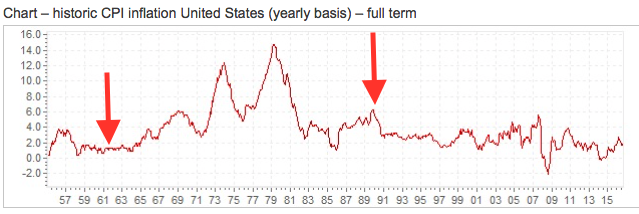

Apparently, Bill Bengen, creator of the 4% safe withdrawal rule, now believes that it should be 5% based on low inflation expectations.

https://www.marketwatch.com/story/the-inventor-of-the-4-rule-just-changed-it-11603380557?mod=home-page

https://www.marketwatch.com/story/the-inventor-of-the-4-rule-just-changed-it-11603380557?mod=home-page