Well I understand your logic but by my calculations at your 3% return the point at which age to switch to 70 would be 83.36 not 77 as you have stated. There is a flaw in your spreadsheet. You show numbers in your age 70 column accumulating starting at age 68 in your left column. Your age 70 column should shift down 2 years. This extra 2 years plus the extra compounding @3% pushes the switch over age to 83.36 and not 77.

See my enclosed spreadsheet. Even at 0% return the switch over point is still 80.37. The reason I had asked about 0% was that I had run that on my own spreadsheet and wanted to see f you got the same answer. That led me to discover the flaw in your spreadsheet.

This would make your argument for taking it at 62 and invest it at 3% even better. But if we entered a bear market and your returns were negative 3% or worse the opposite would be true and you might be better off to wait to take ss. OK I just ran it assuming a -3% return for the years from 62 to 70 and then from 70 on put your positive 3% return in. It still looked like you would be good to age 79 (instead of the 83.36)if you took it at 62 before the age 70 total takes over. No too bad. This is the gamble one takes by taking it early. If someone took it at 62 say 8 years ago and invested it all in an index fund they would be looking pretty good right now but no guarantees going forward.

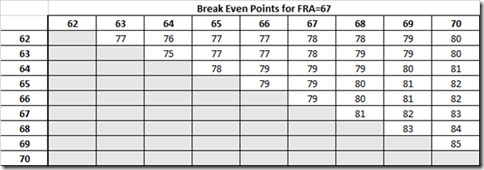

Back to assuming the positive 3% as your example spreadsheet: The age 70 total doesn't catch the age 67 total until you reach 85.5.

It's also interesting to see that if you did wait to 67 you probably would be better to take it at 68 or 69 because the age 70

never catches the total of either of these until well past 100.

Now having said all that all these totals assume that you never spend any of this money and the totals keep growing at 3%, This is fine if you want to pass the money along to heirs. In my situation we have no heirs so would be spending most or all of each years checks. This would change the "break even" numbers but wouldn't matter to me at that point.

Sorry for the long winded post and I could have missed something myself. Check my work and see if I missed something or misunderstood yours.