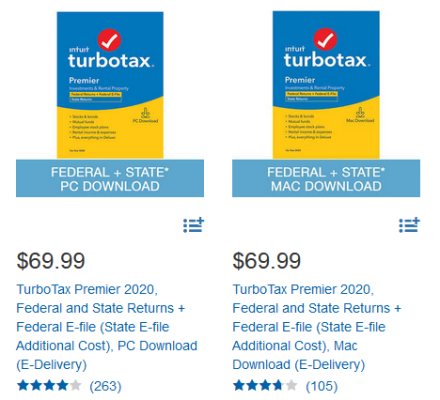

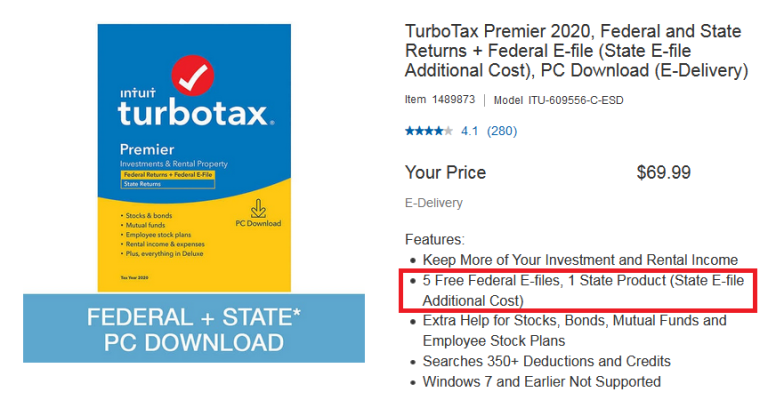

Sort of a strange one here. I purchased the typical "Premier" Turbo Tax program from Costco which includes 5 free Federal e-filings plus 1 State e-filing.

I've always printed and mailed in the past but today we did our daughters taxes first and then at the end we decided to e-file her taxes for the first time.

When we did this the program stated that Turbo Tax will deduct it's fee from her refund for e-filing both these federal and State taxes, even though the software clearly states it includes these free e-filings with the program.

Is this just a standard Turbo Tax fee statement and it self corrects when the filing happens? Not going to be happy if they deduct an extra from her for nothing. Thanks for any insight or suggestions.

I've always printed and mailed in the past but today we did our daughters taxes first and then at the end we decided to e-file her taxes for the first time.

When we did this the program stated that Turbo Tax will deduct it's fee from her refund for e-filing both these federal and State taxes, even though the software clearly states it includes these free e-filings with the program.

Is this just a standard Turbo Tax fee statement and it self corrects when the filing happens? Not going to be happy if they deduct an extra from her for nothing. Thanks for any insight or suggestions.