- Joined

- Jul 1, 2017

- Messages

- 5,790

I have had a case of analysis-paralysis for years with my taxable accounts. Basically, I just looked at them, and froze.

I made my first move a few months ago, sold some funds (which had spewed capital gains), and am now looking at selling a stock that I have too much of and have held way too long. (Viacom & CBS) The Viacom merged with CBS and I have an overall loss basis. The market is high, the stock is low, but I already have too much cash from my recent sale; and will be ending up with way too much cash. (Frankly, I am afraid that the stock is on the road to disappearing altogether and would prefer to diversify the risk. While a fund may drop in value, I doubt all the stocks in the fund will go out of business.)

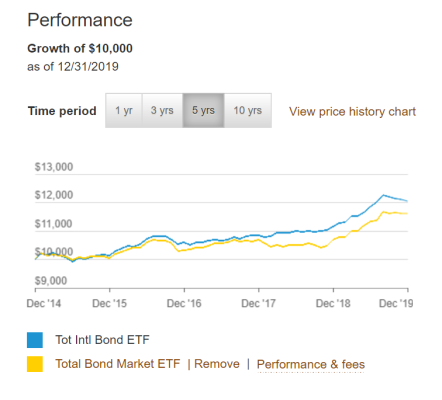

I understand that I can't time the market, but I am looking for some low cost suggestions/advise as to where to put the extra cash, i.e. Vanguard Total Stock ETF? Vanguard Total Bond ETF? Vanguard High Dividend Yield ETF?

This account is currently in TD Ameritrade. They just recently dropped their trading commission. So, should I dollar cost in (i.e. a certain percentage a month)? This cash is sitting in a TD brokerage account that has next to no interest. I am a very nervous investor with an (unjustified) fear of living under a bridge in a cardboard box syndrome. I have to tasar myself with a cattle prod to force myself to do (sell) anything, so lots of trading due to a drop in the price of the funds (above planned withdrawals) probably won't be an issue with me.

It appears that I will be retiring early next year at 59 1/2; and DH is retiring at the end of the year if that information is a factor. We will have health insurance and some monthly income for base expenses through DH's job (and I have some cash set aside which would cover a few years expenses, notwithstanding the above monies). We currently live in a high tax/ HCOL location; and hope to be doing some Roth conversions over the next five years.

Thank you.

I made my first move a few months ago, sold some funds (which had spewed capital gains), and am now looking at selling a stock that I have too much of and have held way too long. (Viacom & CBS) The Viacom merged with CBS and I have an overall loss basis. The market is high, the stock is low, but I already have too much cash from my recent sale; and will be ending up with way too much cash. (Frankly, I am afraid that the stock is on the road to disappearing altogether and would prefer to diversify the risk. While a fund may drop in value, I doubt all the stocks in the fund will go out of business.)

I understand that I can't time the market, but I am looking for some low cost suggestions/advise as to where to put the extra cash, i.e. Vanguard Total Stock ETF? Vanguard Total Bond ETF? Vanguard High Dividend Yield ETF?

This account is currently in TD Ameritrade. They just recently dropped their trading commission. So, should I dollar cost in (i.e. a certain percentage a month)? This cash is sitting in a TD brokerage account that has next to no interest. I am a very nervous investor with an (unjustified) fear of living under a bridge in a cardboard box syndrome. I have to tasar myself with a cattle prod to force myself to do (sell) anything, so lots of trading due to a drop in the price of the funds (above planned withdrawals) probably won't be an issue with me.

It appears that I will be retiring early next year at 59 1/2; and DH is retiring at the end of the year if that information is a factor. We will have health insurance and some monthly income for base expenses through DH's job (and I have some cash set aside which would cover a few years expenses, notwithstanding the above monies). We currently live in a high tax/ HCOL location; and hope to be doing some Roth conversions over the next five years.

Thank you.

Last edited: