If a person contributed nothing to SS but paid FIT (like some municipal employees do), but found a way to claim SS benefits when they retired, wouldn't you say that person was freeloading on SS? The pots are segregated for a reason: People who pay into SS get a direct benefit, people who don't pay in are excluded.

A person who pays no FIT does absolutely nothing to support the Park Service, USDA (food inspectors, food stamps), ATF, border security, the FBI, NASA, block grants of all types, etc, etc. Nothing. And, as a voter, they have no direct reason to oppose federal spending of any kind: They get the benefits and pay nothing for it. Woo-hoo, bring on the cake and circuses! Some powerful interests are eager to create more voters like that.

When lower income workers pay into SS, often that is the only retirement plan they have (and it is supplemented liberally by other SS participants, not the general fund). So, if "contributions to retirement plans that benefit me directly and accrue credits that directly result in retirement payments to me" is going to "count" as my contribution to paying taxes that support the rest of the government (which it obviously should not), I'd like "credit" for all the money I'm putting into IRAs and 401Ks.

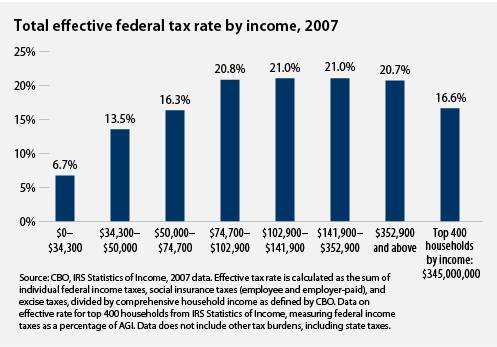

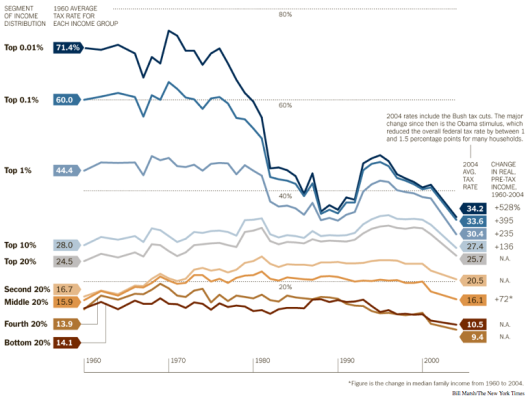

And Midpack's recent charts (thanks!) include these segregated and specific SS and Medicare contributions/taxes when portraying the tax burdens by various income groups, they are unconvincing for the same reason.