I try not to overly obsess, which I could easily do especially since I'm a numbers geek. Most would probably say I still obsess, but around here I might be average? Mainly I keep 4 spreadsheets:

1) Investment Net Worth, showing the value of my investment accounts, including NPV of the pension and SS I'll get later. All reduced by deferred taxes, so that a Roth conversion doesn't change the bottom line number. This also tracks my AA to my goal AA. I save a dated copy of this at least once per year, going back to 1999 (but not every year in the terrible 2000s). Between those saved I update the spreadsheet whenever I feel like it under the same base file name.

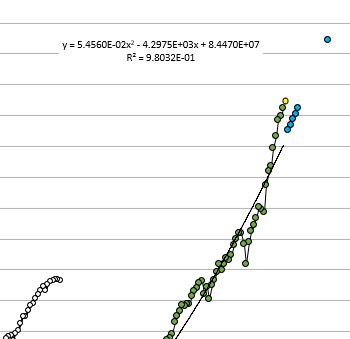

Recently I added another spreadsheet just to enter and graph those values. I really like the up-slope of the graph after the dotcom bust.

2) Monthly spending. Not itemized, just a one line number of what goes in and out of my checking account since most everything runs through there eventually. I note any special expenses like a new car, so I can easily see the cause of a blip. I just keep adding rows and total them up at the end of each year, along with a running 12 month tally, so I've got full history from when I started this in 2011, the year I retired.

3) Variable % Withdrawal, which takes the after-tax number from my Net Worth spreadsheet and multiplies it by the factor used each year to give me my yearly spending allowance. I modified the one from Bogleheads, making it more conservative. From this I can get a rough investment return, increase or decrease in net worth, how much under/over I was spending for the year, and cumulative over/under. And I also compare it to 4% and 3.5% + inflation from my starting number for comparison, and against the model I used to decide the VPW factor I'd use. I have a line for year so I've got history starting from 2016. So this only gets updated once a year.

4) Roth conversion / ACA tracking spreadsheet. Every year I track all income as I receive it (monthly, mostly interest and dividends), so that I can get my Roth conversion as close as possible to the ACA cliff (with a safety factor) or the top of 0% QDivs tax rate.

I find these all very useful. I don't find it to be work at all, and maybe it helps to keep my mind sharp. Some might just skip Roth conversions to avoid this work. That's their business. I don't find it that much work, and it's also useful as a check on income tax form entries before I file. If a turbotax number is smaller than what I have in the spreadsheet, I see if I've missed a 1099.