Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

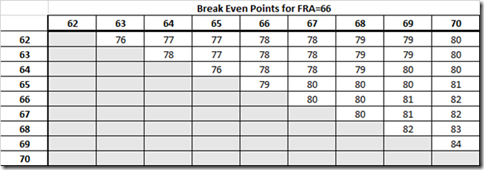

I think all of the social security provided "estimates" assume you continue working at the same salary until the age you claim. So that 2998 might be if you work til 70?

If you use the Social Security Retirement Estimator, you can plug in zeros for your estimated income earnings until taking the SS and you will have an accurate estimate at each year from 62 to 70 if you wish.