You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Debt Clock

- Thread starter imoldernu

- Start date

- Status

- Not open for further replies.

- Joined

- Jul 1, 2017

- Messages

- 5,790

"Our Politicians" are elected by Idiot Voters..... So, no need to blame the Politicians...

If the Politicians ran on the "I want to raise taxes to balance the budget" or the "I want to cut the Defense Budget by 50% to balance the Budget"

........................... What would their chances of Election be? --- Would you even vote for them?

I can certainly think of government spending I would endorse cutting before the Defense Budget - and not SS.

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

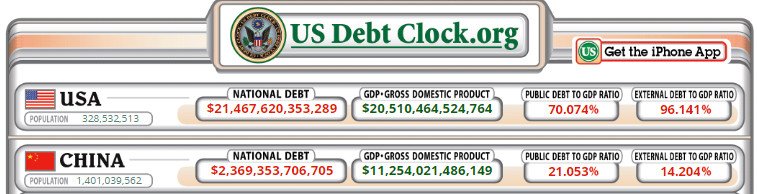

You may not believe so but it has a lot to do with the thread. China being the largest debt holder knows this, they are prospering from it and can crush us anytime they want

You have it backwards. They hold our debt. If we defaulted they would be crushed.

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

"Our Politicians" are elected by Idiot Voters..... So, no need to blame the Politicians...

If the Politicians ran on the "I want to raise taxes to balance the budget" or the "I want to cut the Defense Budget by 50% to balance the Budget"

........................... What would their chances of Election be? --- Would you even vote for them?

Absolutely, although it would have to be raise taxes AND cut spending. I've been waiting for that opportunity my entire adult life.

Maybe we can save a few bucks by doing away with the Space Force.

97guns

Full time employment: Posting here.

China is the largest foreign debtor. They hold less than 6% of the U.S. national debt ($1.19T out of $21T).

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Both China and Russia have been diverging from our debt and forcing us to buy our own, the printing press hasn’t slowed down in fact it’s done nothing but pick up speed

USGrant1962

Thinks s/he gets paid by the post

Both China and Russia have been diverging from our debt and forcing us to buy our own, the printing press hasn’t slowed down in fact it’s done nothing but pick up speed

I don't know why you think China is divesting, their Treasury holdings are up $90B in the last year. And Russia's are insignificant.

http://ticdata.treasury.gov/Publish/mfh.txt

97guns

Full time employment: Posting here.

Cut-Throat

Thinks s/he gets paid by the post

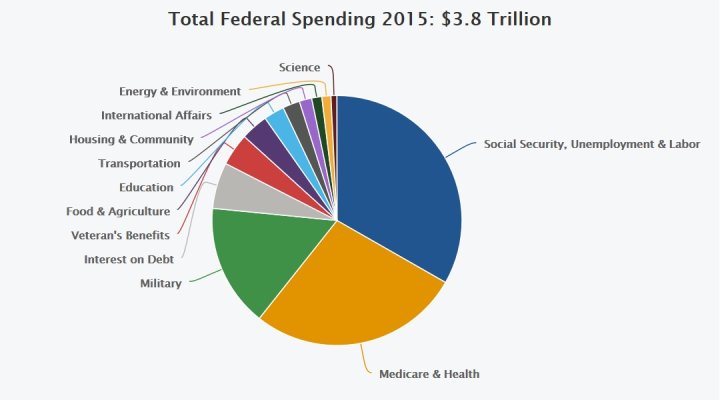

I can certainly think of government spending I would endorse cutting before the Defense Budget - and not SS.

But that is the problem, if you don't cut those, the other stuff is so insignificant that it won't amount to squat!

Attachments

Last edited:

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's on the internet, it must be true!

USGrant1962

Thinks s/he gets paid by the post

It's on the internet, it must be true!

Financial writers gotta write, every day, regardless if there is real news.

The reason is simple the Central Bank is purchasing the debt and returns the interest it receives back to the government. This means the debt is held at actually no cost. By purchasing 95% of the debt each year, the stated goal is to buy enough to hold 10 year treasuries under .1 %. The debt purchase is merely the funding of a negative national account under the government. A side benefit is that they are also buying 95% of the debt that is rolling over, lowering interest costs to contain budget deficits that would otherwise rise. As the Japanese defict spending is not causing an acceleration of monetary supply at the present time (money in circulation is not showing increased velocity), the Central Bank's purchase effectively causes nothing as the increases as the monetary impact of the central government spending is not causing inflation. This appears to mainly be due to the aging of Japanese society.

Once inflation begins however, the Japanese government have no means to control the mechanism and the years of effective cancellation of debt will be over. The time this will occur is totally and completely unpredictable however when it occurs, the fallacy of the former process will be clear to see.

As an example,

If you were to issue a mortgage to yourself and take the proceeds and buy a house, as long as the homeowner takes your currency and the currency used to purchase the house continues to rotate through the economy as being seen of value there is no problem. It could circulate throughout history and if it is acknowledged as holding value it does. You will not foreclose on yourself so there is no risk of default and the currency is always "backed". But there is no backstop once the market decides your currency does not have sufficient value to hold and the holders spend to rid themselves of it.

Thank you for that clear explanation.

The overwhelming amount of information on the World Debt Clock really boils down to the perceived value of the "dollar" of whatever type. A matter of confidence.

Borrowing to stimulate an economy or to pay for governmental needs not covered by income or taxes, obviously stimulates a government economy... but only as long as the debt is backed by confidence in the borrower. The amount of debt is only as important as the world confidence in the ability to repay.

While the relative amount of debt as a percentage of a country's GDP appears to be the determining factor of monetary strength, perception of strength comes from current and historical value... much in the same way as our personal credit rating limits our ability to borrow. Taking this analogy one step further, a current credit rating, might drop from 800 to 500 quite suddenly should a number of personal bankruptcies come to light. An individual may still be able to borrow, but at increasingly high interest rates.

Loss of confidence can be fast or slow. Interest rates may be one indicator of a "dollar" strength, but in the case of international monetary balance, the exchange of owned debt is more subtle. Thus, as an example, if Russia were to sell some of their Chinese debt, the temporal effect on the international marketplace would probably be slower than if China were to sell American debt. An extremely delicate balance... not just between two parties, but effecting everyone, everywhere.

The national debt has grown by more than $10 trillion in just 10 years to $21 trillion dollars, with a current projection to add another $3 trillion dollars in the next four years.

Debt may be the major long term concern for early retirees. Who sets limits?

But that is the problem, if you don't cut those, the other stuff is so insignificant that it won't amount to squat!

Exactly!

My favorite is when people say to cut foreign aid. That’s less than 1.5% of the federal budget. Not going to do much to solve the debt issue on that one.

Why not?While we can certainly have some national debt, annual budgets cannot spend more than they take in forever.

current reminder

Just an update.... so far, the consensus seems to be that the confidence in, and stability of the dollar accounts for the international balance that avoids major disruptions in the world economy.

...still... the numbers awesome. Way above my head and pay grade.

Here's one explanation:

https://www.thebalance.com/the-u-s-debt-and-how-it-got-so-big-3305778

Just an update.... so far, the consensus seems to be that the confidence in, and stability of the dollar accounts for the international balance that avoids major disruptions in the world economy.

...still... the numbers awesome. Way above my head and pay grade.

Here's one explanation:

https://www.thebalance.com/the-u-s-debt-and-how-it-got-so-big-3305778

Attachments

Last edited:

Who is winning?

Some Debt Clock numbers I looked at that make me wonder about a financial bubble. Where the money came from, (GDP) and where it went.

I don't understand these things, but wonder about the numbers... Any thoughts?

.....................................................................................................

2008 --10.7T Nat Debt...14T GDP ... 55T HH Assets ....14 T Corp Assets

2018 --21.6T. Nat Debt...21T GDP ..109T HH Assets....26 T Corp Assets

.......... 100% inc.. ........150% inc...100% increase.....185% increase

How do we determine "bubble"?

Some Debt Clock numbers I looked at that make me wonder about a financial bubble. Where the money came from, (GDP) and where it went.

I don't understand these things, but wonder about the numbers... Any thoughts?

.....................................................................................................

2008 --10.7T Nat Debt...14T GDP ... 55T HH Assets ....14 T Corp Assets

2018 --21.6T. Nat Debt...21T GDP ..109T HH Assets....26 T Corp Assets

.......... 100% inc.. ........150% inc...100% increase.....185% increase

How do we determine "bubble"?

Cut-Throat

Thinks s/he gets paid by the post

All I know is that the people that were warning us about the severe consequences of the Debt a few years ago, are the ones that are now increasing it with reckless abandon!

- Status

- Not open for further replies.

Similar threads

- Replies

- 26

- Views

- 2K

- Replies

- 15

- Views

- 1K

- Replies

- 93

- Views

- 9K

- Replies

- 192

- Views

- 12K

Latest posts

-

-

-

-

-

-

-

-

MYGA Company Ratings. AMBest "A vs A+ vs A++" Does it really Matter?

- Latest: ShokWaveRider

-

-