Sowhatdoidonow

Dryer sheet wannabe

I am currently reading the Investors Manifesto (new book by William Bernstein in preparation for joining the passive low expense world of investing (i.e. I fired my broker). It is a great introduction to this approach but in putting together my portfolio I have a few questions I hope some of you could answer:

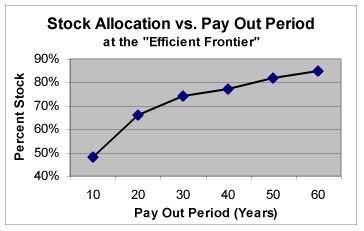

1) In terms of stock/bond allocation percentages Bernstein noted that the most common rule of thumb is that a bond allocation would be the same as an investors age. One would then adjust this up or down from 0% to 20% depending on ones risk tolerance. He also talks elsewhere about how a retired person has "no human capital left" and thus cannot buy more equities when stock prices fall. My question is when one retires early, should the early age and lack of human capital effect ones equity/bond allocation and if so how and why?

2) If the majority of your investments are in taxable accounts and you are early retired therefore no other current income, at what size would your portfolio need to be such that you would shift some or all of bonds toward tax free instruments (e.g. municipals)? How do you figure how much? Is there a guideline?

3) He really stresses that Vanguard is the way to go but if you stay away from the "marketed" high cost funds of Fidelity you could do OK there. Well I transferred everything to Fidelity in the last few months from UBS and would like to make it work there if I can. My question is if there is a way to cross reference funds between Fidelity and Vanguard? Also, does it costs me more to buy Vanguard funds through a Fidelity account. If I buy enough, do they waive purchase fees There just seems like so much information about Vanguard on this forum and the boglehead forum that I wonder if I am going to be at an information or fund availability disadvantage.

There just seems like so much information about Vanguard on this forum and the boglehead forum that I wonder if I am going to be at an information or fund availability disadvantage.

Any help on any one of the above questions would be greatly appreciated.

1) In terms of stock/bond allocation percentages Bernstein noted that the most common rule of thumb is that a bond allocation would be the same as an investors age. One would then adjust this up or down from 0% to 20% depending on ones risk tolerance. He also talks elsewhere about how a retired person has "no human capital left" and thus cannot buy more equities when stock prices fall. My question is when one retires early, should the early age and lack of human capital effect ones equity/bond allocation and if so how and why?

2) If the majority of your investments are in taxable accounts and you are early retired therefore no other current income, at what size would your portfolio need to be such that you would shift some or all of bonds toward tax free instruments (e.g. municipals)? How do you figure how much? Is there a guideline?

3) He really stresses that Vanguard is the way to go but if you stay away from the "marketed" high cost funds of Fidelity you could do OK there. Well I transferred everything to Fidelity in the last few months from UBS and would like to make it work there if I can. My question is if there is a way to cross reference funds between Fidelity and Vanguard? Also, does it costs me more to buy Vanguard funds through a Fidelity account. If I buy enough, do they waive purchase fees

Any help on any one of the above questions would be greatly appreciated.