Tetto

Recycles dryer sheets

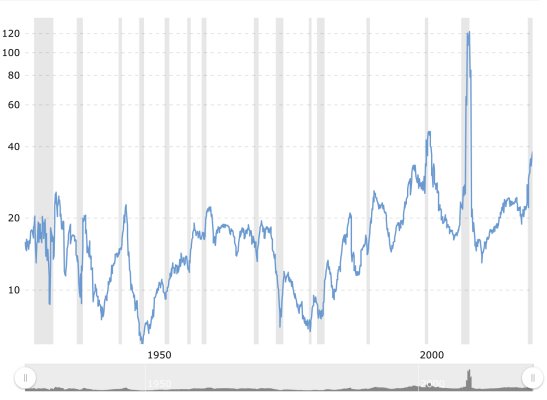

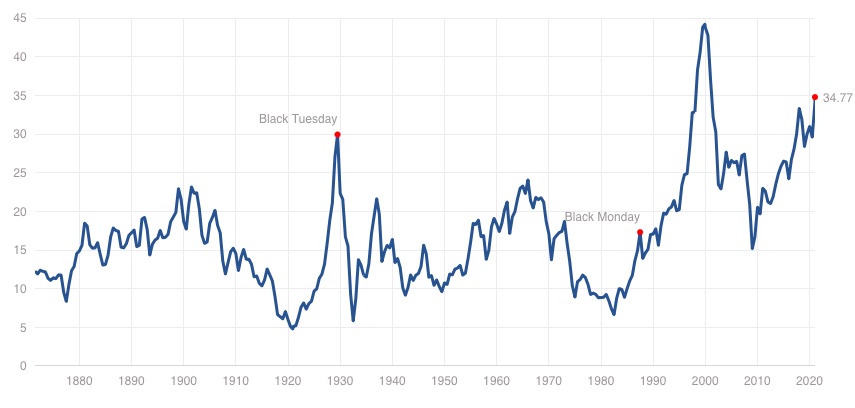

What in gods name is driving this market? I really don’t get these stratospheric heights we are seeing. I’m 7 years away from “needing” my money and 4 month ago I moved a huge (to me) to cash. I’m just not getting what’s happening; is there another massive crash lurking around the corner? It’s pretty well documented that businesses are not making any money!