero in one tiny step. The closer you are to 65, the higher the cliff.

|

|

|

11-03-2019, 09:38 AM

11-03-2019, 09:38 AM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Posts: 5,350

|

There should be a somewhat smaller cliff because people making 300-400% FPL should not be getting such a large subsidy IMO. However, the law is what it is so just do the best you can within the rules.

|

|

|

11-03-2019, 09:55 AM

11-03-2019, 09:55 AM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2009

Posts: 6,695

|

I have been paying close attention to this since Fido's year-end distribution estimates came out about a week ago.

I went over the cliff in 2017 and 2018 when huge cap gain distributions ate up my entire cushion. The cliff was pretty small through 2016, less than $500 for the year. But in 2017, it rose to $800 and in 2018 it rose to $1,800. For 2019, if I go over it again, it will be $2,500.

But the 2019 estimates have me right near the cliff, barely over it. If I sell some high-cost shares of a mutual fund at a loss, it looks like I can barely escape the cliff. I have already set up specific-ID for selling shares although Fido has a bug in its system to prevent me from specifying them if I sell using their website. I would have to talk it through with a phone rep, something I have already tested with a phone rep, assuming they don't fix this glitch.

I can actually make the sale now although I won't know for sure until the last few days of the year if it will be enough, or will I have to make another sale. I will have to be mindful of any wash sale possibilities which could prevent me from taking some losses.

__________________

Retired in late 2008 at age 45. Cashed in company stock, bought a lot of shares in a big bond fund and am living nicely off its dividends. IRA, SS, and a pension await me at age 60 and later. No kids, no debts.

"I want my money working for me instead of me working for my money!"

|

|

|

11-03-2019, 08:29 PM

11-03-2019, 08:29 PM

|

#16

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Like I said, it is a $7000 cliff for us, $8000 to $10000 for people a little older than us.

It is crazy that it would be worthwhile to "lose" some money in the stock market just to pull your income down below 400% poverty level if you are just over 400%.

I think the best way to guarantee a loss would be to buy way out of the money stock options.

|

|

|

11-04-2019, 05:39 AM

11-04-2019, 05:39 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2007

Posts: 13,227

|

Quote: Quote:

Originally Posted by Fermion

Like I said, it is a $7000 cliff for us, $8000 to $10000 for people a little older than us.

It is crazy that it would be worthwhile to "lose" some money in the stock market just to pull your income down below 400% poverty level if you are just over 400%.

I think the best way to guarantee a loss would be to buy way out of the money stock options.

|

How short of time frame can you have for those options? My make-or-break time is usually after the December mutual fund distributions. Vanguard gives estimates earlier, but they can be a little off. If I find out on Dec 22 that I'm a little bit over, can I buy an option and have it expired by the end of the year to take a loss?

|

|

|

11-04-2019, 06:24 AM

11-04-2019, 06:24 AM

|

#18

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2014

Location: Chicago West Burbs

Posts: 3,018

|

Quote: Quote:

Originally Posted by gauss

While on this topic, I will add my own PSA on this that may be relevant for Roth converters or anyone else who can have high discretionary income.

Another threshold to be aware of is when Net Investment Income (NII) tax kicks in. Although not a steep cliff like the ACA subsidy threshold, it can add up if you blow through the exemption amount. The amount can be an 3.8% additional tax above the threshold

I made some large Roth conversions last year and blew through the threshold unexpectedly, but not by too much fortunately.

FWIW the threshold is 200k/250k for single/married filing respectively.

-gauss

|

Help me understand this a bit more. Correct me if I am wrong. The Roth conversion amount is not subject to the NIIT, as it is treated as ordinary income. Only any other interest and dividends are subject to the NIIT. For instance if you had 400k in Roth conversions and 10K in Interest and dividends, only the 10K is subject to the extra 3.8%, correct?

|

|

|

11-04-2019, 06:40 AM

11-04-2019, 06:40 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Quote: Quote:

Originally Posted by RunningBum

How short of time frame can you have for those options? My make-or-break time is usually after the December mutual fund distributions. Vanguard gives estimates earlier, but they can be a little off. If I find out on Dec 22 that I'm a little bit over, can I buy an option and have it expired by the end of the year to take a loss?

|

Really short time frames on weekly options for SPY.

If you bought weekly call options on SPY $400 for the week of December 22 that expire before Dec 27, they should expire worthless (assuming the S&P500 does not go up another 33% lol.

Be careful about wash sales though if you have bought S&P500 index in your taxable or IRA. It might be safer to trade in a more obscure index or stock that you know you have not bought in the past 30 days.

|

|

|

11-04-2019, 07:40 AM

11-04-2019, 07:40 AM

|

#20

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,019

|

Hearing others' stories about an unexpected capital gain pushing them over the cliff has made me appreciate index funds even more, in that they give you almost complete control over when you realize the gains. I'm starting on ACA next year, and not owning any active funds will make managing income much easier and avoid potential gotchas.

One thing I'd recommend to anybody who is going to start ACA and receive subsidies is to do a practice tax return to make sure you understand all the details regarding income, how subsidies are reconciled at tax time, etc. I did this in TurboTax and it really increased my comfort level before taking the ACA plunge.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|