You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Updated Social Security Tools

- Thread starter Finance Dave

- Start date

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

I use this one that I found on bogleheads forum. I compared it to anypia and it is spot on. He updates it every year.

https://onedrive.live.com/view.aspx?resid=57275E04E871FED8!5734&ithint=file%2cxlsx&authkey=!AGBZ_VHIKgY-ufQ

Here's a link to the post on BH where he puts updates.

https://www.bogleheads.org/forum/viewtopic.php?t=231913

https://onedrive.live.com/view.aspx?resid=57275E04E871FED8!5734&ithint=file%2cxlsx&authkey=!AGBZ_VHIKgY-ufQ

Here's a link to the post on BH where he puts updates.

https://www.bogleheads.org/forum/viewtopic.php?t=231913

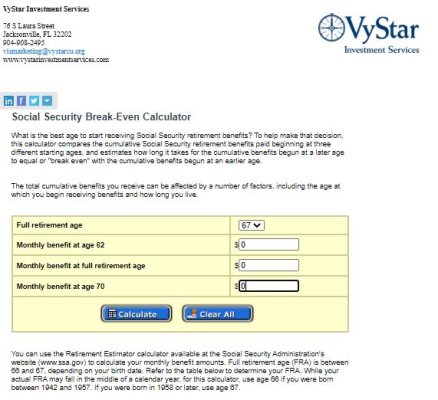

Free SS Break-even Calculator From VyStar Investments

I like the Free SS Break-even Calculator From VyStar Investments. Thoughts on this?

I modeled FRA and age 70. The calculator says my break-even is at age 82.

https://www.broadridgeadvisor.com/w...E24E7C97F0A5D718DC2591DA642B14F62275F9D72F0F8

I like the Free SS Break-even Calculator From VyStar Investments. Thoughts on this?

I modeled FRA and age 70. The calculator says my break-even is at age 82.

https://www.broadridgeadvisor.com/w...E24E7C97F0A5D718DC2591DA642B14F62275F9D72F0F8

Attachments

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

I like the Free SS Break-even Calculator From VyStar Investments. Thoughts on this?

I modeled FRA and age 70. The calculator says my break-even is at age 82.

https://www.broadridgeadvisor.com/w...E24E7C97F0A5D718DC2591DA642B14F62275F9D72F0F8

I thought everyone's break even age was 82. Mine is.

VanWinkle

Thinks s/he gets paid by the post

I think that opensocialsecurity.com is the best of the bunch, because it also takes mortality into account. It is important to understand how it works.

What is does is that it calculates and expected present value for every possible claiming strategy based on the assumptions that you provide (under Advanced Options). So not only the benefit, but also the probability that you are alive to receive the benefit.

The claiming strategy that results in the highest expected present value is the optimal claiming strategy. You can also compare that to alternative claiming strategies like both as early as possible, at 65, at FRA and at FRA for the lower earner/70 for the higher earner, etc.

Now all of that said, for us the results were not particularly sensitive. Table below compares the EPVs of various alternatives.

No haircut Haircut Optimal solution 100.0% 100.0% Both now 97.8% 98.9% Both 65 99.0% 99.7% Both at FRA 99.2% 99.2% Me 70/DW FRA 98.7% 96.3%

We are the same age but I was the higher earner. My PIA is 333% of hers. Above is with 3.3% real rate of return and 2017 non-smoker preferred mortality.

I'm curious why you used a 3.3% real rate of return? What did you base the return on?

Thanks,

VW

www.longevityillustrator.org = Helpful

+1

Great

+1

Great

Hermit

Thinks s/he gets paid by the post

Everyone's situation is different. I collected SS on the late DW's account from retirement at 63 until 70 earlier this year. With the additional thousands of dollars coming in during those years the answer for me was quite obvious. BTW, I don't recommend this path as a planned strategy. I am sure I would be much happier and we would be much wealthier were she still with me!I thought everyone's break even age was 82. Mine is.

mountainsoft

Thinks s/he gets paid by the post

I'm still trying to find a Soc Sec calculator that will tell what I'll get at FRA if I don't work the last year before FRA (and thus have no income to contribute to my Soc Sec earnings.) Every calculator I've tried seems to assume that I'll be working right up until FRA. Anyone have one?

This is my favorite Social Security Calculator: https://ssa.tools/

You log in to your MySocial Security account, and copy your actual earnings record, then paste it into the tool on the web site above. You can tell it how many years you still plan to work, and how much you expect to earn those years (For example, if you just want to work part time the next five years). It will calculate what your benefits will be at various ages (62-70).

I personally create entries in Flexible Retirement Planner using each of those values. Then I can play around with different filing age combinations to see what gives us the best overall results.

I've been reducing these estimated benefits by 25% for the expected SS "haircut" around 2034, but recently started reducing them by 31% after reading how COVID may affect social security.

bjorn2bwild

Thinks s/he gets paid by the post

I'm most interested in my healthy lifespan. This calculator asks a few extra questions ---

https://apps.goldensoncenter.uconn.edu/HLEC/

https://apps.goldensoncenter.uconn.edu/HLEC/

VanWinkle

Thinks s/he gets paid by the post

I'm most interested in my healthy lifespan. This calculator asks a few extra questions ---

https://apps.goldensoncenter.uconn.edu/HLEC/

Nice, I live longer with this one- can we make it the official lifespan guide?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm curious why you used a 3.3% real rate of return? What did you base the return on?

Thanks,

VW

At the time (Dec 2019) I was thinking 5% nominal on a 60/40 AA (low compared to historical average) less 2.7% for inflation (historical average IIRC).

I've only used "open."

Does anyone know when the SS projections reflect the zero's of early retirement? My wife, the younger and high earner, worked 1/3 of last year so it's not zero's yet nor has she put in a full (max) number of years.

Will this or next year's statement be the accurate one or will it take even longer?

Does anyone know when the SS projections reflect the zero's of early retirement? My wife, the younger and high earner, worked 1/3 of last year so it's not zero's yet nor has she put in a full (max) number of years.

Will this or next year's statement be the accurate one or will it take even longer?

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The risk in suspending might be if benefits get cut during the suspension time....

Nope.

Won't happen within the next 10 years, and the person suspending is thinking of doing it now.

So zero risk.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I thought everyone's break even age was 82. Mine is.

It must be fixed !!

Mine is also 82

Nice, I live longer with this one- can we make it the official lifespan guide?

Ya, it's pretty optimistic, It says I have 30.5 years left, I'm 65 now.

Maybe I better keep living frugally!

This is my favorite Social Security Calculator: https://ssa.tools/

This is exactly what I was looking for! Thank you!

It was fun to see that If I'd worked one more year as I'd originally planned to do, I'd have earned $11 more per month Social Security - not a whole lot (of course, I'd also have another full year's salary (smile!)) But I do not regret retiring last year one bit!)

Is it possible to save a thread for later reference?

Just bookmark it.

blue.zapfel

Confused about dryer sheets

This is a great tool, told me exactly what I needed much easier than anything else.

This is my favorite Social Security Calculator: https://ssa.tools/

You log in to your MySocial Security account, and copy your actual earnings record, then paste it into the tool on the web site above. You can tell it how many years you still plan to work, and how much you expect to earn those years (For example, if you just want to work part time the next five years). It will calculate what your benefits will be at various ages (62-70).

I personally create entries in Flexible Retirement Planner using each of those values. Then I can play around with different filing age combinations to see what gives us the best overall results.

I've been reducing these estimated benefits by 25% for the expected SS "haircut" around 2034, but recently started reducing them by 31% after reading how COVID may affect social security.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

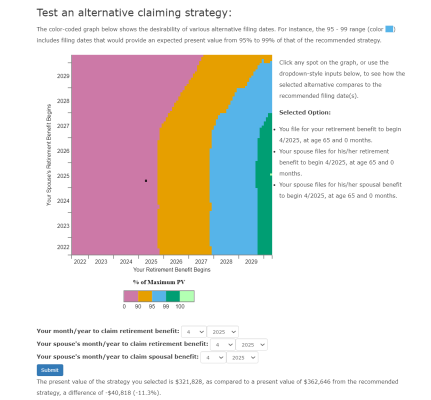

I just wanted to post that opensocialsecurity.com has a neat new feature:

The little light green box is the "optimal" strategy, and the little black box is the combination that your selected as an alternative claiming strategy.... I chose at age 65 for each as an example.

the output now includes a color-coded graph that shows the desirability of many of the different filing dates all at once. (In most cases, it shows all of the options, but there are some situations where a 2-dimensional graph simply cannot represent every possible option.) The benefit is that you can immediately see which filing dates are almost as good as the recommended filing date(s), which dates are “pretty good,” and which dates are not so good.

In addition, you can click on that graph to very quickly compare many different alternative options. (It functions as an alternative to the dropdown inputs for filing dates on the “test an alternative claiming strategy” part of the page.)

The little light green box is the "optimal" strategy, and the little black box is the combination that your selected as an alternative claiming strategy.... I chose at age 65 for each as an example.

Attachments

Last edited:

explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,439

Just tried opensocialsecurity.com.

It recommends waiting until 69 years and 7 months.

In previous threads about when to claim social security, I believe the breakeven period between claiming at 62 and 67 was like sometime in your 80s?

That is if you claimed at 67 (or maybe it was 70), it would take 15 years give or take a couple of years before you catch up to the SSA payments you didn't collect between 62 and 67 or 62 and 70?

In my case, it would be about 10k more a year at 67 and 17k more at 70.

I wonder if the pandemic has changed people's decision-making considerations.

Of course if SSA income was a key part of your ER planning, it shouldn't change things too much.

OTOH, we've lost a year of ER, which probably means reduced spending in addition to time lost from things you wanted to do.

So maybe there's more of an impulse to make up for lost time, spend more earlier?

I can live without SS payments until 70 but maybe I'm inclined to increase my budget before then.

Maybe decide on something in between, like wait until 65 to claim?

It recommends waiting until 69 years and 7 months.

In previous threads about when to claim social security, I believe the breakeven period between claiming at 62 and 67 was like sometime in your 80s?

That is if you claimed at 67 (or maybe it was 70), it would take 15 years give or take a couple of years before you catch up to the SSA payments you didn't collect between 62 and 67 or 62 and 70?

In my case, it would be about 10k more a year at 67 and 17k more at 70.

I wonder if the pandemic has changed people's decision-making considerations.

Of course if SSA income was a key part of your ER planning, it shouldn't change things too much.

OTOH, we've lost a year of ER, which probably means reduced spending in addition to time lost from things you wanted to do.

So maybe there's more of an impulse to make up for lost time, spend more earlier?

I can live without SS payments until 70 but maybe I'm inclined to increase my budget before then.

Maybe decide on something in between, like wait until 65 to claim?

I would wait a few months to see what the impact of COVID and the payroll tax holiday will be on SS. I suspect the new run out of money date will be shocking, and this may effect your calculations. But, I don’t know much about this. Someone here probably does.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think the expected present value concept used by opensocialsecurity.com is much preferable to break even, since it explicitly considers mortality tables.

Similar threads

- Locked

- Replies

- 127

- Views

- 7K

- Replies

- 6

- Views

- 1K