pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My historical "go-to" bond fund was the Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX) which has a 1.56% SEC yield and a duration of 5.3 years.

About a year ago I transferred most of my fixed income allocation to Vanguard Intermediate-Term Investment-Grade Fund Admiral Shares (VFIDX) which currently has a 2.11% SEC yield and a duration of 5.3 years (average maturity of 6.4 years).

This is in my Vanguard IRA for tax efficiency.

I'm thinking of using 5-year CDs instead of bond funds for my domestic fixed income allocation and using the new VG international bond fund for my international fixed income allocation. I don't anticipate touching these funds at all in the next 10 years.

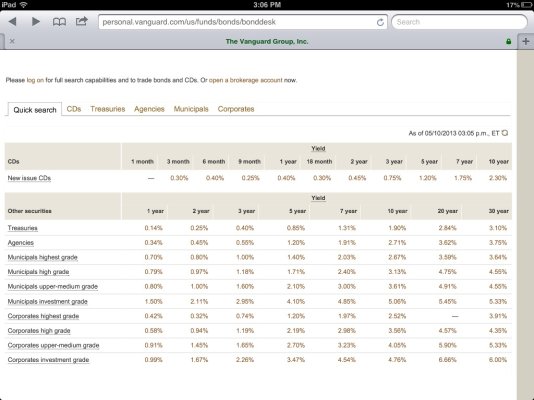

I see that 5 year CD rates are in the 1.50-1.75% range. I'm thinking that the credit and interest rate risk associated with VFIDX isn't worth and extra .61%-.36%. Thoughts?

Also, does anyone know whether I can buy/hold these non-Vanguard CDs in my Vanguard IRA or would I need to create an IRA with each financial institution that I am buying a CD from and rollover money from my Vanguard IRA to the new IRA accounts?

About a year ago I transferred most of my fixed income allocation to Vanguard Intermediate-Term Investment-Grade Fund Admiral Shares (VFIDX) which currently has a 2.11% SEC yield and a duration of 5.3 years (average maturity of 6.4 years).

This is in my Vanguard IRA for tax efficiency.

I'm thinking of using 5-year CDs instead of bond funds for my domestic fixed income allocation and using the new VG international bond fund for my international fixed income allocation. I don't anticipate touching these funds at all in the next 10 years.

I see that 5 year CD rates are in the 1.50-1.75% range. I'm thinking that the credit and interest rate risk associated with VFIDX isn't worth and extra .61%-.36%. Thoughts?

Also, does anyone know whether I can buy/hold these non-Vanguard CDs in my Vanguard IRA or would I need to create an IRA with each financial institution that I am buying a CD from and rollover money from my Vanguard IRA to the new IRA accounts?