Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

One of the financial writers who I have followed and respected for many years is Jonathan Clements. In today's article tell us that he believes we finally hit the time when finding a safe and descent yield is gone. And he gives us four strategies for the future (assuming you agree with him beliefs).

https://humbledollar.com/2020/06/fa..._RilH8G7RXjjUVYDm7L9qBQHAK8uNsH89GT3DboOkS9Vk

He discusses four areas of change:

1. Abandon bonds.

2. Delay Social Security.

3. Bet your life.

4. Revisit tax efficiency.

https://humbledollar.com/2020/06/fa..._RilH8G7RXjjUVYDm7L9qBQHAK8uNsH89GT3DboOkS9Vk

THEY’VE LONG BEEN endangered, but 2020 may mark their demise: After four decades of falling interest rates, it seems safe investments offering attractive yields have finally disappeared.

He discusses four areas of change:

1. Abandon bonds.

2. Delay Social Security.

3. Bet your life.

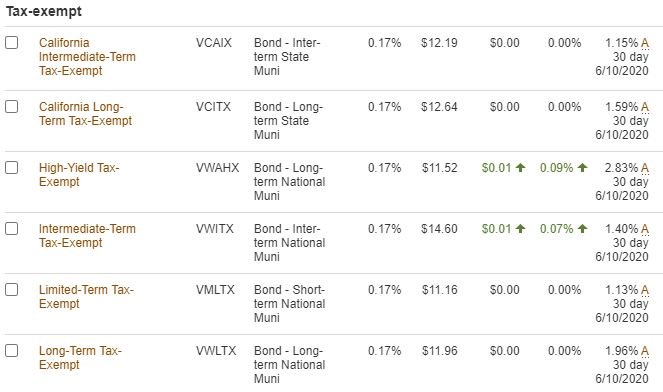

4. Revisit tax efficiency.