TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

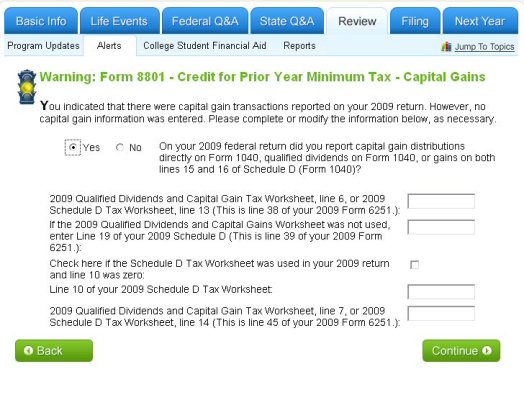

I'm getting this Yellow warning from TaxAct, and I'm not really understanding it.

When it says "however, no capital gain information was entered." is it referring to my 2009 or 2010 return? There's info on the Schedule D on both 2009 and 2010.

When I follow the instructions in a blind, non-understanding way, I answer "Yes" and all the values are zero. I have a capital gains carryover loss from 2009.

Can someone orient me as to what this is all about?

Thanks.

When it says "however, no capital gain information was entered." is it referring to my 2009 or 2010 return? There's info on the Schedule D on both 2009 and 2010.

When I follow the instructions in a blind, non-understanding way, I answer "Yes" and all the values are zero. I have a capital gains carryover loss from 2009.

Can someone orient me as to what this is all about?

Thanks.