I echo what Koolau says. It’s a great tool for planning, and is more important for those that depend entirely or nearly on it for income. But depending on what percentage of your income comes from the portfolio, people with lots of rental income, pensions, annuities etc, are less likely to “follow the rule” when retired. Many are forced to do so, if it is mostly in pretax IRAs, via RMDs eventually, where as those with 100% Roth and no RMDs calculate it differently. Naturally, income from $120k via 4% from a Roth is not the same as $120k via 4% from a tIRA The rule does not ever claim to be a tool for living income, but merely a historic probability withdrawal vehicle from a sustainable 30year portfolio, to aid income.

Personally, it is net spendable funds that I care about, so tax arbitrage via Roth conversion is my current tact. I haven’t “enabled” the 4% rule yet, between Roth conversions and delayed SS filing.

Since I have the majority of my retirement funds in my Fidelity accounts, it is easy to estimate the percentage based on withdrawals. I simply subtract the amount I expect to withdraw as a SS substitute (approx $150k, taxable at this time ) from the total, and see what percentage above that amount I have drawn. At this time any income needed in addition to pensions and DW SS, that are less than my yet to be filed SS, means I have not touched my “real” savings yet, which, thanks to C19, I haven’t even gotten close to, to date. My conservative portfolio grew 10%, plus the funds amount I have withdrawn, as one would expect with the markets returns these last years.

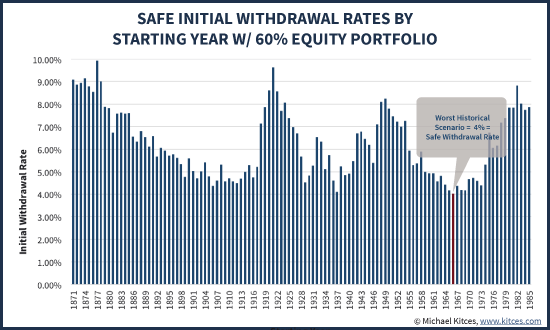

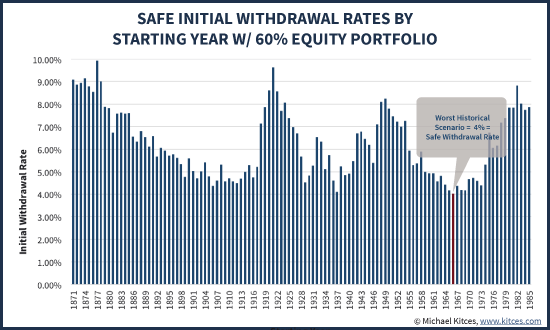

I read Kitces paper many times before retiring and liked the idea a lot. For my circumstances, I have no desire at all to leave a large inheritance, so increased withdrawal rate based on success & growth appeals to me, though in our circumstances, our natural tendencies curb wanton spending and like many here we are forced to BTD (but not for excessive toys, etc) if we want to use that 4%, and even more so, if we ratchet. IIRC, approx 50% increase in size from the start means to ratchet up, and I will likely be there by the time we can BTD on travel like we planned.

If we assume 2% inflation, then 4% becomes 6% over 20 years. Yet a lot of Firecalc threads still show net growth at a 6% withdrawal. It has been noted that there is irony in that you can really BTD when you are too old to enjoy it.