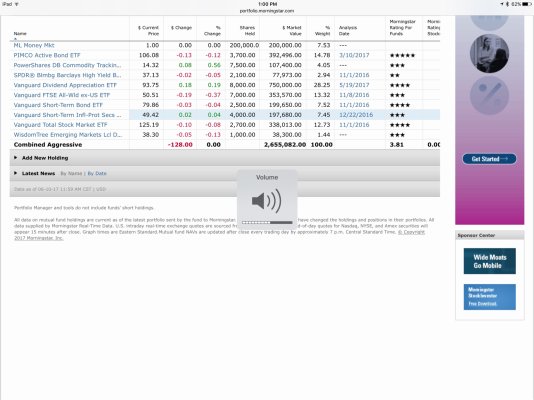

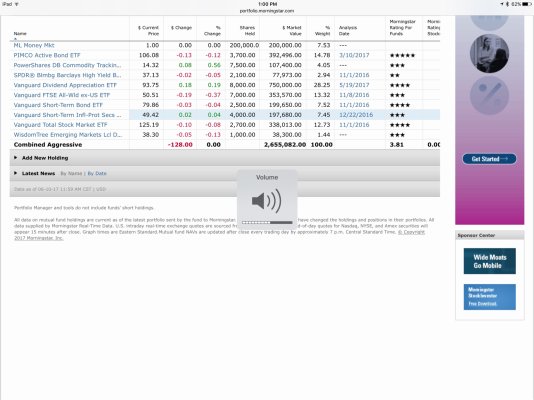

I set up a dummy portfolio using thoughts from Morningstar. I am still about a year away from making the jump. I think I would like to have a simple portfolio that I just rebalance annually. Not looking for views on the specific investment vehicles. More looking for thoughts on the general approach of a simple, low maintenance investment portfolio throughout retirement. Thanks for any feedback !