Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,522

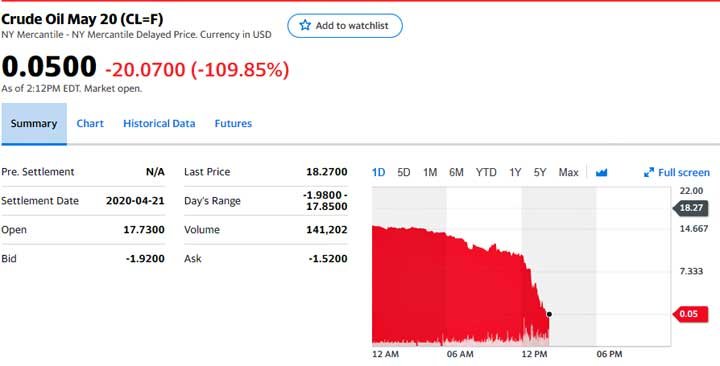

Looked at the commodity prices this morning and was shocked to see crude oil was at $10.50 a barrel.

Just took a look now, barely an hour later and the price of a barrel of oil is at $5.04!

I think the last time oil was this cheap was in the 1970's.

Just took a look now, barely an hour later and the price of a barrel of oil is at $5.04!

I think the last time oil was this cheap was in the 1970's.