mitchjav

Recycles dryer sheets

The Stock Market is near Correction Levels

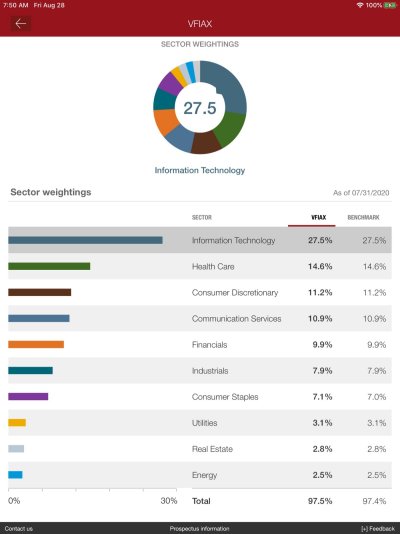

There's an article in Forbes this week arguing that without tech stocks + NFLX + AMZN + GOOG (all of which are apparently not classified as tech), the S&P 500 would be near correction levels. Points out how the index is being increasingly overwhelmed by tech. With S&P index funds being one of the most popular investments, many people are very dependent on tech companies continuing success. Given that growth has its limits, the author suggests that the S&P 500 equal weight fund would be a better reflection of overall market performance and that it would be better to hitch our wagons to this measure. Interested in everyone's thoughts?

There's an article in Forbes this week arguing that without tech stocks + NFLX + AMZN + GOOG (all of which are apparently not classified as tech), the S&P 500 would be near correction levels. Points out how the index is being increasingly overwhelmed by tech. With S&P index funds being one of the most popular investments, many people are very dependent on tech companies continuing success. Given that growth has its limits, the author suggests that the S&P 500 equal weight fund would be a better reflection of overall market performance and that it would be better to hitch our wagons to this measure. Interested in everyone's thoughts?

Last edited: