street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,538

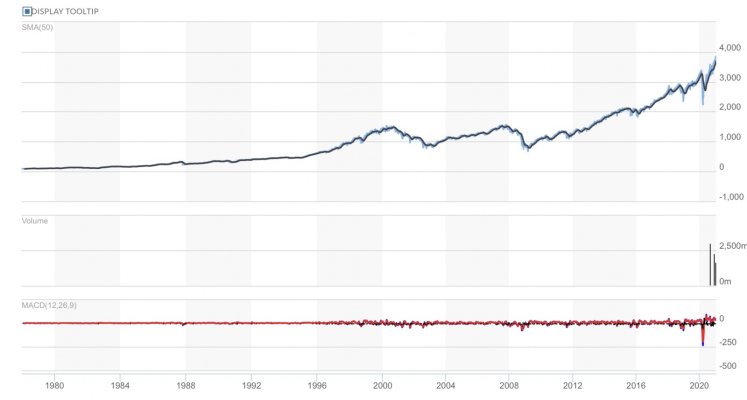

Nobody knows.....many claim to know with theories and analysis....don't believe them. But then again you shouldn't be concerned if you have an AA consistent with your risk tolerance level and time horizon. History has shown us that you are just as likely to be wrong than right about predicting the short term direction of the market. I told this story in another thread when the market was declining in the spring of 2020 but I will repeat it here.

I have a friend who moved away from my area but I still keep in touch. He had a problem letting his emotions and predictions rule his investment decisions and he knew it, he would watch the business news, listen to the sensationalist talking heads and churn his portfolio as a result. He was doing terrible and he knew it. Several years back he decided it was worth it to have Fidelity manage the account and suck it up and pay the management fee. IMHO based on his history, I couldn't disagree with him. Along comes the recent turmoil and what does he do.....he calls Fidelity and demands that they sell everything....they tell him he can't since he has a managed account so he has them change it back to un-managed and unloads his entire portfolio to cash.

A rookie mistake and a cardinal sin. I did something similar about 35 years ago with not a lot of money in the market but still got nervous and sold. Lol

It has been drilled into every market investor since God was a boy, to never make that mistake. A very hard thing to do but need to stick in there during hard times.