grasshopper

Thinks s/he gets paid by the post

- Joined

- Oct 9, 2010

- Messages

- 2,475

I have a bill maturing manana but I will repurpose part of it for a Discover Bank $150 for 2 month bonus offer.

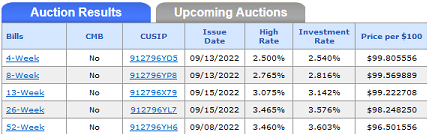

I bought a 6-month on the secondary market today for 3.519%, so a bit lower but not a huge difference.I bought a 26-week T-Bill at auction today at 3.576%.

( I'm still trying to figure out how to calculate all this).

( I'm still trying to figure out how to calculate all this). . Don't understand all the math behind this but I'll get there.

. Don't understand all the math behind this but I'll get there. I bought a 26-week T-Bill at auction today at 3.576%. The 13-week sold at 3.142%.

26 weeks is as far out as I’d go at this point and is close to what the 52 week sold for last week at 3.603%.

When you say you bought @ 3.142% at auction does that mean you selected a TBill paying 3.142% @ 26 weeks?

I am under the impression that one just puts in an order and you get whatever the auction price turns out to be.

I'm new to this so excuse my ignorance.

1-year treasury still higher at 3.89% and the 6 month at 3.76%.2-year Treasuries touched 3.7% this morning.

So... I posted earlier that I picked up some 1 yr Tbills @ 3.1%.

Turns out I got a 10 months bill @ 2.6%( I'm still trying to figure out how to calculate all this).

That is I got a 1yr note with 10 months left on it.

I thought I was buying a 1yr from 8/9/22 to 8/9/23 but I got a 10 month from 6/8/22 to 6/8/23 ? I guess I was buying on the secondary market.

Turns out I'm not that smart after all. Don't understand all the math behind this but I'll get there.

Today it looks like the feds announce the following new issue Tbill auction, I will try to get some of these on Vanguard today.

Bills CMB CUSIP Offering Amount Announcement Date Auction Date Issue Date

4-Week No 912796YE3 09/13/2022 09/15/2022 09/20/2022

8-Week No 912796YQ6 09/13/2022 09/15/2022 09/20/2022

I'm looking at putting a bit into the 26 week and 2 year note auctions on 9/26 and the 52 week auction on 10/4.Interestingly enough, the 4-week t-bill rate has dipped a bit today (2.496) while the 3-month is higher (3.25%).

I might funnel some more $ to Schwab for next weeks 13 & 26 week auctions. My first purchases (8-week) will be maturing early October, we will see what rates are then.

1-year treasury still higher at 3.89% and the 6 month at 3.76%.

Inflation report came in a little hotter than expected.

So... I posted earlier that I picked up some 1 yr Tbills @ 3.1%.

Turns out I got a 10 months bill @ 2.6%( I'm still trying to figure out how to calculate all this).

That is I got a 1yr note with 10 months left on it.

I thought I was buying a 1yr from 8/9/22 to 8/9/23 but I got a 10 month from 6/8/22 to 6/8/23 ? I guess I was buying on the secondary market.

Turns out I'm not that smart after all. Don't understand all the math behind this but I'll get there.

Today it looks like the feds announce the following new issue Tbill auction, I will try to get some of these on Vanguard today.

Bills CMB CUSIP Offering Amount Announcement Date Auction Date Issue Date

4-Week No 912796YE3 09/13/2022 09/15/2022 09/20/2022

8-Week No 912796YQ6 09/13/2022 09/15/2022 09/20/2022

I was not surprised when the inflation rates were announced at 8:30, I did not think they would drop rather that they would go up. I also thought the market was nuts yesterday and would drop a lot today, which at 1 pm (the last time I looked) it was giving back most of the gains over the past few weeks. I was surprised at how much the 2 year note was just after 8:30.

I bought 20 more T bills on the secondary market that mature 10/11 at 2.433%. I am still hesitant to make any large purchases for 13 or 26 weeks just yet as I think there will be better opportunities in the coming few weeks.

You do realize that you are admitting to trying to time the bond market, right?I bought 20 more T bills on the secondary market that mature 10/11 at 2.433%. I am still hesitant to make any large purchases for 13 or 26 weeks just yet as I think there will be better opportunities in the coming few weeks.

That is pretty much my thinking too though I'll probably wait an extra month or so.I'm keeping everything short term right now too. Most of my T bills expire 09/27 - 10/11. I will be locking in some 13 week to 26 weeks after the next Fed meeting.

I suppose, I prefer to say that I am being opportunistic and waiting for what looks like a nice yield. I can keep buying short term but at some point I want to lock in purchases when it looks like the Fed is going to take a break or stop. I'm not trying to get the highest yield over the next 6-12 months but I feel yields will drift higher over the coming months.You do realize that you are admitting to trying to time the bond market, right?Not that there's anything wrong with that.

How lucky would you consider yourself if the S&P 500 hit 3100?I am doing the same with the equity market, that is waiting for 3800 to buy and again at 3700 and if it hits 3666 I am going to consider that my lucky break.

How lucky would you consider yourself if the S&P 500 hit 3100?

.

.