Personally, I believe the market with all the uncontrolled and unregulated algorithmic trading, is completely unnatural. I look at P/E ratios and Tesla, just to name one example had a P/E ratio of 1,200. IMHO anything above 50 is risky. If you put it into perspective the market capitalization for Tesla was equal to all other automobile manufacturers combined which is, of course, ridiculous.Yet, it was still being listed as a buy and people are getting hammered as it retracts. The entire tech market is overblown and it will correct. It simply has to. However, we also have the issue of political motivations on the market and the PPP interfering added to the Feds use of IMHO ridiculous MMT and it all looks insane. I predict a major collapse but when is always the question. Because of the high risks involved of overnight corrections we go to cash every day. We have been doing this since 2016. Still, just trading 4 hours a day and not every day, we are earning around $12k a month which is fine by me. I do not trust this market and I believe it is completely out of control. We have been fortunate that the shorting was low, maybe on orders, but they are back. The tech market wants to make the economy look bad (not difficult) to push voters towards the liberals and the tech companies are all sworn to help them do that. Should Trump get re-elected there will be anti-trust efforts in revenge so in some ways these companies are betting the farm on Biden winning. But, this is just another factor in the equation.

Covid has not gone away and is in some ways getting much worse, particularly in the US but the second wave is emerging rapidly in those countries that either didn't have restrictions or relaxed them. More recent world-wide data now are showing mean age of deaths is now 37 and that men who are symptomatic roughly 50% have permanent testicle destruction with a loss of fertility and hormone production.

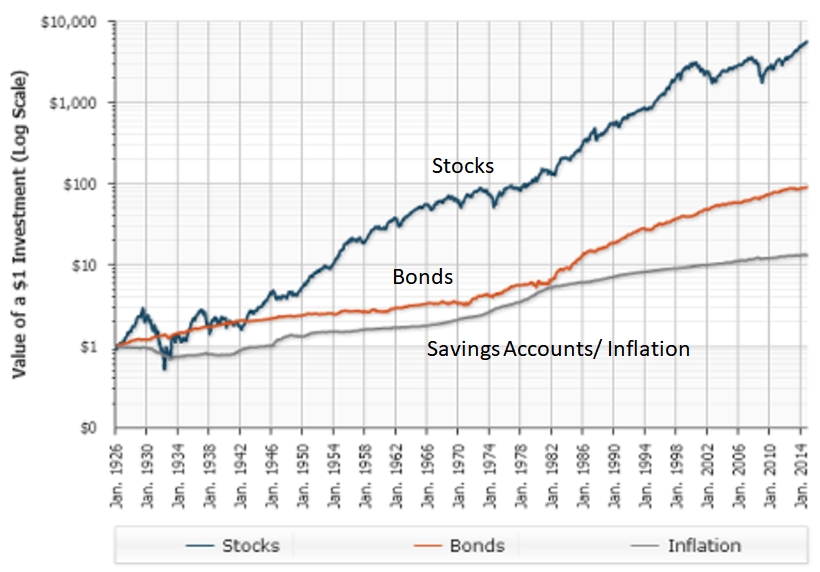

The economy is not better and the war drums are beating with multiple efforts by the US to topple governments we don't like at a time when we cannot afford it. Then we have the insane levels of US dollars being released into the markets increasing the debt to levels which are unbelievable which will cause massive inflation. Only the massive debt itself and the Fed purchasing equities and financial instruments directly is keeping this down. Mortgages are now 40% owned by the Fed as an example. How much of the market is owned by them is anyone's guess. All of it is unregulated and under the control of people with zero experience. Mnuchin was a Hollywood producer.