FICA is designed to be breakeven at your life expectancy. If you expect to live longer or have a much younger spouse, it makes sense to delay. Poor health or poor savings, take it early. I'll be going early since i expect to die on schedule, and prefer to have whatever benefits I can muster sooner, rather than the many risks of later.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trying to understand the SS age 70 wait

- Thread starter JeffyD

- Start date

Your analysis serves you well. I am waiting at least until 69, and maybe 70, to maximize payments as much as I can for my long-surviving spouse. This also allows me to convert more IRA in the 12% bracket. I view it as a once-a-year decision: delay or not. Notice that my decision does not include break-even points or maximums over our lifetimes.

These are good points. Because I am still 10 years from when I think I would like to retire (still love my job), I am not up to speed on the finer points of Social Security. Hopefully I will remember these.

There are a couple of things to consider. We do not have a crystal ball on our longevity. My wife died at 68, but started collecting at 62, so she had 6 years to collect.

The other thing is the present value of a future stream of income.

I think there is no one right answer, but depends on the individual situation.

I agree. Nobody knows what the right answer was until the dance is over.

The HalfBreed

Recycles dryer sheets

Although I receive a CSRS Pension, I'm good with that. I've considered going out and becoming eligible for a monthly SS payment, and I have 34 or 35 quarters / credits already. The WEP will cut my monthly benefit from ~ $525 to ~ $135, so, I pass, for now.

I've been retired since 2012, and everyone I worked with that retired (they're all older than me by 8 - 20 yrs) began taking it at 62, even while they were working. I understand their point and agree that, if they feel it's in their best interest, so be it.

My Crystal ball has been in the shop since the mid 1970's, so, taking it at 70, one could easily perish at age 71. Projected math could go out the window in less than a year.

Who knows, right ? I wish you all the best in your projections.

I've been retired since 2012, and everyone I worked with that retired (they're all older than me by 8 - 20 yrs) began taking it at 62, even while they were working. I understand their point and agree that, if they feel it's in their best interest, so be it.

My Crystal ball has been in the shop since the mid 1970's, so, taking it at 70, one could easily perish at age 71. Projected math could go out the window in less than a year.

Who knows, right ? I wish you all the best in your projections.

Last edited by a moderator:

rrs26ja

Dryer sheet aficionado

I took SS at 62. Here was my thought then. When I ran the analysis, the break even point was 78. I guess my decision was yes I will get more money starting at 78, but what would my quality of life be. I wanted the extra money to travel and vacation with my grandchildren. Now looking at RMD, I might have been better off taking money from my investments and waiting to take SS. Too late now.....

Ablatus

Dryer sheet wannabe

Windfall

Has any California Public employee that is effected by the Windfall SS provision figured out if it makes any noticeable difference taking ss at 62 or 70?

Has any California Public employee that is effected by the Windfall SS provision figured out if it makes any noticeable difference taking ss at 62 or 70?

Should be health dependent. Bad health? Collect at 62. Good health? collect at 70. You do not want to collect at 70…and then pass away at 71. I used the Goldilocks approach at 66. Not too early and not too late. I am financially secured with my investments and pensions so I consider SS as disposible income such as monthly payments on a new sports car. For people who need SS more than I do, then collect as late as possible if your health is rated good or excellent by your doctor. I suggest consulting your doctor on your longevity outlook.

qwerty3656

Full time employment: Posting here.

- Joined

- Nov 17, 2020

- Messages

- 762

If you didn't buy home owners insurance and your house didn't burn down, you would have great return on that money.From the time I was 62 until 70, the S&P 500 return was 14.9% per annum.

That was well over the 5%-6% breakeven return.

My decision to take SS at 62 was a very good move.

For my wife, the S&P return from 62 to 70 was 12.9%

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

^^^ Yeah, hindsight is 20/20. Why would anyone buy bonds if they knew what rayvt knows?

The differences are rather small overall. A few great investment years or a few poor ones can sway either choice to be superior, but in the big scheme of things, it really depends on how much you depend on or will depend on SS and what it does for you. The spreadsheet bottom line is really the least important factor of all. The absolute dollar amount difference really is just too variable because of all the reasons already listed. I went more conservative in investing once I retired, and even pulling whatever I want from my portfolio, it’s still over $100k higher than when I retired. My objective in life is not to deny myself anything so that I can leave more behind! I saved it to use it. The inflation gains on a larger SS annuity (plus my pension) mean that I can spend more on whatever with little regard for the portfolio level.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If you didn't buy home owners insurance and your house didn't burn down, you would have great return on that money.

I get your point. But except for having in some minds an insurance element, the comparison

between SS claim timing and homeowner's insurance is not well established.

Homeowner's insurance has a known price and a fixed term. I can easily judge if the value is worth the price.

SS longevity insurance has an unknown price since the "premium" depends in part on future investment returns and part on longevity, the insurance has an unknown term. Accordingly, determining the value of the insurance to me is difficult.

Now, I am not against either type of insurance. They are just not very comparable in my opinion.

A Gold One

Dryer sheet wannabe

- Joined

- May 26, 2019

- Messages

- 12

A few more thoughts on this rich topic...

I like this thinking as well.

In my case, I did the attached analysis in May when I was considering filing. I used data from the SS estimator and tried to factor in relevant variables.... I am sure I am missing something, but this helped me to see a few things more clearly.

Others have commented thoughtfully on the various factors that can help one determine what is right for them. These are beyond the scope of what I was hoping to solve for.

For my analysis I assumed a 4% return and a 12% tax rate. (Note that changing those numbers reasonably higher or lower did not substantially effect the final outcome)

One thing this analysis showed me is that if I took SS at 62, then by the time I was 70, my after-tax cash in hand would be almost $188K more than if I had waited. It also showed that longevity permitting, I could make that difference back in approximately in 11+ more years. Delaying till 70 would be accretive starting at age 81.4. (Note: my analysis did not take into account the investment gains in those 11+ years - if any).

Seeing the data sliced this way was helpful for me. Would love to hear any feedback on this.

I am going through this analysis now myself. My wife and I are retired and are 59 (me), and 58 (obviously, my wife). The one nice thing about taking benefits early is that, assuming you need the income and can either spend your assets first and take social security later, or take social security now and defer spending your assets, is that in the later case if we die before 70, we have spent the “government’s money”, not our own. Our assets can be passed to our beneficiaries, so from an estate planning perspective, social security early sort of acts as an insurance policy to pass a minimum amount of wealth onto our kids. Hopefully, this makes sense, and more importantly is correct.

I like this thinking as well.

In my case, I did the attached analysis in May when I was considering filing. I used data from the SS estimator and tried to factor in relevant variables.... I am sure I am missing something, but this helped me to see a few things more clearly.

Others have commented thoughtfully on the various factors that can help one determine what is right for them. These are beyond the scope of what I was hoping to solve for.

For my analysis I assumed a 4% return and a 12% tax rate. (Note that changing those numbers reasonably higher or lower did not substantially effect the final outcome)

One thing this analysis showed me is that if I took SS at 62, then by the time I was 70, my after-tax cash in hand would be almost $188K more than if I had waited. It also showed that longevity permitting, I could make that difference back in approximately in 11+ more years. Delaying till 70 would be accretive starting at age 81.4. (Note: my analysis did not take into account the investment gains in those 11+ years - if any).

Seeing the data sliced this way was helpful for me. Would love to hear any feedback on this.

Attachments

RockLife

Recycles dryer sheets

- Joined

- Feb 24, 2017

- Messages

- 93

For me it's going to be a year by year decision. I turn 62 in one year and I plan to write down a list of considerations to re-read each year (so I don't forget something in later years). It will contain the break-even analysis, rate of return on nest-egg, tax implications (incl. Roth conversions), ACA subsidy impacts, health of both of us, spending needs and WANTS; maybe other things. There is no wrong answer if you have considered all the factors and make an informed decision.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The analysis works for you, while others may add a factor or two.I like this thinking as well.

In my case, I did the attached analysis in May when I was considering filing. I used data from the SS estimator and tried to factor in relevant variables.... I am sure I am missing something, but this helped me to see a few things more clearly.

Others have commented thoughtfully on the various factors that can help one determine what is right for them. These are beyond the scope of what I was hoping to solve for.

For my analysis I assumed a 4% return and a 12% tax rate. (Note that changing those numbers reasonably higher or lower did not substantially effect the final outcome)

One thing this analysis showed me is that if I took SS at 62, then by the time I was 70, my after-tax cash in hand would be almost $188K more than if I had waited. It also showed that longevity permitting, I could make that difference back in approximately in 11+ more years. Delaying till 70 would be accretive starting at age 81.4. (Note: my analysis did not take into account the investment gains in those 11+ years - if any).

Seeing the data sliced this way was helpful for me. Would love to hear any feedback on this.

We went with an analysis for a 30-year period, since one of us has a very good chance of getting to 90, and the other much less.

Since we're both working to at least FRA, it also means our category of thinking is different than those who early retire. After considering the break-even points and curves, we decided that breaking even was not a major consideration for us.

Thanks for sharing your analysis.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I get your point. But except for having in some minds an insurance element, the comparison

between SS claim timing and homeowner's insurance is not well established.

Homeowner's insurance has a known price and a fixed term. I can easily judge if the value is worth the price.

SS longevity insurance has an unknown price since the "premium" depends in part on future investment returns and part on longevity, the insurance has an unknown term. Accordingly, determining the value of the insurance to me is difficult.

Now, I am not against either type of insurance. They are just not very comparable in my opinion.

Not sure that I agree that they are not very comparable, though I'm not a fan of the house insurance comparison.

The premium of SS longevity insurance is the SS benefits foregone while delaying and the benefits are the increase in SS as a result of delaying.

Limited-pay life insurance where you pay premiums for x years and then your heirs get a death benefit at death might be a better analogy.

In both cases the outlay and the benefits are known, but what is unknown is the timing of your death... so it is impossible to calculate the present value of future benefits to compare it to the present value of future costs.

What you can do, and I have provided for the SS decision many times, is provide a table of the IRRs if you live to various ages to get a sense of the "return"... see post#24 of this thread for a table of IRRs for 62 vs 70 assuming a 2% COLA.

Last edited:

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

you get an actuarial increase if you delay payment after your SSNRA - pretty simple

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

SSNRA = social security normal retirement age I think, aka FRA.

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

SSNRA = social security normal retirement age I think, aka FRA.

yes - same thing

the reduction prior to ssnra is probably still 1/15th, 1/30th and a percentage after ssnra

when this was designed, the intent was to provide for actuarial increases using some basis - I'm not sure if it was ever updated

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

no one knew more about SS than Bob Meyers, FSA

https://www.amazon.com/Within-system-century-social-security/dp/0936031123

https://www.amazon.com/Everyone-Should-About-Social-Security/dp/0009280545

OP you may want to read one of these or something similar if you are interested

https://www.amazon.com/Within-system-century-social-security/dp/0936031123

https://www.amazon.com/Everyone-Should-About-Social-Security/dp/0009280545

OP you may want to read one of these or something similar if you are interested

Everyone's situation is different. We have enough cash to live on until age 70 (we are now AGE 65 AND 67). That means our income is incredibly low. This gives us the opportunity to do Roth conversions until age 70 when we both start taking SS. Not to mention then at age 72 having to take RMD's and then the taxes on everything combined. Of course, one of us could pass by then as well, but it still should work out according to our Financial Advisor. And that includes hopefully leaving something for our only child, including the house. But- we do not have long term care insurance so I am not sure what will happen....

I wanted to just start withdrawing out of our Traditional IRA's now instead of using cash to bring our IRA balances down and instead of the hassle of Roth conversions and having to pay the taxes on those out of our bank account right now. But our FA says it is still worth it so I am going with what he says unless I find more information that what I want to do makes more sense.

I wanted to just start withdrawing out of our Traditional IRA's now instead of using cash to bring our IRA balances down and instead of the hassle of Roth conversions and having to pay the taxes on those out of our bank account right now. But our FA says it is still worth it so I am going with what he says unless I find more information that what I want to do makes more sense.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

From the time I was 62 until 70, the S&P 500 return was 14.9% per annum.

That was well over the 5%-6% breakeven return.

My decision to take SS at 62 was a very good move.

For my wife, the S&P return from 62 to 70 was 12.9%

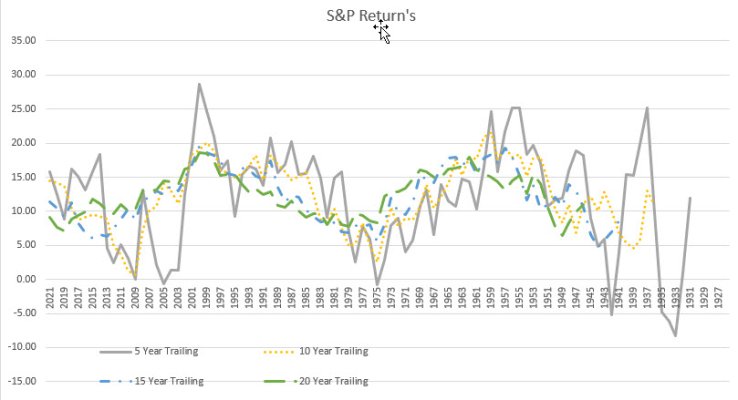

S&P has regularly returned over the 4% that most models plan for, given the right runway. I looked at S&P performance, starting back to 1926 and looked not by year (one year doesn't a plan it make). But on 5, 10, 15 and 20 year training periods. Who knows what is the "right" trailing period, but the worst case for each was -8.25%, .067%, 4.66% and 6.46%. The average and median all were well above that magical 4%, in line with your experience.

| By Year | 5 Year | 10 Year | 15 Year | 20 Year | |

| Max | 53.99 | 28.70 | 21.52 | 19.59 | 18.59 |

| Min | -43.34 | -8.25 | 0.67 | 4.66 | 6.46 |

| Average | 12.24 | 11.77 | 12.09 | 12.14 | 12.40 |

| Median | 14.69 | 13.13 | 12.17 | 11.96 | 12.79 |

We all know how bad things were in the depression, and perhaps changes to stock and financial markets could impact the future. I also then looked at same data, starting back in 1961. It really didn't change the returns:

| By Year | 5 Year | 10 Year | 15 Year | 20 Year | |

| Max | 37.58 | 28.70 | 20.06 | 19.59 | 18.59 |

| Min | -37.00 | -0.77 | 0.67 | 6.09 | 7.16 |

| Average | 11.89 | 11.43 | 11.39 | 11.64 | 12.09 |

| Median | 15.06 | 13.12 | 10.73 | 11.40 | 11.49 |

We can't predict the future, but historically we've see better than 4% return. If once uses the 20 year, which after all we are looking at the long return period if we are talking about retirement, of 6.46% or 7.16% that significantly changes the results of "when" to start SS.

As I mentioned way back in message #15, there is no one right answer. Everyone just looks at it based on "their" financial position, lifestyle and even expected longevity. For some, SS is their only source of income, waiting isn't an option, while others may view SS as just some extra pocket money. Some may already have an illness or known condition that will limit their, their spouse or both, expected longevity, some may already be 90 and still going strong. If someone uses the same "base" return of 4% then answer will always be the same, but as chart shows above, that could be very well below what one might expect over an extended period.

Attachments

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I took SS at 62. Here was my thought then. When I ran the analysis, the break even point was 78. I guess my decision was yes I will get more money starting at 78, but what would my quality of life be. I wanted the extra money to travel and vacation with my grandchildren. Now looking at RMD, I might have been better off taking money from my investments and waiting to take SS. Too late now.....

One thing that often slips through the cracks during the 62-70 discussion is that you can do something very radical and compromise by taking SS in the mid 60's. Nobody is forced to wait until 70 once their 62nd birthday has come and gone.

On small advantage of taking SS at 70 is that you can change your mind and take it earlier if circumstances show that has become the better decision. Take SS at 62, and once the window of opportunity has passed to reverse the decision, and you are stuck for life.

IMHO, it's better to spend your time well enjoying life, rather than fussing too much about squeezing the last possible penny out of one's SS payments.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Agree with you there. And it's a small amount of difference relative to the time. As if the government is enticing people to stretch to 70, well, honestly it must be more beneficial for them overall.One thing that often slips through the cracks during the 62-70 discussion is that you can do something very radical and compromise by taking SS in the mid 60's. Nobody is forced to wait until 70 once their 62nd birthday has come and gone.

On small advantage of taking SS at 70 is that you can change your mind and take it earlier if circumstances show that has become the better decision. Take SS at 62, and once the window of opportunity has passed to reverse the decision, and you are stuck for life.

IMHO, it's better to spend your time well enjoying life, rather than fussing too much about squeezing the last possible penny out of one's SS payments.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Agree with you there. And it's a small amount of difference relative to the time. As if the government is enticing people to stretch to 70, well, honestly it must be more beneficial for them overall.

And businesses, too. They want cheap labor and people to stay in the labor market. Investment companies want you to save more so they can make more off their fees. I believe our corporate overlords are really behind many of the one size fits all, wait until 70 to claim articles that do not take into account the pros and cons of claiming at different ages. It was pretty clear to us when we went to talk to our 401K advisor about retiring he had his retirement more in mind than ours.

Last edited:

Similar threads

- Replies

- 55

- Views

- 5K

- Replies

- 144

- Views

- 9K